|

|

5 January 2022 Why ether could be more exposed in 2022 |

| LMAX Digital performance |

|

LMAX Digital volume has been light this week, though we continue to reconcile the activity as holiday hangover trade. Total notional volume for Tuesday came in at $510 million, 31% below 30-day average volume. Bitcoin volume printed $288 million on Tuesday, 23% below 30-day average volume. Ether volume came in at $162 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,126 and average position size for ether at 6,735. Volatility has been trending lower as we come into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,218 and $197 respectively. |

| Latest industry news |

|

In case you missed it the other day, here’s an overview of our thoughts as we get going in 2022. As we look ahead to the year of 2022, our overall outlook remains constructive. However, unlike 2021, we believe there is risk for bitcoin to outperform ether when considering three major factors. 1) Macro: Less investor friendly, higher US interest rates are in the pipeline, while COVID fallout has still not been properly assessed. This backdrop lends itself more to the benefit of flight to safety, store of value assets, which would likely translate to bitcoin outperformance relative to ether. 2) Competition: We also believe ether could have a tougher path forward given all of the competition around it. With bitcoin, we don’t really see any competition. But as far as Ethereum goes, there are many other blockchains on the rise trying to capture market share. These include, Solana, Polkadot, and Tezos. 3) Regulation: Regulation is another concern for the space overall in 2022. There are still many questions unanswered here and market participants will be looking for clarity. We worry this clarity could once again prove more disruptive to the Ethereum blockchain given the conversation around the definition of securities. On net, we still believe the longer-term benefits and potential around cryptocurrencies will prove to be a prop for both bitcoin and ether relative to the US Dollar in 2022. At the same time, we also see a place where bitcoin could outperform ether over the next 12 months. |

| LMAX Digital metrics | ||||

|

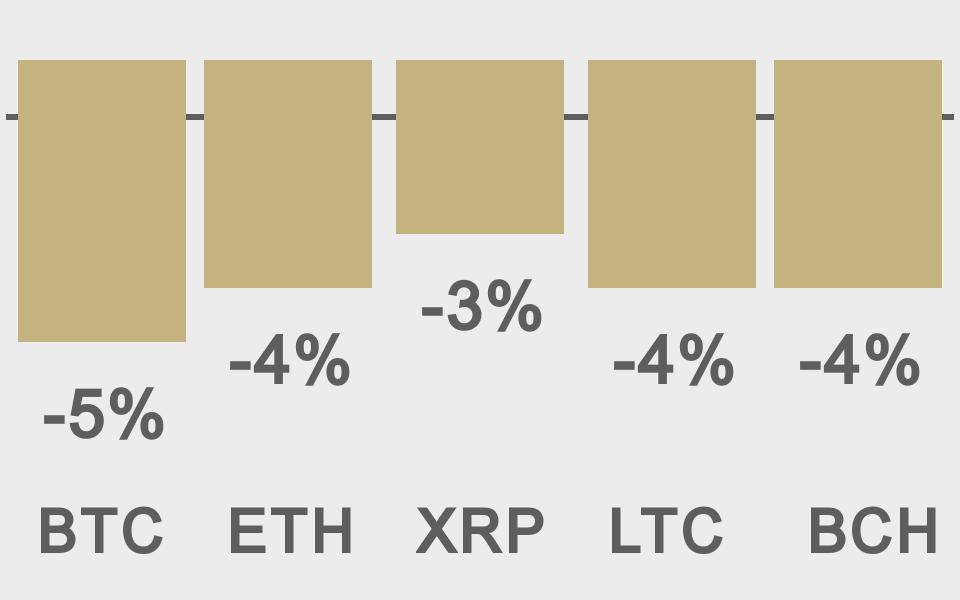

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

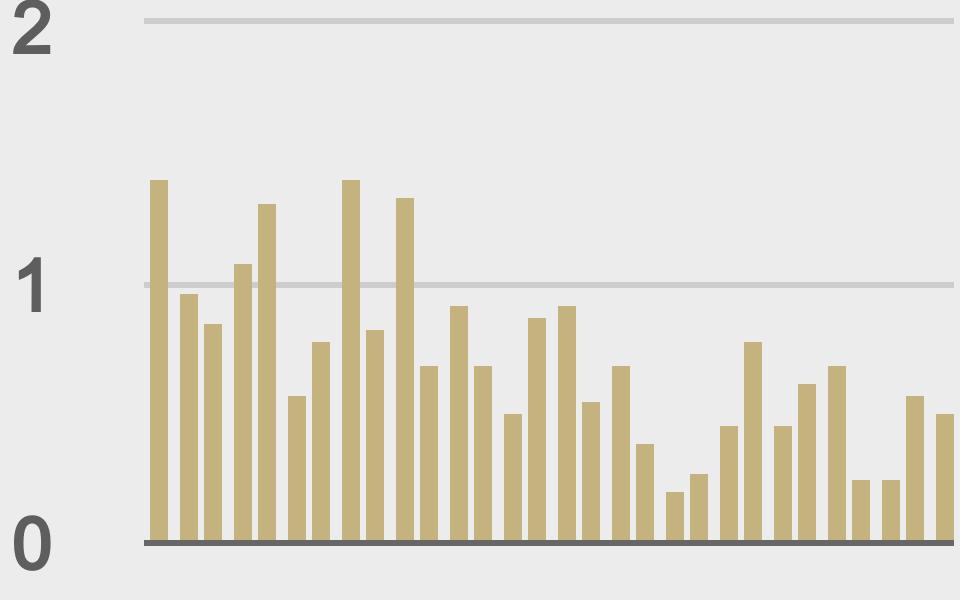

Total volumes last 30 days ($bn) |

||||

|

||||

|

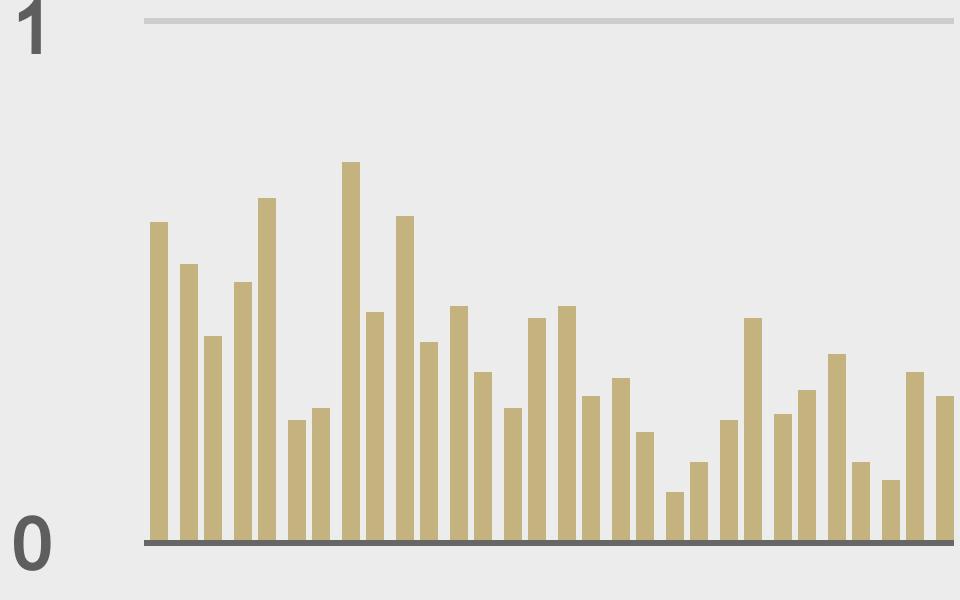

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

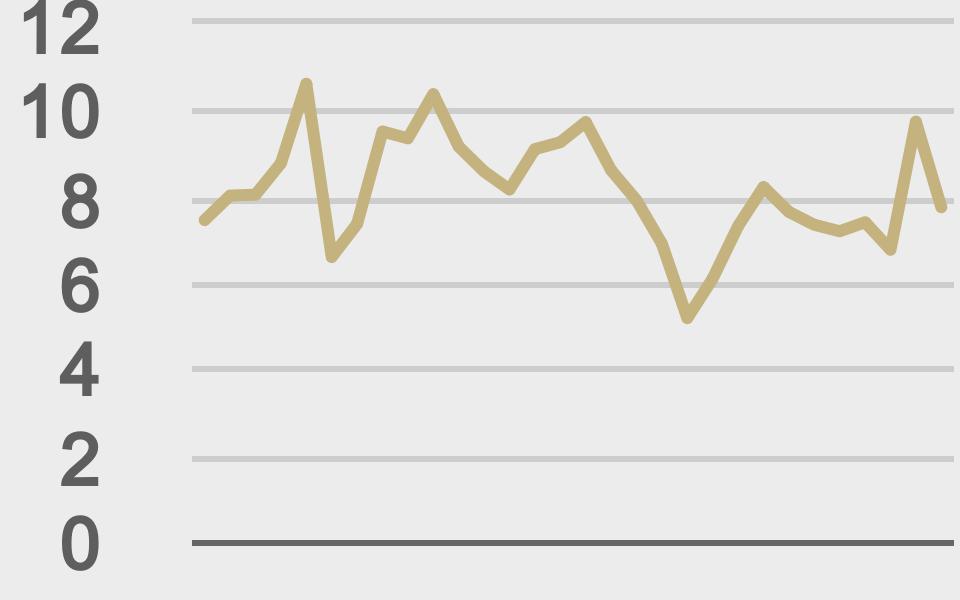

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||