| ||

| 9th February 2026 | view in browser | ||

| Asia rallies as policy stays fluid | ||

| Global markets open the day with a cautiously constructive tone, as Asian equities rally on Japan’s decisive political outcome and China’s liquidity support, while softer consumer data in Australia, steady-but-data-dependent central banks in the West, and shifting dynamics in gold underscore a still-fragile global growth and inflation backdrop. | ||

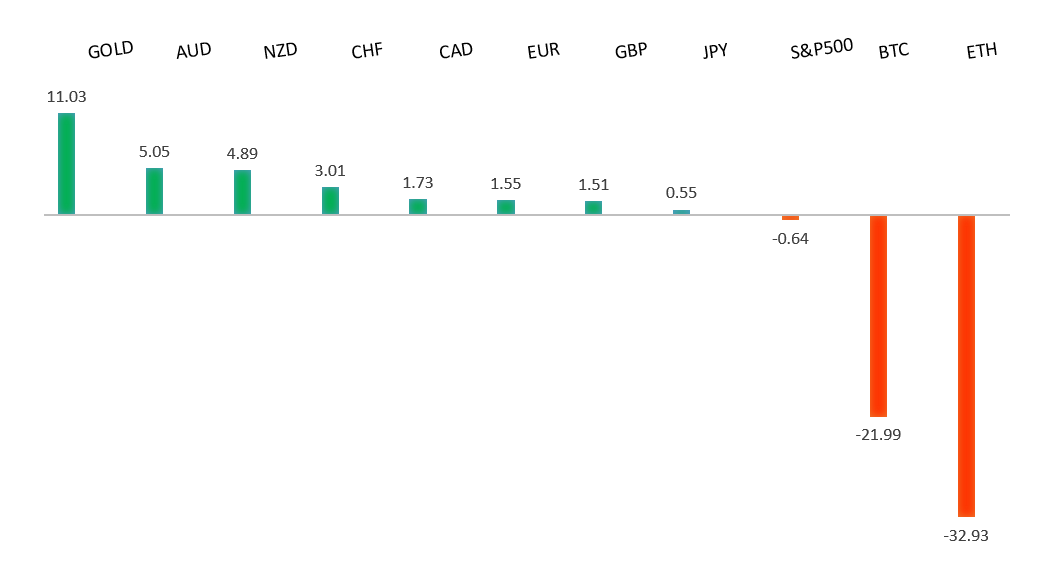

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2083 - 27 Janaury/2026 high - Strong R1 1.1875 - 2 February high - Medium S1 1.1765 - 6 February low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro edged higher, driven more by a lack of dollar follow-through than any fresh euro catalyst. ECB officials have downplayed the move as “not dramatic,” noting the exchange rate is already baked into forecasts and signaling little urgency to push back against strength unless it moves beyond recent ranges, though some warn prolonged gains could risk inflation undershooting. The euro-area economy showed modest resilience with roughly 0.3% q/q growth in Q4 and added support from Germany’s increased fiscal spending, even as data remain mixed. Medium-term optimism around EU reforms and integration offers a structural tailwind for the euro, but stretched speculative long positioning means the currency could be vulnerable to pullbacks on negative surprises. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 158.00 - Figure - Medium R1 157.66 - 9 February high - Medium S1 154.55 - 2 February low - Medium S2 151.97 - 28 January/2026 low - Strong | ||

| USDJPY: fundamental overview | ||

| The yen initially firmed after Japan’s snap election but remains under pressure as markets refocus on weak fundamentals. The LDP’s landslide victory under Takaichi has revived expectations of aggressive fiscal support and tolerance for yen weakness, keeping near-term risks skewed toward further depreciation. Still, some banks argue the huge mandate could ultimately rein in fiscal excess, especially with US pressure, prospective BoJ normalization, and supportive balance-of-payments dynamics pointing to a more constructive medium-term outlook for the yen despite ongoing volatility. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6300. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7095 - 29 January/2026 high - Strong S1 0.6897 - 6 February low - Medium S2 0.6834 - 23 January low - Medium | ||

| AUDUSD: fundamental overview | ||

| The Aussie dollar is modestly higher, holding up despite softer household spending data as markets continue to focus on the RBA’s still-restrictive stance. Investors are pricing a higher-for-longer cash rate, with policymakers clearly uncomfortable about inflation staying above target amid tighter capacity constraints and demand that still needs cooling. Ongoing debate around expansionary fiscal policy is adding a hawkish undertone, reinforcing expectations that rates may not fall anytime soon. As a result, the AUD remains sensitive to upcoming inflation, jobs and growth data, with any upside surprises likely to fuel renewed tightening bets and further AUD strength. | ||

| Suggested reading | ||

| Stock Market Volatility a Regular Midterm Feature, Fisher Investments (February 6, 2026) Interest Rates And The Rise Of The Shadow Banks, E. Basilico, Alpha Architect (February 2, 2026) | ||