| ||

| 24th November 2025 | view in browser | ||

| Cautious optimism as the new week gets going | ||

| Global markets start the week in a cautious but slightly more optimistic tone, with Fed commentary driving expectations for a possible December rate cut and pushing Treasury yields sharply lower. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

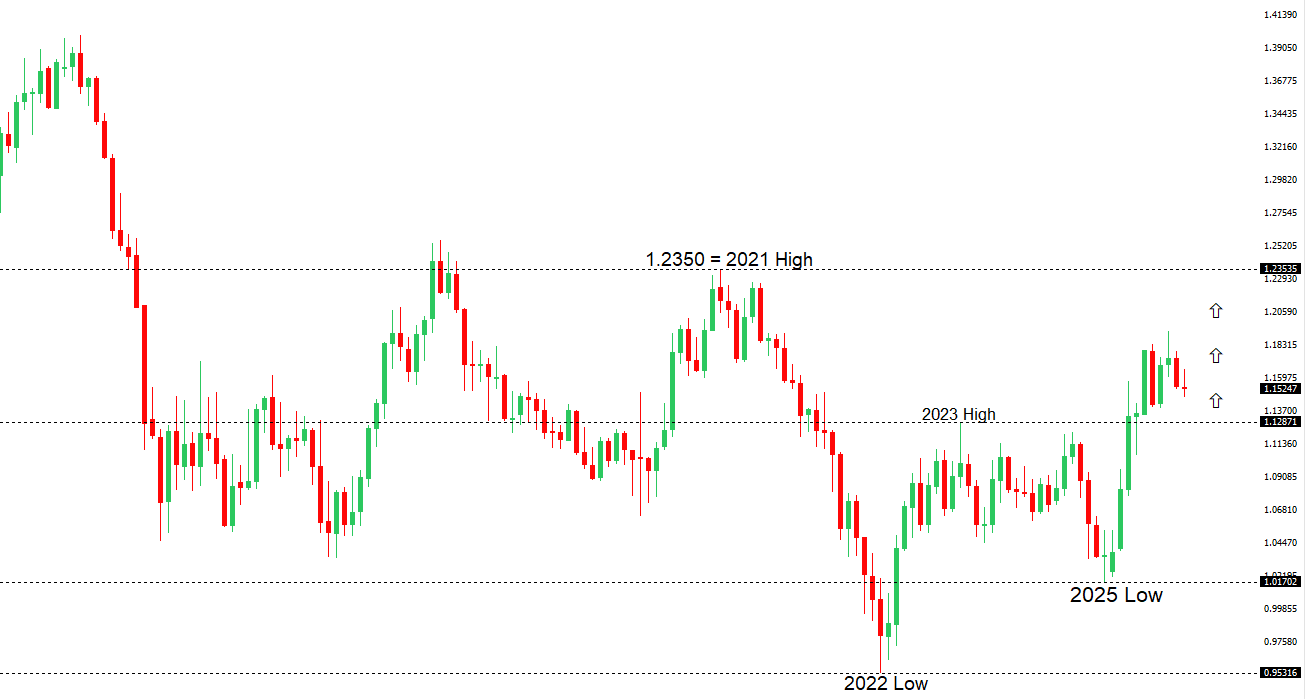

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone data show the economy holding modest momentum, with November’s PMI easing slightly but still supported by stronger services even as manufacturing remains pressured by U.S. tariffs. Wage growth has cooled sharply, reinforcing the ECB’s confidence that inflation is moving toward target and supporting its wait-and-see stance, with potential easing only if weakness persists. Recent comments from officials signal little urgency for further rate moves, and with the Fed expected to cut rates in 2026, the narrowing rate gap may favor the euro alongside improving eurozone growth aided by German stimulus. Geopolitical risks linger—particularly pressure on Ukraine to accept concessions—which markets view as a drag on the euro. This week’s data, including ECB inflation expectations and German IFO, GfK, and retail sales, will be watched for confirmation that sentiment and activity remain resilient. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s yen remains under pressure despite recent verbal warnings from Finance Minister Katayama and hints from BOJ officials that a rate hike is nearing. A large ¥21.3 trillion stimulus package, funded mostly through new bond issuance, has fueled worries about Japan’s heavy debt load, rising yields, and fiscal sustainability—factors that could weaken the currency further. Markets see the government favoring loose fiscal policy and only cautious monetary tightening, raising doubts that any upcoming BOJ rate hike will be more than a one-off. Geopolitical tensions with China and Japan’s latest military moves add to upside risks for USDJPY. Without a meaningful policy shift, any FX intervention is likely to offer only brief relief. Meanwhile, economists’ forecasts point to modest GDP growth, slightly firmer inflation, and a BOJ policy rate of 0.75% by late 2025, with key data and BOJ commentary this week likely to shape near-term expectations. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar found support at 0.6421 as markets rebounded on rising expectations of a Fed rate cut in December, though a close above the 200-day moving average is still needed to confirm stability. Hopes of new Chinese property stimulus and a firmer yuan are also helping AUD sentiment. At home, the RBA remains cautious: despite three earlier cuts, policymakers now see sticky inflation, a tight labor market, and solid wage growth keeping rates on hold for some time. Recent Australian data reinforces this view, with some analysts suggesting the easing cycle may be over—potentially leaving Australia with one of the highest G10 rates if the Fed cuts in 2026. Meanwhile, Australia’s growth outlook has brightened on stronger commodity exports and the removal of U.S. food-import tariffs. This week’s new monthly CPI is expected to show only a slight easing, keeping the focus on inflation trends. | ||

| Suggested reading | ||

| Rate Cut Drama Could Put Lisa Cook In The Hot Seat, N. Irwin, Axios (November 21, 2025) The Economy Is Likely to Reaccelerate in 2026, T. Slok, Apollo Academy (November 20, 2025) | ||