| ||

| 1st December 2025 | view in browser | ||

| Cautious start to the week | ||

| Global markets open the week on a cautious footing, with U.S. equity futures edging lower as sentiment softens amid mounting uncertainty around the Fed’s December decision and a data-light runway that heightens the importance of upcoming ISM manufacturing and core PCE readings. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

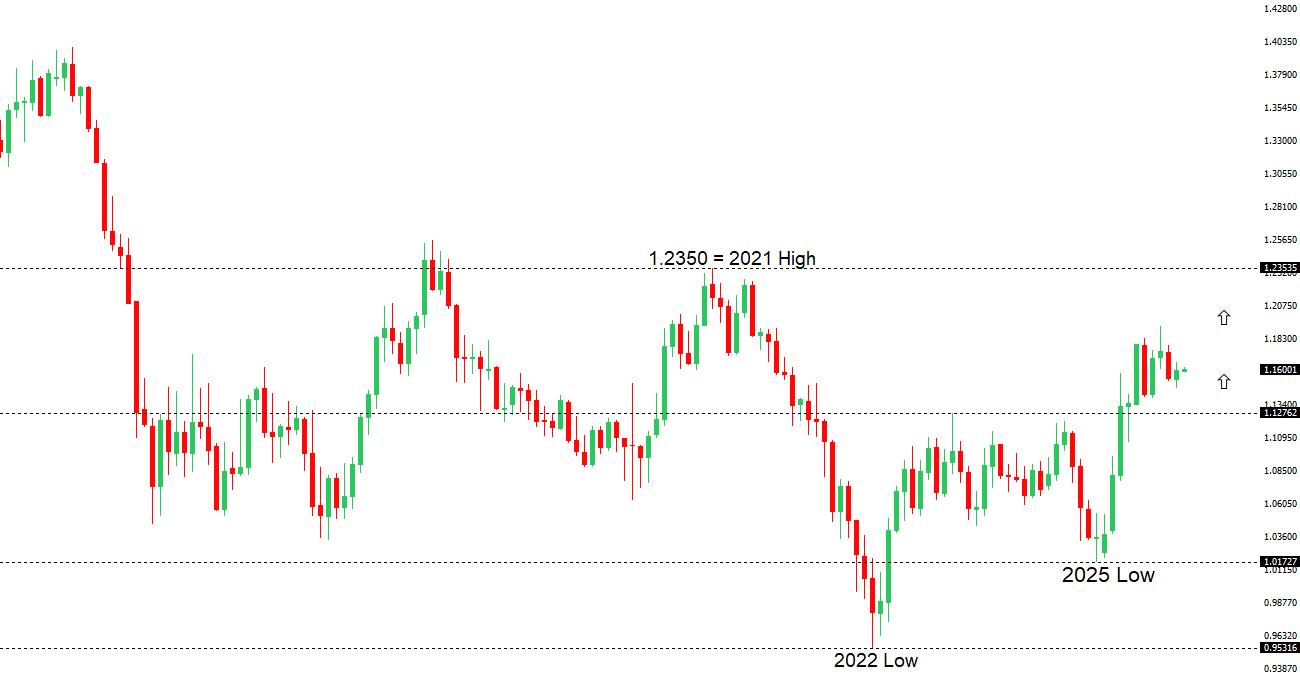

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Germany’s inflation ticked up to 2.6% in November—its highest in nine months—mainly due to volatile travel and energy costs, even as underlying trends still point toward inflation easing below 2% over time. ECB President Christine Lagarde says current interest rates are appropriate, with no change expected in December unless new forecasts point sharply lower, though policymakers remain wary of risks like tariffs or supply disruptions. She notes the euro-area economy is proving more resilient than feared, even with soft spots in Germany and France. With most major central banks nearing the end of their policy shifts—and the Fed potentially the only one easing again in 2026—the dollar could face a downward phase that supports the euro. Geopolitically, the U.S. sees a “good chance” for progress on Ukraine talks, though Russia’s growing drone advantage may stiffen its bargaining stance. Investors this week will watch eurozone inflation, PMI surveys, and final Q3 GDP and employment data. | ||

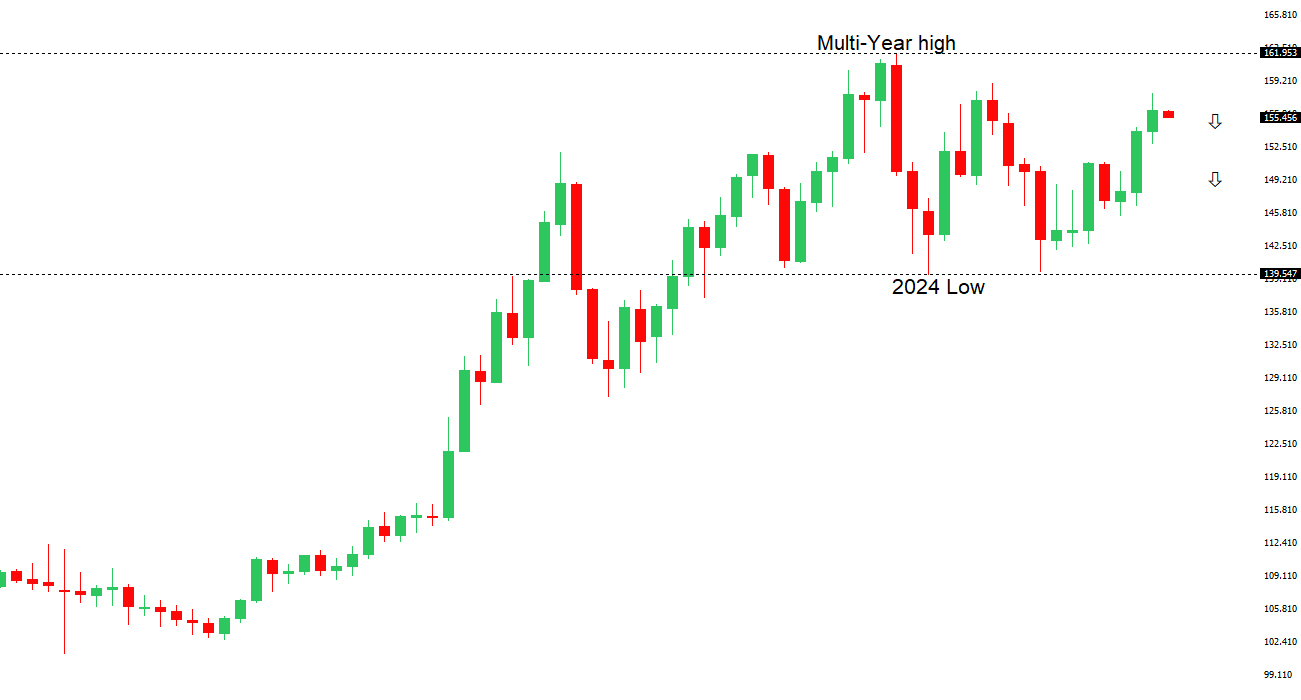

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 155.21 - 19 November low - Medium S2 154.81 - 18 November low - Medium | ||

| USDJPY: fundamental overview | ||

| The yen has firmed slightly into early December as markets bet the Bank of Japan may finally raise rates, supported by steady domestic data and a softer U.S. dollar. Governor Ueda signaled that a December hike is on the table, pushing market odds above 70%, though policymakers want to see wage gains keep pace with inflation. Expectations of Fed rate cuts next year and a gradually tightening BOJ have tilted medium-term yield spreads in the yen’s favor, with some banks forecasting notable yen strength in early 2026. Still, doubts remain over how far the BOJ can tighten amid Japan’s loose fiscal stance and growing external risks, including weaker Chinese demand and geopolitical tensions. This week’s consumer confidence, household spending, leading indicators, and final PMI readings will give markets more clues on Japan’s economic trajectory. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s recent run of strong economic data suggests the economy is entering a cyclical upswing, supporting the RBA’s decision to stay on hold. Business investment—especially in data centers—has surged, housing prices and credit growth are climbing, consumer spending is improving, and both manufacturing and services activity have strengthened. A tight labor market and near-record government spending add further momentum, but higher-than-expected inflation and stagnant productivity mean the economy may be hitting capacity limits, making near-term rate cuts unlikely. Many analysts now expect the next move to be rate hikes in 2026, which could leave the AUD as one of the highest-yielding G10 currencies and a preferred risk and China-proxy play. This week’s 3Q GDP, alongside trade and household spending data, will offer a fuller view of the economy’s trajectory. | ||

| Suggested reading | ||

| In Fukushima’s shadow: Japan’s pivot back to nuclear, T. Griggs, Financial Times (December 1, 2025) ‘Infinite money glitch’; meet arithmetic, C. Coben, Financial Times (November 26, 2025) | ||