|

|

| When risk comes off |

| LMAX Digital performance |

|

Wednesday’s LMAX Digital volumes were up from the previous day, but still well off 30-day average volume. The activity is understandable with the market cooling off from record volumes in the previous month. Total notional volume came in at $1.3 billion, down 31% from 30-day average volume. Bitcoin volume ticked up from $693 million to $796 million, but was still off 17% from 30-day average volume. Ether volume also improved from the previous day of $258 million, coming in at $308 million on Wednesday, but still off a sizable amount from 30-day average volume of $547 million. Total notional volume at LMAX Digital over the past 30 days comes in at $56 billion. Average trading size for Bitcoin came in at $11,570 on Wednesday. Average trading size for Ether came in at $4,305 on Wednesday. The average daily trading range for BTCUSD is $3,182. The average daily trading range for ETHUSD is $270. |

| Latest industry news |

|

The big story into Thursday is around global macro fundamentals and the impact this latest Federal Reserve decision will have on the crypto space. We believe it’s important to see crypto assets growing more sensitive to developments in the global economy and have been warning for some time that there could be price sensitivity around such events. The question right now is whether or not Bitcoin can hold up in the face of downside pressure in risk correlated assets resulting from a shift in a Fed dot plot that now shows rates pushing up earlier than expected. On the one hand, the Fed’s move comes in anticipation of higher inflation and Bitcoin as an asset should welcome plenty of demand as a hedge against inflation and a store of value. On the other hand, because Bitcoin is still considered by many investors to be an emerging asset that has yet to fully mature into a widely accepted store of value, it is viewed as risk correlated and therefore somewhat exposed to a downturn in risk assets. Ultimately, the primary takeaway here is that more downside pressure in US equities over the coming sessions, could open some fallout weakness in Bitcoin before it finally finds support from medium and longer-term players. A secondary takeaway is that Bitcoin should outperform other crypto assets in periods of risk off, given Bitcoin’s status as a safer asset within the space. |

|

LMAX Digital metrics |

||||

|

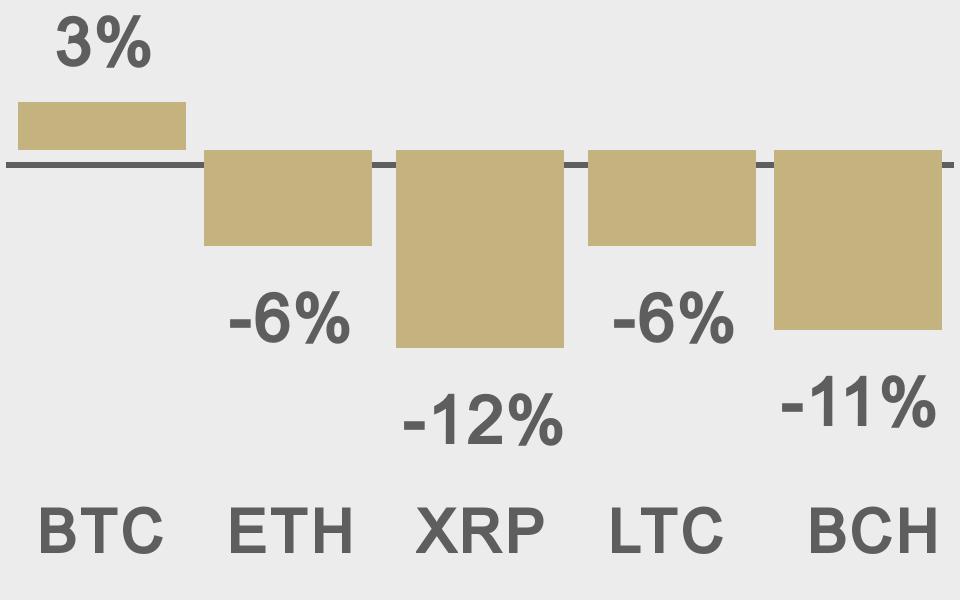

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

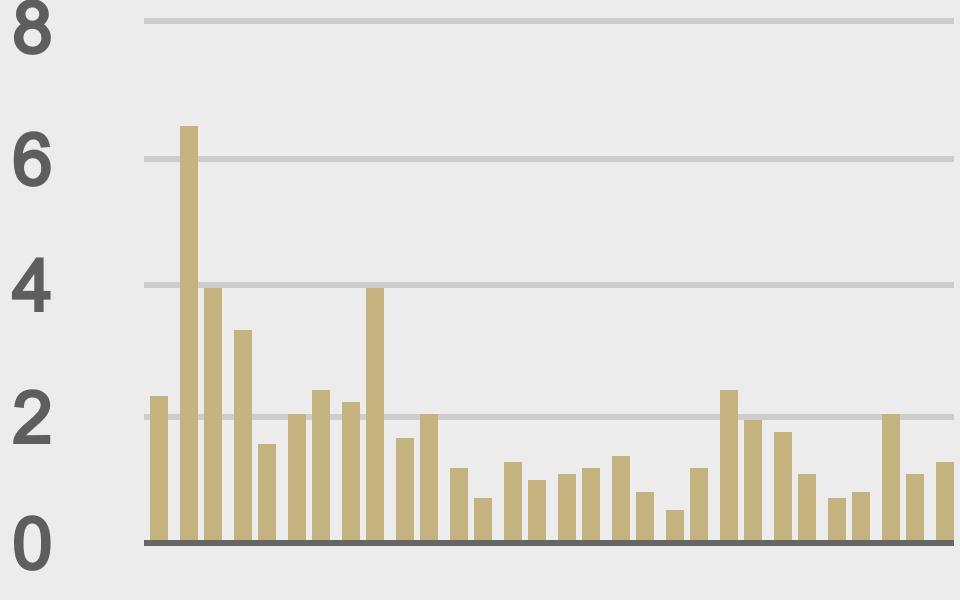

Total volumes last 30 days ($bn) |

||||

|

||||

|

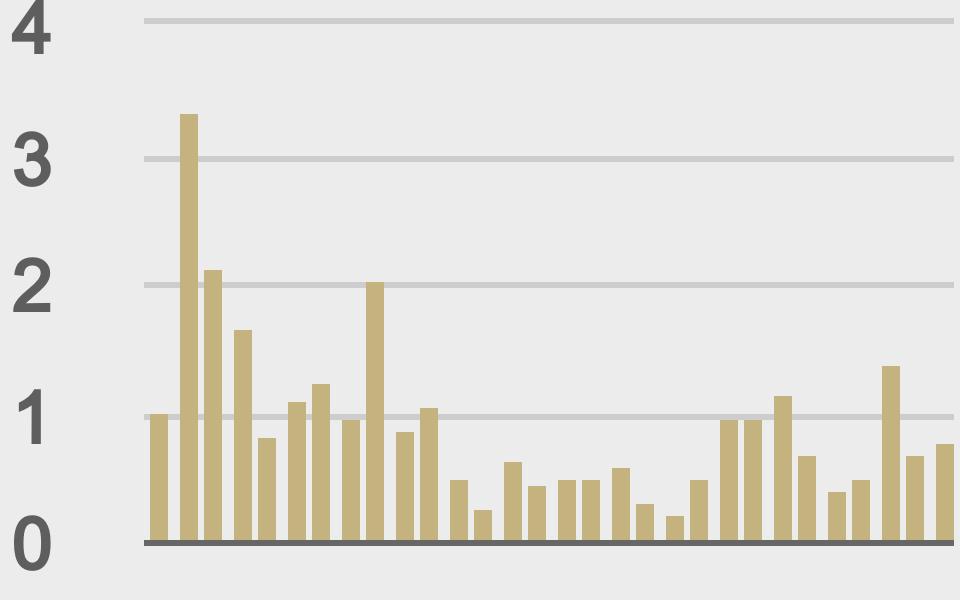

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

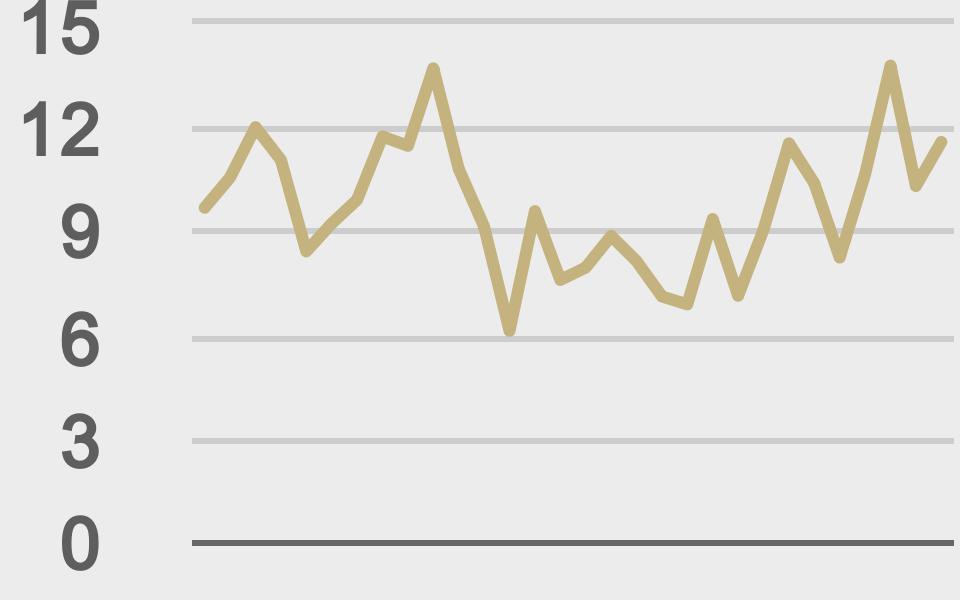

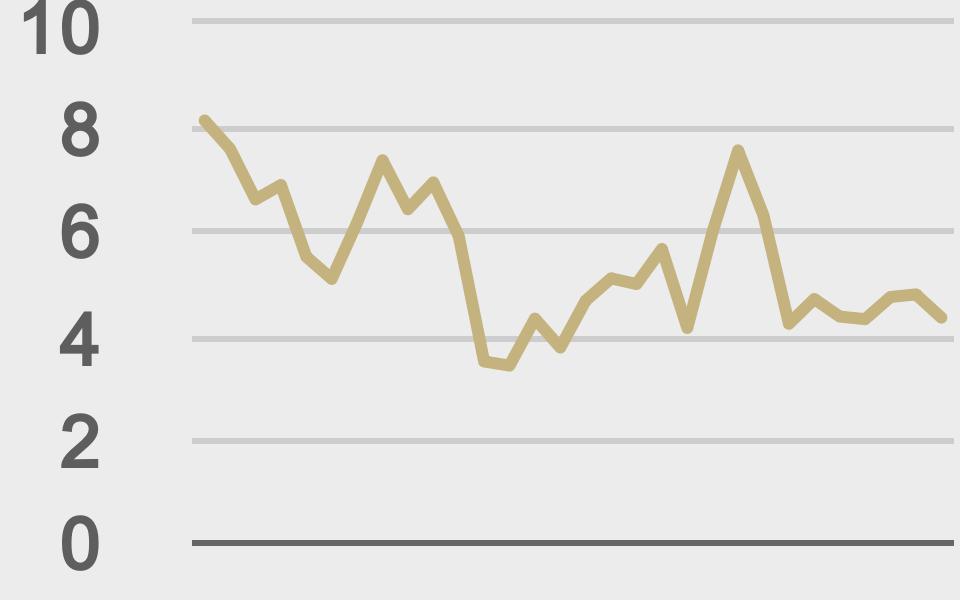

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@WhatBitcoinDid |

||||

|

@TheStalwart |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||