| ||

| 5th August 2025 | view in browser | ||

| Dollar holds steady after NFP selloff | ||

| The U.S. dollar held steady on Monday after Friday’s sharp selloff triggered by the Non-Farm Payrolls report. Looking ahead to Tuesday, markets await the U.S. trade balance, final PMIs, and ISM services data, which could influence expectations for a potential September rate cut. | ||

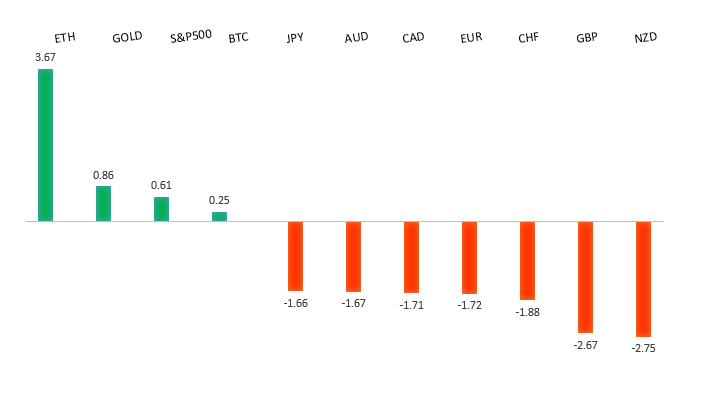

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1703 - 25 July low - Medium R1 1.1600 - Figure - Medium S1 1.1392 - 1 August low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The Euro plummeted in July due to robust US economic data, a hawkish Federal Reserve, and tensions over a new US-EU trade deal, but a weaker-than-expected US jobs report last Friday sparked a sharp rebound as hopes for earlier Fed rate cuts resurfaced. Some analysts speculate the Fed may opt for a significant 50bps rate cut in September if labor markets weaken further, contrasting with the ECB, which is nearing the end of its easing cycle as Eurozone inflation stabilizes. Despite resilient 0.1% growth in Q2, the Eurozone faces challenges from global trade tensions, with a sharp drop in August’s Sentix Investor Confidence to -3.7, driven by a 15% EU import tariff, particularly hitting Germany’s sentiment, signaling potential pressure on the ECB to reassess its cautious stance. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.00 - Figure - Medium S1 146.81 - 25 July low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Last Friday’s disappointing US jobs report triggered a dollar sell-off, shifting Federal Reserve policy expectations and weakening the USD against the yen, with USDJPY trading defensively this week. The Bank of Japan June meeting minutes reiterated plans for potential rate hikes if US tariff risks remain manageable, with a focus on predictable reductions in JGB purchases to maintain market stability; markets are more focused on the upcoming July meeting summary for fresh policy insights. The BOJ raised its inflation forecasts for 2025–2027, citing higher food prices, and slightly increased its 2025 growth forecast, though risks remain. Despite Governor Ueda’s dovish tone, analysts see hawkish signals in BOJ’s outlook, with 42% of economists predicting an October rate hike, driven partly by yen weakness, though political uncertainty and Japan’s fiscal challenges, including a potential extra budget to counter US tariffs, could complicate policy normalization. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6688 - 7 November 2024 high - Strong R1 0.6625 - 24 July/2025 high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Last Friday, G10 currencies, particularly the Yen and Euro, rallied against the dollar due to softer-than-expected U.S. labor data, raising hopes for Federal Reserve rate cuts in September, though Trump’s tariff announcements tempered gains. Australian economic indicators showed strength, with July’s Melbourne Institute Inflation rising to 2.9% year-on-year, June retail sales surging 1.2% month-on-month, and building approvals jumping 11.9%, signaling robust consumer spending and a potential housing sector recovery despite high interest rates. While markets anticipate two RBA rate cuts this year, strong economic data may lead the RBA to pause, with analysts expecting a cautious stance at the upcoming August meeting, supported by upward revisions in July’s S&P Global Australia PMI data. | ||

| Suggested reading | ||

| The Fed Isn’t What John Cochrane Wants It to Be, Never Was, J. Tamny, Forbes (August 3, 2025) Regulatory Crypto Clarity Is Green Light for Wall Street, S. McBride, RiskHedge (August 1, 2025) | ||