|

|

6 January 2025 What about bitcoin dominance? |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.5 billion, notably lighter in the thin holiday trade. Breaking it down per coin, bitcoin volume came in at $1.1 billion, 20% lower than the previous week. Ether volume came in at $339 million, 5% higher than the week earlier. Total notional volume over the past 30 days comes in at $18.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,736 and average position size for ether at $2,217. Market volatility has cooled off since topping out in December. We’re looking at average daily ranges in bitcoin and ether of $3,316 and $162 respectively. |

| Latest industry news |

|

Bitcoin dominance has been a big theme in crypto markets over the past several months. The metric is used to measure bitcoin’s market share relative to the total cryptocurrency market. At the moment, bitcoin is capturing over 57% of the total market capitalization for crypto assets. This is just off multi-month high levels that had been seen back in November. But since November, we’ve seen a slow decline in dominance that could now be warning of a more significant top. This is actually good news for crypto assets as it suggests investors are feeling more upbeat about the overall outlook and interested in taking on added exposure beyond bitcoin. Of course, this would make sense when considering the strong year we’ve just seen, with bitcoin rocketing to record highs, ETF flows blowing away expectations, and many traditional market participants finally starting to dip their toes in the water. What’s even more interesting is the fact that the world’s second largest crypto asset has yet to really get going and make its own retest of its record high that was set all the way back in 2021. ETH is still a ways off the record high that came in just ahead of $5,000. In recent weeks, we’ve started to see ETH making a move, which has been contributing to the slow decline in bitcoin dominance. Naturally, the incoming US administration is expected to be extremely friendly to crypto assets, which further supports the notion that there will be a significant pickup in demand for ETH and ETH related assets over the coming days and months. |

| LMAX Digital metrics | ||||

|

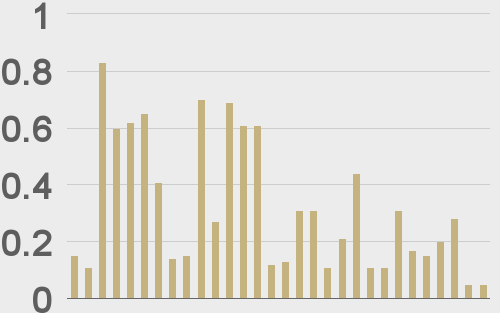

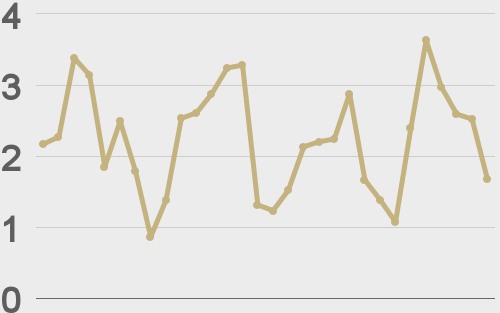

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||