| ||

| 20th August 2025 | view in browser | ||

| Dollar gains as markets brace for Powell’s speech | ||

| Markets have pulled back from bets on aggressive Federal Reserve rate cuts as fears grow that Fed Chair Powell might resist dovish expectations at the Jackson Hole symposium. | ||

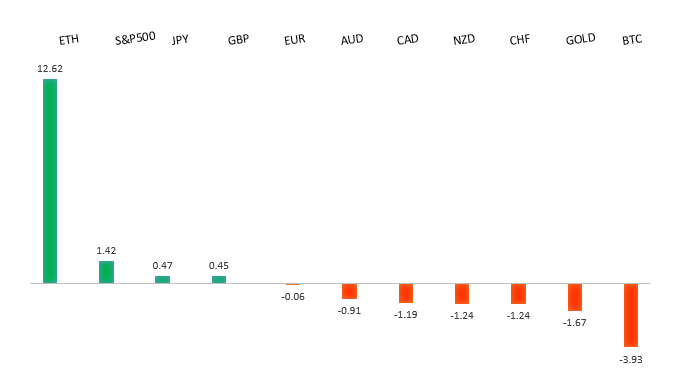

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1731 - 13 August high - Medium S1 1.1528 - 5 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| European leaders remain cautiously hopeful after a White House summit, but note Russia’s lack of clear commitment to peace in Ukraine. Analysts see a full peace deal as unlikely, as Trump’s push for a comprehensive settlement aligns more with Russia, creating tension with Ukraine and Europe, while security guarantees could face Russian resistance. A potential Trump-Putin-Zelensky meeting could pave the way for a peace framework if common ground is found. Meanwhile, markets are cautious ahead of Fed Chair Powell’s Jackson Hole speech, with focus on today’s U.S. PMI data and FOMC minutes for insights into growth, inflation, and potential rate cuts. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 148.52 - 12 August high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s July CPI, due August 21, is expected to stay high at 3.1%-3.3%, with core measures above the Bank of Japan’s 2% target, driven by rising food and household costs. The BOJ’s upward revision of inflation forecasts and discussions of potential rate hikes bolster expectations for an October rate increase, as the upcoming Outlook Report could justify policy shifts. Recent data shows Japan’s exports fell sharply by 2.6% year-on-year in July, with a trade deficit of ¥117.5 billion, raising concerns about economic growth amid U.S. tariffs, despite strong domestic investment indicated by robust machine orders. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6569 - 14 August high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| High-beta G10 currencies, including the Australian dollar, weakened against the U.S. dollar after a Nasdaq selloff dampened risk appetite, though traders are likely to avoid bold moves before Fed Chair Powell’s Jackson Hole speech. Australia’s Westpac Consumer Confidence Index hit a three-and-a-half-year high of 98.5 in August, driven by the Reserve Bank’s third rate cut of 2025 and optimism about lower mortgage rates, with broad-based gains in family finances, economic outlook, and reduced unemployment fears. Despite this, AUDUSD remained subdued as markets await U.S. PMI data and FOMC minutes for clues on Federal Reserve rate cut plans, which could significantly influence the currency’s direction. | ||

| Suggested reading | ||

| Dollar Is Not Going To Save Your Savings: You Must Invest C. Reilly, RiskHedge (August 18, 2025) Trump Admin Fed Demands Not Evidence Based, J. Calhoun, Alhambra (August 17, 2025) | ||