|

|

31 May 2022 Will the recovery hold up? |

| LMAX Digital performance |

|

LMAX Digital volumes were lower to start the week, though the price action was understandable considering the absence of the US market. Total notional volume for Monday came in at $600 million, 15% below 30-day average volume. Bitcoin volume printed $447 million on Monday, 3% above 30-day average volume. Ether volume came in at $90 million, 51% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,596 and average position size for ether at 3,993. There had been some signs of a pickup in volatility earlier in the month, though things have trended back down to yearly low levels as May closes out. We’re now looking at average daily ranges in bitcoin and ether of $1,666 and $145 respectively. |

| Latest industry news |

|

We’re coming off some impressive performance on Monday, with bitcoin leading the recovery charge and finally breaking out from an extended period of consolidation. The move follows a push higher in stocks and is a welcome relief to crypto investors with the upside break taking the immediate pressure off the downside. At the same time, volumes and volatility remain exceptionally low as May closes out. Earlier in the month, there were signs of a pickup in both volume and volatility, but that trend has since faded and we’re back to yearly low levels on both metrics. While the price action is encouraging, it will be more encouraging if accompanied by a pickup in volume and if happening during fuller trade as opposed to holiday weekend trade. And so, how things play out for the remainder of the week will be important to keep an eye on. We’ve highlighted our concern with crypto lagging stocks in this latest run higher. Stocks had been rallying last week, while crypto assets continued to decline. This is concerning because it highlights potential reduction in appetite in the aftermath of the Luna fallout. It’s also concerning because stocks are still in downtrend mode and could start rolling back over at any moment. Global macro themes should continue to play a major influence on direction over the coming weeks. And in the days ahead, the market will be getting ready to take in the monthly employment report out of the US. We think the hourly earnings component continues to be an important indicator to watch as it relates to inflation risk. |

| LMAX Digital metrics | ||||

|

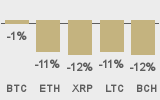

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||