| ||

| 26th August 2025 | view in browser | ||

| Dollar dips amid Fed drama | ||

| The U.S. dollar weakened on Tuesday despite positive consumer confidence and durable goods data, as markets focused on President Trump’s controversial attempt to remove Federal Reserve Governor Lisa Cook, following his announcement on Truth Social. | ||

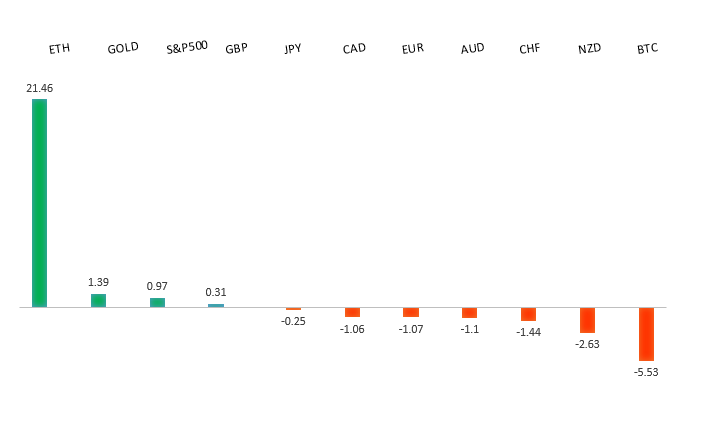

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1743 - 22 August high - Medium S1 1.1583 - 22 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank is maintaining a cautious “wait-and-see” approach, holding interest rates steady at 2.15% for main refinancing and 2% for the deposit facility, with inflation at the 2% target and likely to dip lower due to a strong euro and falling energy prices. In contrast, the U.S. Federal Reserve is adopting a more dovish stance, which may support the euro’s strength in the near term. However, political turmoil in France, where the government faces a potential collapse due to opposition to budget cuts and tax increases, could undermine eurozone stability and pressure the euro if borrowing costs rise significantly. Despite these risks, ECB President Lagarde remains optimistic about resilient euro-area growth and minimal impact from U.S. tariffs, while historical trends suggest French political volatility may have short-lived market effects. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 148.52 - 12 August high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Tokyo’s August inflation data, a key indicator of Japan’s nationwide trends, is expected to dip slightly due to temporary energy subsidies, though the core-core inflation rate (excluding fresh food and energy) should remain high at around 3.0% year-on-year. This supports expectations for a Bank of Japan rate hike, with traders now pricing in a 43% chance of an October hike, bolstered by the BOJ’s hawkish outlook and narrowing U.S.-Japan yield spreads. Prime Minister Shigeru Ishiba’s rising approval ratings (57.5%) suggest growing political stability, potentially reinforcing the BOJ’s normalization path, though a record JPY 32.4 trillion debt financing request could complicate further rate hikes due to fiscal constraints. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6569 - 14 August high - Medium S1 0.6414 - 22 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Reserve Bank of Australia’s August meeting minutes suggest more interest rate cuts are likely in the coming year to achieve inflation and employment targets, with markets expecting at least two cuts by early 2026. The Australian dollar may face downward pressure against the US Dollar, but long-term AUDUSD gains are supported by China’s stimulus measures, which boost demand for Australian commodities, and concerns over the USD’s credibility due to U.S. political and policy uncertainties. Upcoming Australian CPI data and China’s industrial profits report could influence RBA’s next steps, with analysts anticipating no rate cut in September but potential cuts in November 2025 and February 2026. | ||

| Suggested reading | ||

| Powell Mimicked ‘Three-Armed Economist’ In JH, J. Calhoun, Alhambra (August 25, 2025) Powell Gives the Market What It Wants, Not What It Needs, R. Forsyth, Barron’s (August 22, 2025) | ||