| ||

| 17th October 2025 | view in browser | ||

| Dollar dips on bank woes, Fed eyes cuts | ||

| A selloff in US regional bank shares, triggered by loan fraud allegations, drove Treasury yields lower and contributed to the dollar’s soft tone. Fed Governor Christopher Waller endorsed a measured 25-basis-point rate cut at the October FOMC meeting, citing tame core inflation and temporary tariff pressures, while signaling further reductions. | ||

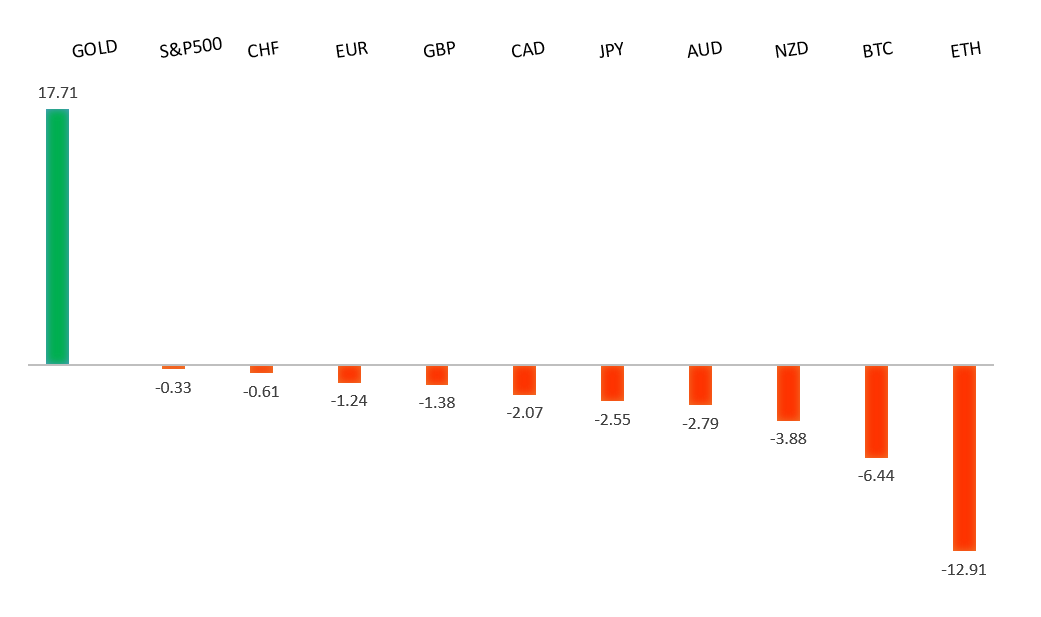

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1731 - 6 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| French PM Lecornu survived two no-confidence votes, boosting chances of passing France’s budget—though its deficit may still exceed 3% of GDP by 2029—while weak German data, like the disappointing ZEW survey, keeps euro gains tied to a softer dollar. Markets need stronger German stimulus or Eurozone growth to confidently buy the euro, or a dovish Fed pivot and weak US data could drive it higher despite mild European improvements. MUFG’s Derek Halpenny expects an ECB rate cut by mid-2026, but the Fed’s more aggressive easing should still strengthen the euro, with further ECB cuts possible if energy prices fall due to OPEC+ hikes and redirected Chinese exports. Trump plans to meet Putin in Budapest in two weeks for Ukraine peace talks, touting progress—any real advances would lift the euro. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.50 - Mid-Figure - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| US credit worries are drawing trader attention, sparking safe-haven flows into the yen, echoing a sharp 800-pip drop in 2023 after the Silicon Valley Bank collapse. BOJ Governor Kazuo Ueda signaled possible near-term rate hikes if economic confidence grows, but he’ll wait for more data amid global risks like US-China trade tensions; meanwhile, US Treasury Secretary Bessent hinted Washington dislikes the yen’s weakness, saying proper BOJ policy will let it find its level naturally. Sanae Takaichi’s odds of becoming Japan’s first female PM have risen with advancing LDP-JIP coalition talks, due for a decision Monday—success could mean policy continuity with fiscal expansion, weakening the yen mildly, boosting stocks, and raising long-term bond yields. However, skeptics doubt her ability to push bold spending amid Japan’s 250% GDP debt load, fractured alliances, and LDP resistance, likely leaving her as a weak leader with little room for major initiatives. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6462 - 17 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s unemployment rate rose to 4.5% in September—the highest in nearly four years—despite adding nearly 15,000 jobs, which fell short of expectations and signaled softening in the labor market as more people sought work. This has intensified calls for the Reserve Bank of Australia to deliver a fourth interest rate cut in November, with market odds jumping from 40% to over 70%. Policymakers remain cautious amid lingering inflation, awaiting a key subdued reading on October 29 to justify further easing. For Aussie bulls, a next rally likely hinges on dovish U.S. data confirming Fed cuts, while our base case of a Trump-Xi truce extending the November tariff deadline at APEC could boost the pair beyond its current consolidation between the 50 and 200-day moving averages. | ||

| Suggested reading | ||

| The Fed Has Been Flying Blind. It Doesn’t Have To, B. Khurana, Barron’s (October 16, 2025) Central Bank Gold Buying Surges to Record Levels in 2025, M. Hidayat, Discovery Alert (October 14, 2025) | ||