|

|

21 March 2024 Why bitcoin should never have trouble finding bids |

| LMAX Digital performance |

|

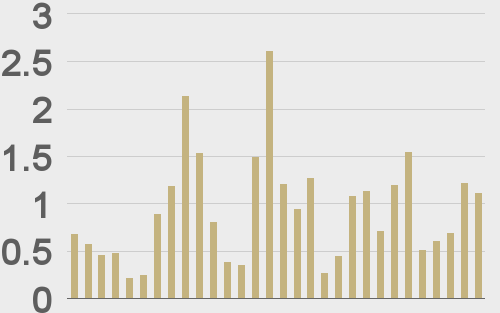

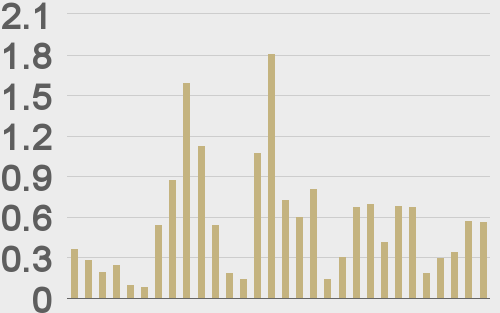

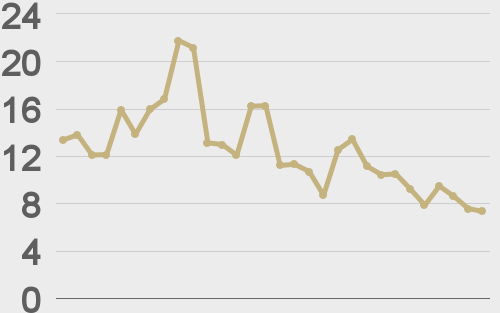

LMAX Digital volumes were healthy once again on Wednesday. Total notional volume for Wednesday came in at $1.1 billion, 19% above 30-day average volume. Bitcoin volume printed $567 million on Wednesday, 1% above 30-day average volume. Ether volume came in at $428 million, 75% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,680 and average position size for ether at $4,399. Market volatility continues to track at multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,947 and $242 respectively. |

| Latest industry news |

|

Earlier this week, we highlighted the importance of keeping an eye on the Fed decision and talked about how the event would likely inspire quite a bit of volatility in financial markets that would extend to crypto assets as well. Indeed, this is how things played out. The Fed opted to downplay recent economic data, keeping with its current outlook for three rate cuts in 2024. The takeaway here is that the decision was more investor friendly than not, which allowed risk assets to run back to the topside. US equities pushed to fresh record highs and the US Dollar was sold aggressively. All of the good vibes spilled over into the world of crypto, with bitcoin leading the charge. And yet, one of the most attractive things (and perhaps most underappreciated) about bitcoin right now, is its ability to find demand whether we’re staring at a risk on backdrop or a risk off backdrop. When risk sentiment is running high, there is demand for bitcoin as an emerging market play and as a technology play. When risk is coming off, there is plenty of good reason to be wanting to buy bitcoin given its attractive properties as a store of value asset. It’s possible, looking further down the road in 2024, the Fed is forced to scale back its rate cut bets and move to a less investor friendly policy track. And while we could see some short-term selling in bitcoin from the risk off flow, as per our point above, bitcoin should be very well supported in any period of extended weakness in stocks as a compelling alternative store of value. This leaves the outlook for bitcoin exceptionally constructive in 2024 and sets the stage for that next big push towards the major psychological barrier at $100k. |

| LMAX Digital metrics | ||||

|

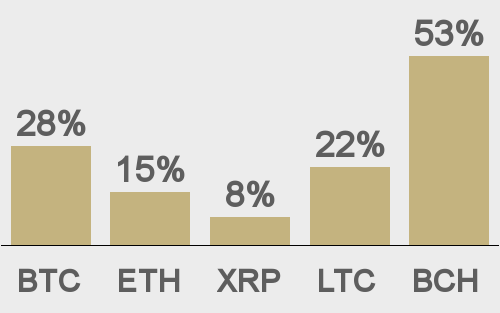

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||