| ||

| 6th August 2025 | view in browser | ||

| Dollar dips as ISM services disappoints | ||

| The U.S. dollar has come under additional pressure after a weak ISM Services report showed a headline drop to 50.1, though prices paid hit their highest level since October 2022. | ||

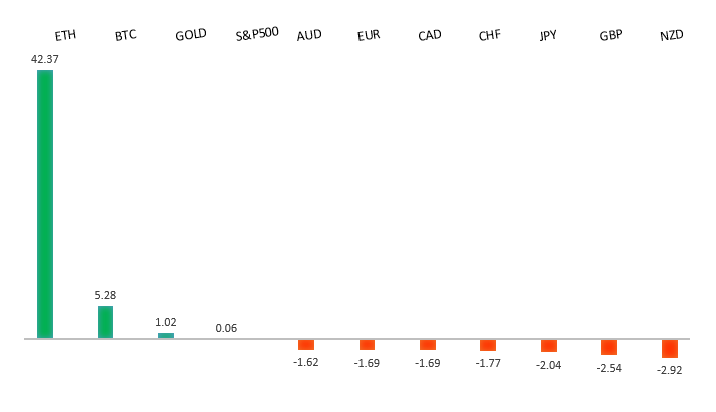

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1703 - 25 July low - Medium R1 1.1600 - Figure - Medium S1 1.1392 - 1 August low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro is expected to recover against the dollar as eurozone fiscal stimulus takes effect by year-end. Recent Eurozone data shows rising producer prices, suggesting the ECB will maintain a cautious, data-dependent approach to rate cuts, potentially supporting the euro. Meanwhile, a weaker U.S. jobs report has raised speculation that the Federal Reserve might cut rates by 50 basis points in September, highlighting diverging monetary policies between the Fed and the ECB. ECB official Christodoulos Patsalides noted the eurozone’s resilience, with 0.1% growth in Q2, despite global uncertainties, and emphasized that ECB policy will remain flexible due to high uncertainty. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.00 - Figure - Medium S1 146.62 - 5 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s trade negotiator, Ryosei Akazawa, is pressing the U.S. to quickly implement a recent trade deal, focusing on lowering tariffs on Japanese cars and parts, though the timeline remains vague and the lack of a formal agreement raises concerns about enforceability and potential disputes. The Bank of Japan’s June meeting minutes highlight the risks of U.S. tariffs but affirm plans for rate hikes if trade tensions don’t escalate, with market attention on the upcoming July meeting summary for fresh policy insights. Mitsubishi UFJ’s CEO, Hinori Kamezawa, supports a BOJ rate hike due to strong inflation and labor shortages, while a government panel’s proposed 6% minimum wage increase—the largest since 1978—signals a sustained wage-price cycle. June wage data shows nominal earnings up 2.5%, the fastest in four months, but real earnings fell 1.3% due to inflation, reinforcing the BOJ’s confidence in its rate-hiking path. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6688 - 7 November 2024 high - Strong R1 0.6625 - 24 July/2025 high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s household spending grew 4.8% year-on-year in June, the fastest since January 2024, but monthly growth slowed to 0.5%, below the expected 0.8%. Higher costs and waning post-rate cut effects moderated spending, with clothing, furnishings, recreation, and miscellaneous goods driving the increase. Discounting boosted spending, but cooling migration and global demand pressures may weaken momentum, especially given Australia’s high household debt. Markets anticipate two rate cuts in 2025, but the Reserve Bank of Australia is expected to remain cautious, with cuts likely only if economic data, particularly unemployment, worsens significantly. | ||

| Suggested reading | ||

| ‘Independent’ Shouldn’t Mean ‘Beyond Criticism’, T. Bliman, Fisher Investments (August 3, 2025) Will data centers crash the economy?, N. Smith, Noahopinion (August 2, 2025) | ||