| ||

| 18th February 2026 | view in browser | ||

| Balancing easing hopes with policy uncertainty | ||

| Global markets head into the new session balancing softer inflation signals and growing expectations for monetary easing in the UK and US against still-cautious central banks, evolving fiscal debates in Japan, and longer-term questions around AI-driven productivity and its potential impact on future interest rate paths. | ||

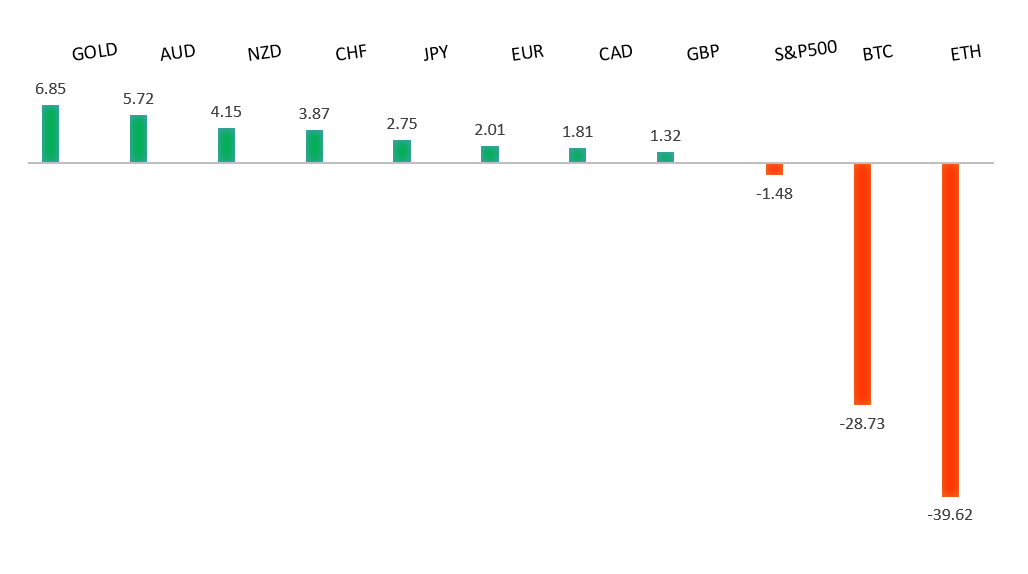

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2081 - 27 Janaury/2026 high - Strong R1 1.1929 - 10 February high - Medium S1 1.1765 - 6 February low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro is under mild pressure after a weaker-than-expected German ZEW survey weighed on sentiment. ECB Vice President-designate Vujčić noted the euro has an opportunity to expand its global role as confidence in the dollar is reassessed, though structural limitations remain. Near term, the euro’s direction will be driven mainly by USD moves and incoming eurozone inflation data, including France’s final January CPI release later today. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 156.30 - 10 February high - Medium R1 154.52 - 11 February high - Medium S1 152.24 - 12 February low - Medium S2 151.97 - 28 January/2026 low - Strong | ||

| USDJPY: fundamental overview | ||

| USDJPY is trying to reverse Tuesday’s modest dip but still trading near last week’s roughly two-week low of 152.24. Japan’s January trade data showed exports jumping 16.8% year-over-year—the strongest increase in more than three years—driven by solid demand from Asia and Europe and some pre-Lunar New Year shipments, while weaker imports helped narrow the trade deficit. Although the strong export performance points to improving growth momentum, USD strength and higher US yields remain the key drivers. Continued gains in US yields could push USDJPY back toward the mid-154s, while a shift toward risk aversion or changing BoJ expectations would be needed to drive the pair back toward 152. | ||

| AUDUSD: technical overview | ||

| There are signs of the formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6700. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7147 - 12 February/2026 high - Strong S1 0.7005 - 9 February low - Medium S2 0.6897 - 6 February low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is trading with a softer tone today. Earlier, RBA meeting minutes struck a more cautious tone, highlighting a data-dependent approach and balanced risks, even as officials acknowledged rising concerns around inflation and the labor market before the last rate hike. Despite the recent dip, the currency remains up 6.2% year-to-date, supported by the RBA’s hawkish stance and ongoing focus on wage pressures, especially in services. Attention now turns to Thursday’s employment report, which is expected to show a 20,000 increase in jobs and a slight rise in unemployment to 4.2%. | ||

| Suggested reading | ||

| Can USD Remain World’s Currency?, P. Fenwick, Foundation of Economic Education (February 13, 2026) Thematic Investing Is Fun, But Is It Good for Investors?, M. Cannivet, Forbes (February 13, 2026) | ||