| ||

| 10th October 2025 | view in browser | ||

| Dollar holds up as Germany slumps, Japan wavers | ||

| The U.S. dollar has been enjoying a nice run of positive momentum, supported by weak German economic data, which is pressuring the euro, and a faltering yen following Sanae Takaichi’s LDP election win in Japan, despite her recent moderate stance. | ||

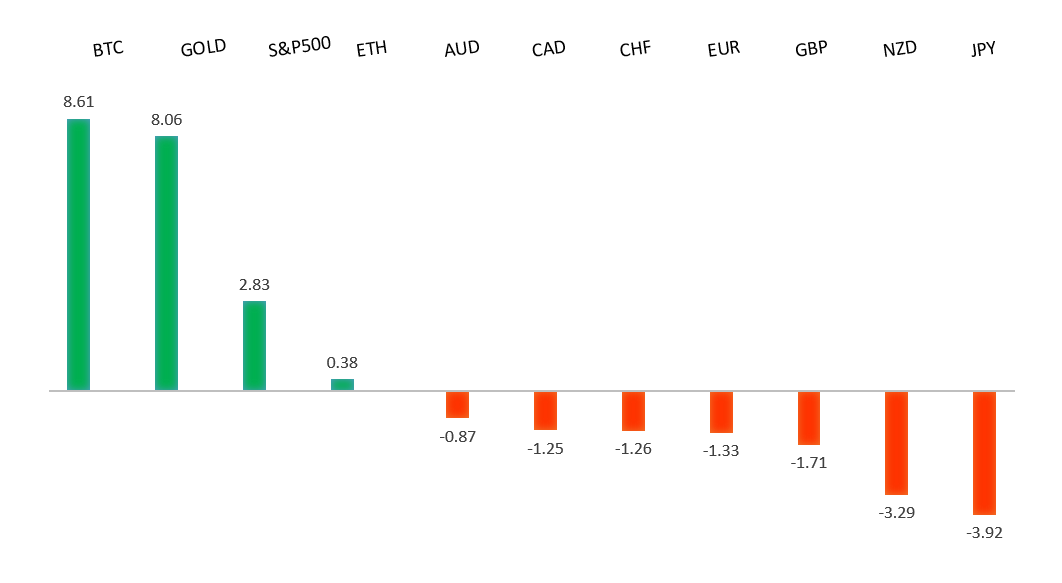

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1662 - 8 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Germany’s economy, the largest in the Eurozone, is facing challenges as August trade data shows a wider-than-expected trade surplus of €17.2 billion, driven by a 0.5% drop in exports and a 1.3% decline in imports. Exports to the US fell sharply by 20% year-on-year, largely due to Trump’s 15% tariff on European goods, while manufacturing, particularly in the automotive sector, continues to weaken. With two years of economic contraction already and a projected GDP growth of just 0.2% for 2025, Germany risks a third recession, which could pressure the ECB to adopt a more dovish stance on interest rates within 6–12 months if economic conditions deteriorate further. Chancellor Merz’s fiscal expansion plans are delayed by administrative issues, with significant stimulus not expected until 2026, while the ECB remains cautious, maintaining steady rates as inflation nears 2% and Eurozone growth is forecasted at 0.9–1.2% through 2027. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 150.20 - 7 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| During a live TV broadcast, Japanese Finance Minister Sanae Takaichi stated she does not intend to weaken the yen excessively or revise the 2013 BOJ accord aimed at combating deflation, emphasizing collaboration between the government and the BOJ on economic policies while leaving monetary policy decisions to the BOJ. Market expectations for aggressive stimulus may fade due to practical challenges and international pressure, particularly from the US, which could view a weaker yen as currency manipulation, while domestic fatigue with bold political rhetoric grows. Political uncertainty surrounds the Liberal Democratic Party leadership, with speculation that Sanae Takaichi may replace Shigeru Ishiba as prime minister, and the Komeito party’s potential exit from the LDP coalition could lead to a non-LDP prime minister for the first time in years, as opposition groups unite around inflation control and political reform. Japan’s September economic data shows robust machine tool orders (+9.9% YoY) and persistent producer inflation (PPI +2.7% YoY), signaling strong manufacturing investment and ongoing cost pressures, which could push the BOJ toward further policy normalization. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6707 - 17 September/2025 high - Strong R1 0.6660 - 18 September high - Medium S1 0.6540 - 9 October low - Medium S1 0.6520 - 26 September low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Reserve Bank of Australia is adopting a cautious approach to monetary easing, reducing expectations for rapid rate cuts and potentially strengthening the Australian dollar in the near term. Governor Bullock’s positive outlook on the economy and labor market, combined with recovering consumption, suggests a November rate cut is unlikely unless the Q3 CPI significantly underperforms. One notable Australian financial services company predicts the interest-rate gap with the US could favor Australia by mid-2026, potentially pushing the Australian dollar to 70 US cents if the RBA holds rates steady while the US Federal Reserve cuts rates further. Elevated consumer inflation expectations at 4.8%, driven by tight labor markets and rising costs, reinforce the RBA’s cautious stance. | ||

| Suggested reading | ||

| Careful What You Wish For: AI’s Downfall Would Hurt, A. Clark Estes, Vox (October 9, 2025) Investors Don’t Fear The Shutdown. Maybe They Should, C. Smart, Barron’s (October 9, 2025) | ||