| ||

| 27th January 2026 | view in browser | ||

| Dollar steadies as trade risks resurface | ||

| Markets are steady with the dollar staging a modest rebound and equities leaning higher, as investors weigh near-term yen dynamics and key U.S. data against renewed tariff threats from Washington and signs of improving global trade ties via a potential EU–India deal. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.1919 - 17 September/2025 high -Strong R1 1.1907 - 26 Janaury/2026 high - Medium S1 1.1769 - 20 January high - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The Euro is holding modest gains this year and has rebuilt bullish momentum as a softer dollar and rising concern over erratic U.S. policy push investors toward euro assets as a liquid, relatively safe alternative. Talk of possible U.S.–Japan intervention to curb dollar strength adds to this shift, though a move toward 1.20 could test ECB tolerance and revive rate-cut expectations. Meanwhile, Germany’s Ifo index highlights a still-weak economic backdrop despite early signs of recovery, with confidence dented by tariff uncertainty and slow stimulus rollout—leaving the euro supported in the near term by FX dynamics, but its medium-term growth outlook fragile without deeper structural reforms. | ||

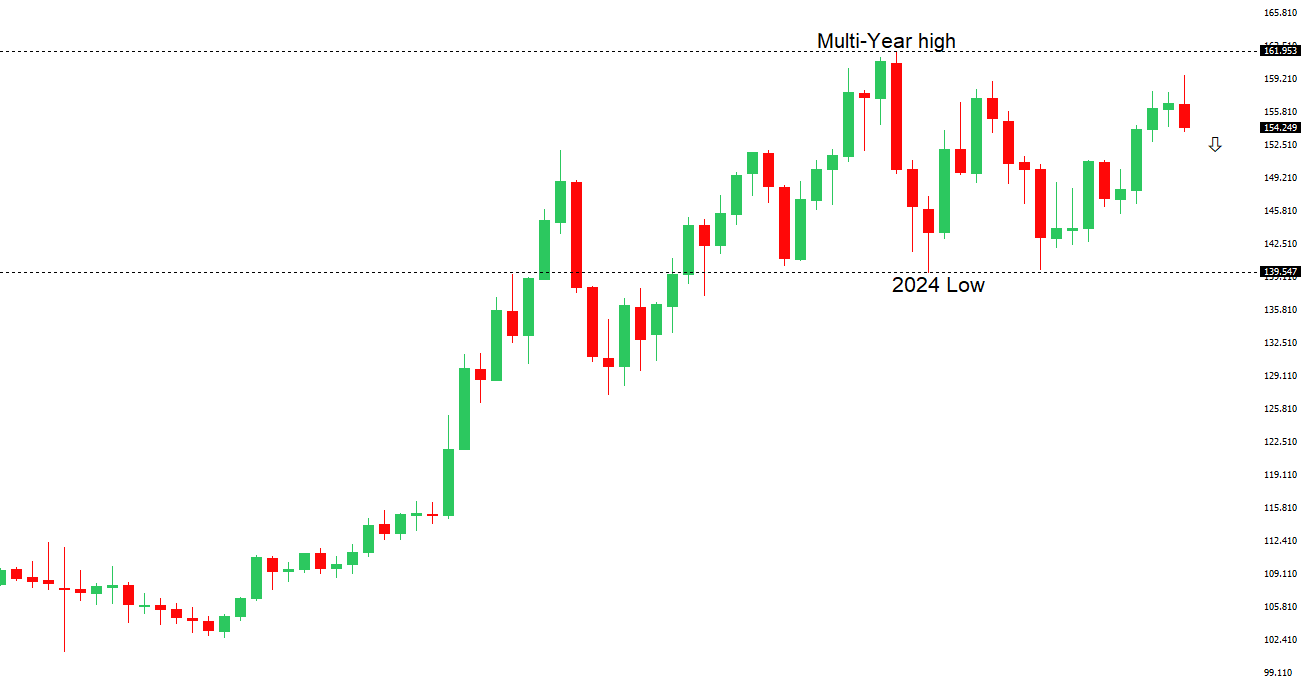

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 156.00 - Figure - Medium R1 155.35 - 26 January high - Medium S1 153.30 - 26 January/2026 low - Medium S2 152.82 - 7 November low - Medium | ||

| USDJPY: fundamental overview | ||

| USDJPY has edged higher but remains near recent lows as mounting intervention risk caps upside, following rare rate checks by both Tokyo and the New York Fed and increasingly forceful warnings from Japanese officials. Last Friday’s sharp yen rally—its biggest since August—broke key support and revived talk of possible, even coordinated, US-Japan action, echoing past episodes that preceded intervention near 160. Traders now see the high-150s as a psychological ceiling, with history suggesting any yen-buying move could knock USDJPY 2–4% lower on the day (and up to ~5% in aggressive cases), pointing to a potential downside zone around 145–150 if coordination materializes, though officials say intervention would only come in response to excessive volatility and there’s still no clear evidence it has begun. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6300. | ||

| ||

| R2 0.7000 - Psychological - Strong R1 0.6942 - 30 September/2025 high - Strong S1 0.6834 - 23 January low - Medium S2 0.6767 - 7 January high - Medium | ||

| AUDUSD: fundamental overview | ||

| The Aussie eased slightly after a strong run, now up 3.6% YTD and about 10% YoY, with domestic data continuing to underpin the currency. A blowout December jobs report and improving business confidence have lifted three-year yields and boosted expectations for a February RBA hike, positioning the AUD as a relative rate-differential winner in G10 as markets increasingly see the RBA staying hawkish into 2026, even as the Fed is expected to ease later this year. Attention now turns to Wednesday’s CPI, with unofficial data pointing to firm inflation in the mid-3s—above the RBA’s target—keeping risks tilted toward an early, modest tightening, though many analysts doubt inflation will be strong enough to force a February move. Positioning remains supportive, with speculators still net short AUD but steadily covering since December. | ||

| Suggested reading | ||

| Growing Trade War Fears Remain Unsubstantiated, Fisher Investments (January 24, 2026) Why Aren’t Bond Yields Falling?, M. Rzepczynski, Disciplined Global Macro (January 22, 2026) | ||