| ||

| 29th April 2025 | view in browser | ||

| Bessent reassures on debt ceiling | ||

| Trading conditions have been rather quiet thus far on Tuesday, perhaps thinned by Japan’s holiday. In Canada, the election results show the Liberals, led by Mark Carney, securing a fourth consecutive election victory, though a majority government is still uncertain. | ||

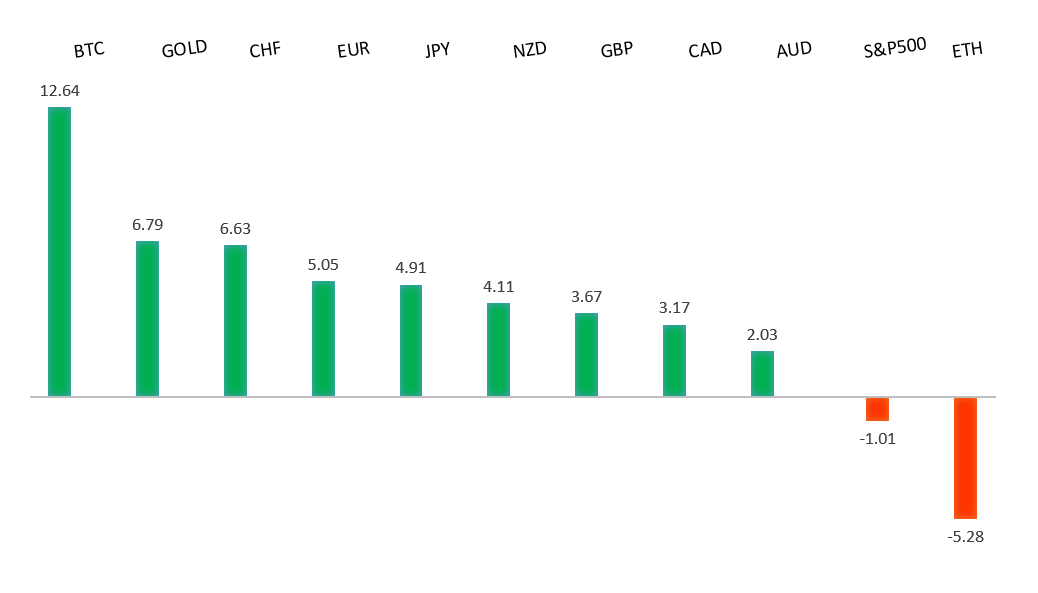

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R1 1.1574 - 21 April/2025 high - Strong R1 1.1440 - 23 April high - Medium S1 1.1308 - 23 April low - Medium S2 1.1264 - 15 April low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB’s June meeting will unveil updated economic projections, likely reflecting weaker Eurozone growth and inflation due to President Trump’s tariffs, with 2025 growth forecasts dropping from 1% to 0.8%, per the IMF. ECB President Lagarde has emphasized a data-driven approach amid stalling business growth, easing wage pressures, and a strengthening Euro, fueling expectations for an eighth 25bp rate cut, potentially lowering the deposit rate to 1.5% by year-end to boost demand. However, Franklin Templeton predicts a pivot to rate hikes by late 2025, anticipating a recovery driven by defense and infrastructure spending, which could reignite inflation in 2026. Germany’s new CDU-Social Democrat coalition is adding political stability, but consumer confidence, as seen in April’s sharp drop to -16.7 and May’s expected Gfk survey decline to -25.7, remains dampened by trade tensions and uncertainty, likely weakening upcoming economic, industrial, and services indicators. | ||

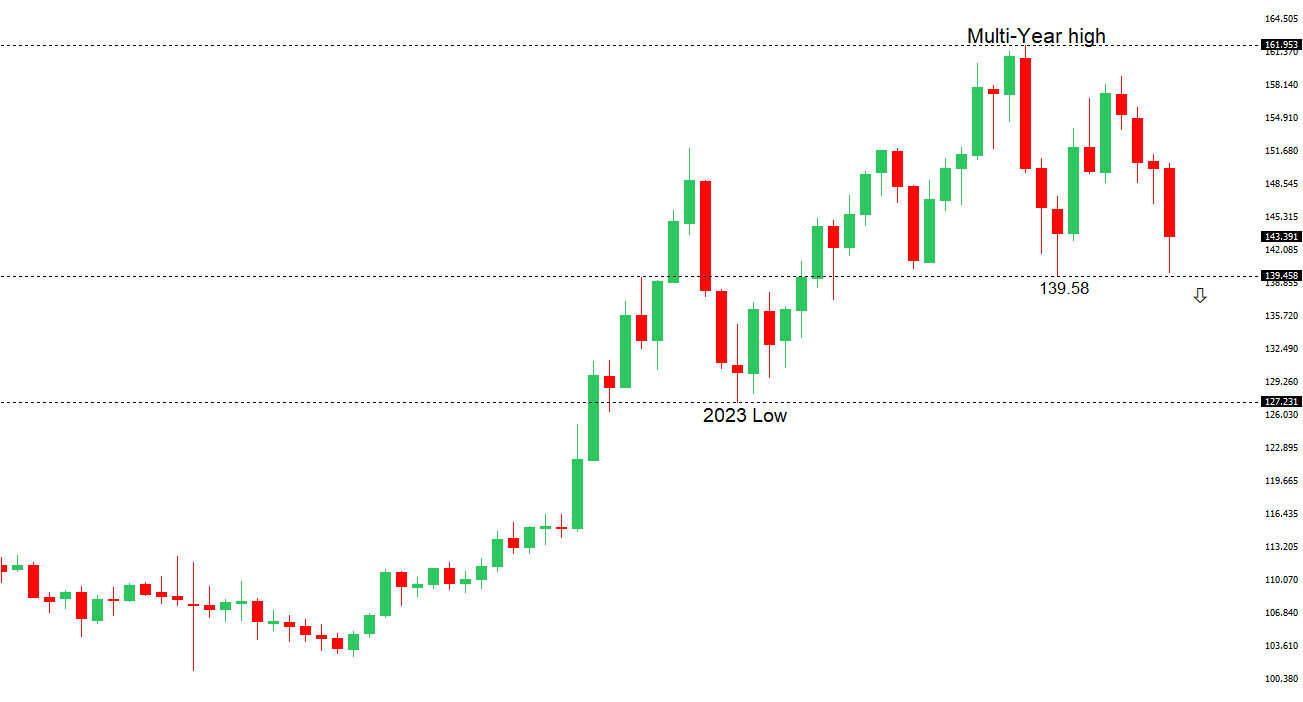

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 144.58 - 11 April high - Medium R1 144.04 - 25 April high - Medium S1 141.45 - 23 April low - Medium S1 139.89 - 22 April/2025 low - Strong | ||

| USDJPY: fundamental overview | ||

| Investors are closely monitoring the upcoming BOJ policy meeting, US-Japan trade talks, and key Japanese and US data releases, alongside US-China tensions, before determining market direction. Rising risk sentiment has weakened the Yen, but there could be renewed Yen demand if positive trade deals emerge, particularly favoring Japan. Such deals could reduce tariff uncertainties, refocusing attention on the BOJ’s potential rate hike resumption in late 2025, maintaining the USD/JPY downtrend. Despite strong yen bullishness in CFTC futures, overbought signals suggest caution. The BOJ is expected to hold its 0.5% rate at the April 30–May 1 meeting, but robust Tokyo CPI underscores persistent inflation, potentially prompting rate hikes later if trade clarity improves. The BOJ’s quarterly outlook may lower growth forecasts but reaffirm gradual rate increases, supported by wage growth and inflation. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6500 - Psychological - Strong R1 0.6450 - 29 April/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar is showing signs of bottoming, driven by a shift away from USD assets and supported by China’s signaling of accelerated fiscal and monetary stimulus, including potential rate cuts and increased bond issuance, alongside easing US-China trade tensions. Meanwhile, US Secretary Bessent’s comments on de-escalating trade tensions with China further support this trend. However, OIS markets expect the RBA to cut rates in May, prioritizing growth over inflation concerns. S&P Global Ratings cautioned Australia’s AAA credit rating could be at risk if election pledges lead to higher deficits, though polls suggest the Centre-Left Labor government is likely to win the May 3 election, influenced by global anti-conservative sentiment tied to the Trump effect. | ||

| Suggested reading | ||

| Question Time: Much Ado About Nothing?, B. Williams, Alhambra Investments (April 28, 2025) How cryptocurrencies are solving America’s stocks and bonds problem, A. Tapscott, The NY Post (April 26, 2025) | ||