| ||

| 4th December 2025 | view in browser | ||

| Fed cuts loom while Europe and Asia turn hawkish | ||

| The United States remains front and center in the macro narrative as Treasury markets wrestle with conflicting signals—10-year yields firmed to 4.08% even as private payrolls posted their sharpest drop since early 2023, reinforcing expectations for a Fed rate cut next week and keeping the dollar near five-week lows. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

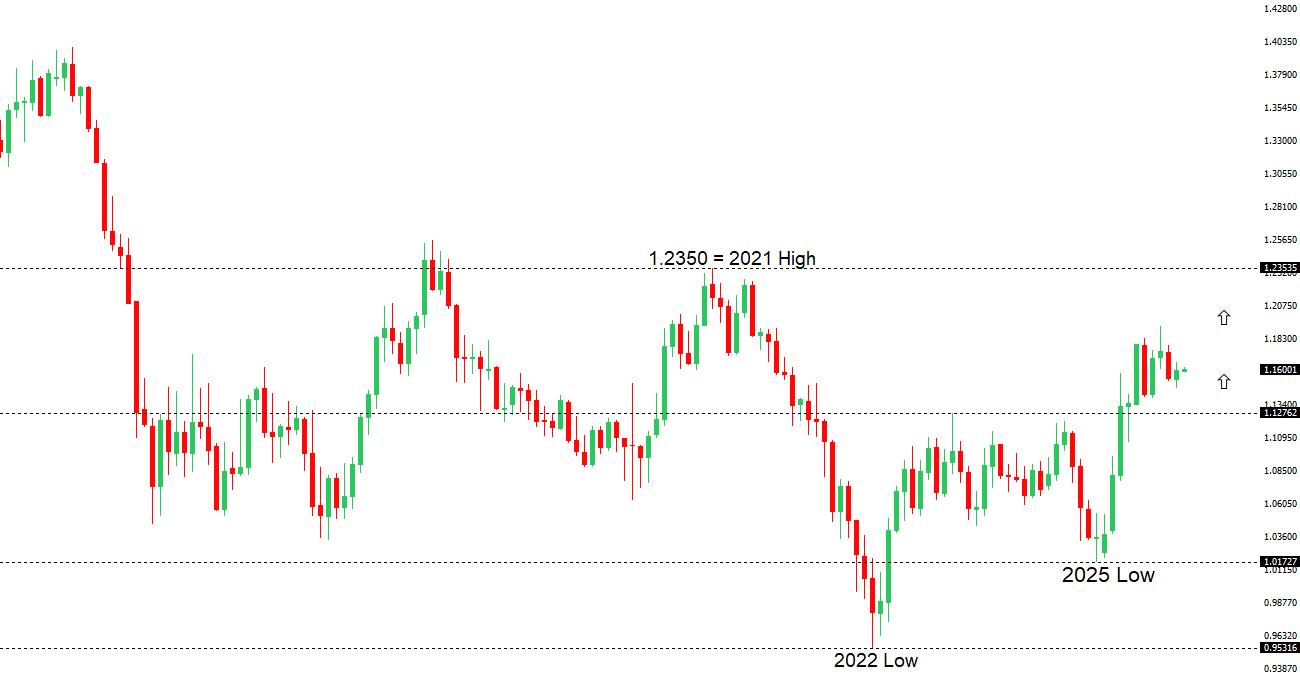

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1678 - 3 December high - Medium S1 1.1547 - 26 November low - Medium S2 1.1469 - 5 November low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB expects the euro’s recent strength to steadily push eurozone inflation lower over the next three years, with the biggest impact—about a 0.6-point drop for every 10% rise in the currency—felt roughly a year after the move. With the euro already up more than 12% this year, that disinflation could influence future policy debates even as officials signal comfort with current rates near 2%. One major European bank sees the euro gradually appreciating to around $1.20 by late 2026, though gains may be limited if U.S. growth stays strong and tech-driven capital flows continue supporting the dollar. Meanwhile, U.S.–Russia talks over a potential Ukraine peace deal ended without a breakthrough, and Russia’s battlefield advantage may be strengthening Moscow’s demands in negotiations. | ||

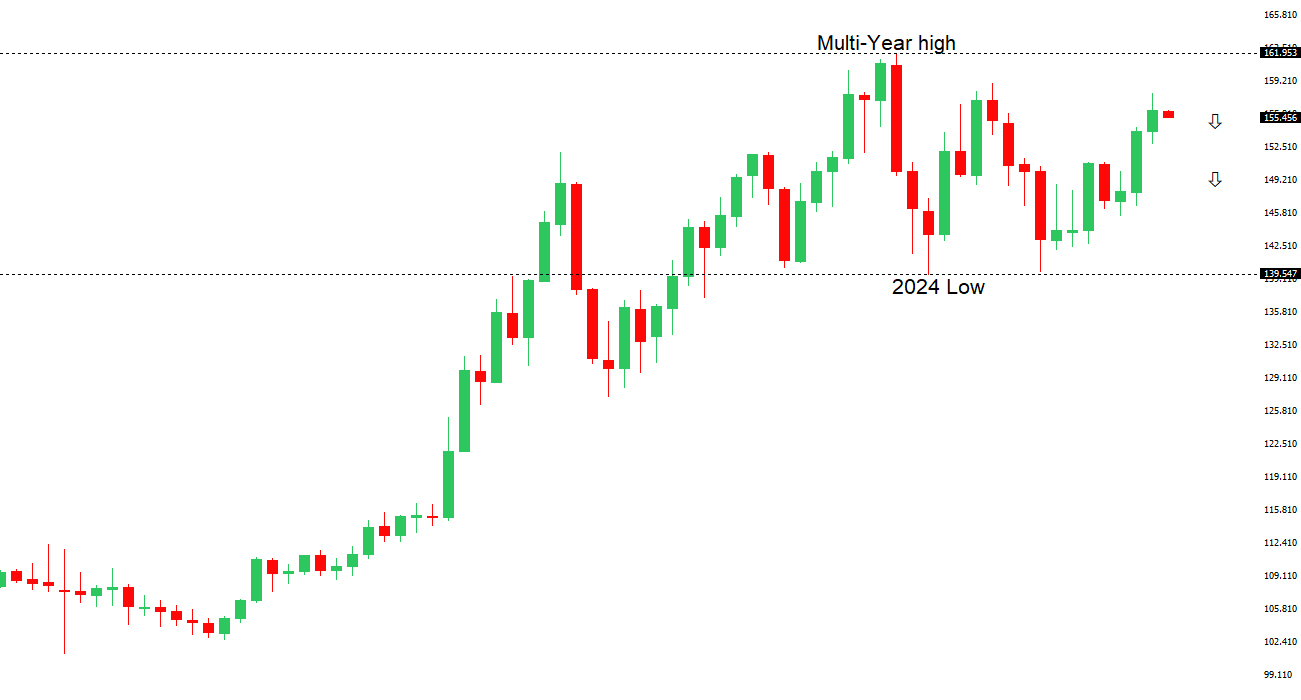

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.90 - 20 November/2025 high - Strong R1 156.59 - 28 November high - Medium S1 154.66 - 1 December low - Medium S2 153.61 - 14 November low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s metalworkers’ union JCM, representing two million employees, plans to demand at least a ¥12,000 monthly base-pay hike—matching last year’s record request and aligning with Rengo’s push for wage gains of 5% or more. Strong corporate profits and policy support give unions confidence that companies can absorb higher labour costs. BOJ Governor Ueda has stressed that early wage-negotiation momentum will be crucial for the Bank’s December 19 policy decision, with markets pricing an ~80% chance of a rate hike. His recent comments about Japan’s “neutral” rate being above current levels have reinforced expectations of tightening and lifted JGB yields. While some warn of yen carry-trade unwinding, wide U.S.–Japan yield differentials mean a sudden crash is unlikely. The market still expects only gradual BOJ hikes as the Fed eventually cuts, keeping the rate gap from closing too quickly. Even if the BOJ hikes in December, investors may soon question how much further it can tighten given its cautious stance and a fiscally expansionary Takaichi administration. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6520 - 28 November low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Aussie dollar jumped after weak U.S. ADP data boosted expectations of a Fed rate cut next week, while strong Australian household spending data reinforced the case for the RBA to stay on hold. October spending surged 1.3%—more than double forecasts—driven by discretionary items like clothing, footwear, furnishings, and hospitality tied to events and festivals. With demand still firm and inflation risks lingering, markets expect the RBA to keep policy steady through most of 2026, with the next move potentially being a hike. This positions the AUD to remain one of the highest-yielding G10 currencies into early 2026, making it an attractive carry play. | ||

| Suggested reading | ||

| Is AI Becoming the Next “Too Big to Fail” Industry?, M. Keenan, American Thinker (December 2, 2025) A Case for a New Floating Rate Treasury Note, D. Duffie, Brookings (December 2, 2025) | ||