| ||

| 17th September 2025 | view in browser | ||

| Fed rate cut looms, markets eye Powell’s next move | ||

| Markets are bracing for the Federal Reserve’s next moves, with a 25-basis-point rate cut already expected and attention now on Fed Chair Powell’s press conference and the Fed’s economic projections for clues about future rate cuts, inflation risks, and labor market trends. | ||

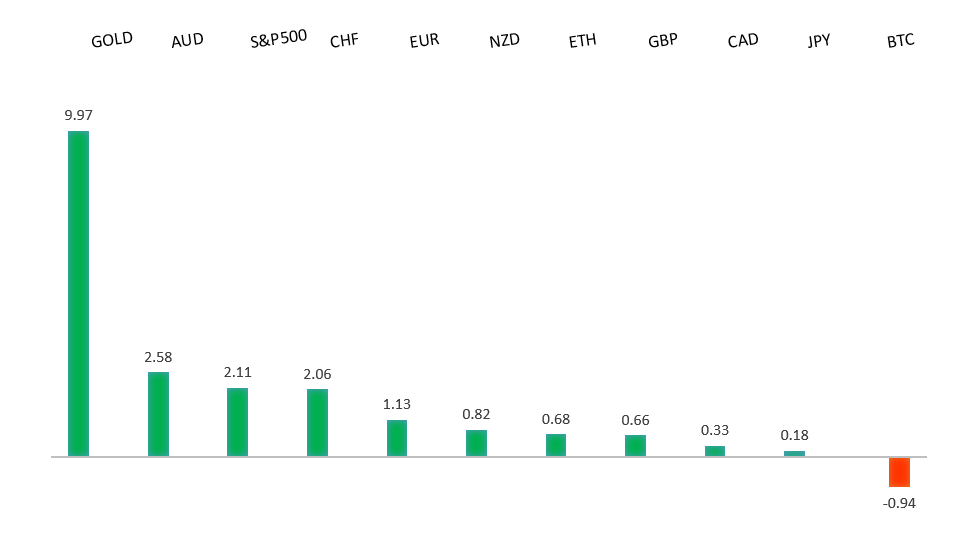

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1900 - Figure - Medium R1 1.1879 - 16 September/2025 high - Medium S1 1.1758 - 16 September low - Medium S2 1.1660 - 11 September low - Medium | ||

| EURUSD: fundamental overview | ||

| Analysts increasingly expect the European Central Bank to raise interest rates rather than cut them, with no hikes anticipated before June next year, as ECB members like Martins Kazaks and Gediminas Simkus argue current rates are appropriate given stable 2% inflation and a non-deteriorating economy. This stance contrasts with the U.S. Federal Reserve’s potential dovish guidance, which could push the Euro to $1.18-$1.20, with one major European bank predicting a rise to $1.20 by year-end if the Fed cuts rates by 75 basis points. Meanwhile, Germany’s ZEW Survey Expectations for September rose to 37.3, beating estimates and signaling growing optimism among financial experts about Germany’s economic recovery, despite challenges like global demand and trade policy uncertainties. | ||

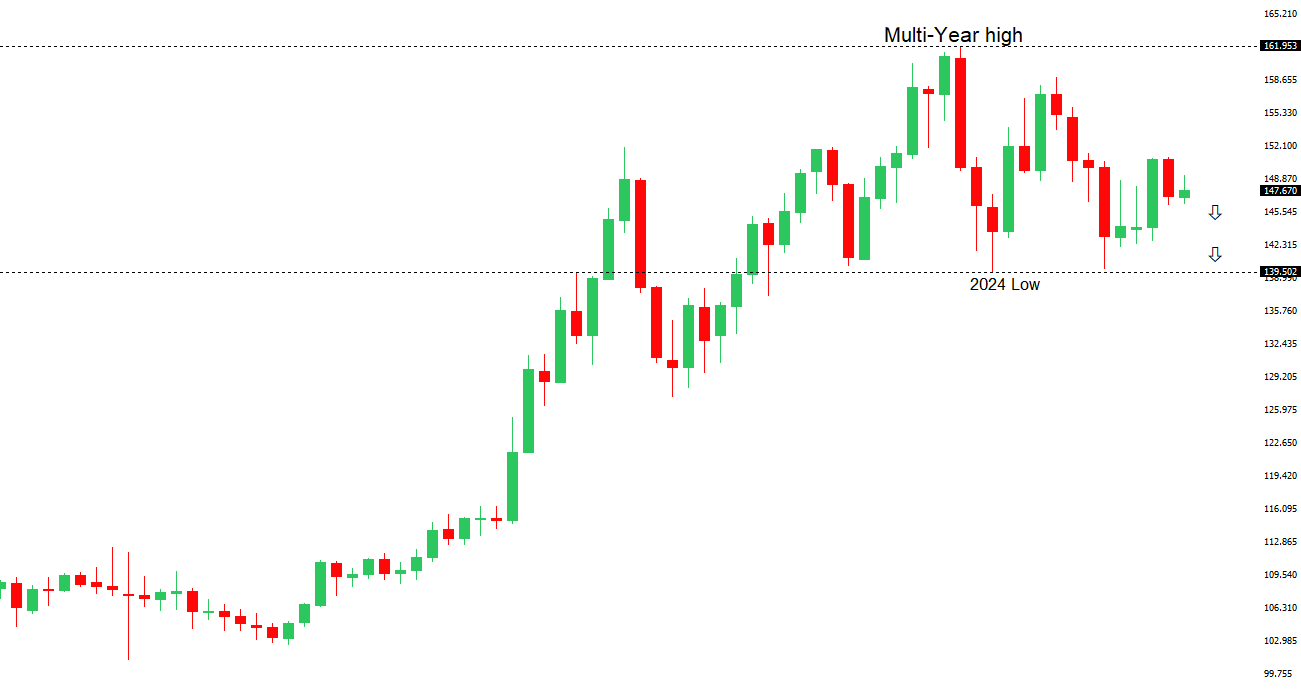

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.14 - 3 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan is likely to maintain its current policy rate of 0.5% at its September 2025 meeting, awaiting clarity on Japan’s political leadership following Ishiba’s resignation. Despite political uncertainty, steady economic growth, rising wages, and reduced trade risks bolster the case for a potential rate hike in October or December, with a Bloomberg survey favoring a hike by January. The Liberal Democratic Party leadership race, particularly a potential Shinjiro Koizumi victory, could support BOJ tightening, strengthening the yen, while a Sanae Takaichi win might weaken it due to her preference for continued easing. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6700 - Figure - Medium R1 0.6690 - 17 September/2025 high - Strong S1 0.6483 - 2 September low - Medium S1 0.6414 - 22 August low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Federal Reserve is expected to cut rates by 25 basis points at its next meeting, with further cuts anticipated in October and December, while the Reserve Bank of Australia is likely to maintain its 3.6% rate in September, with potential cuts in November or early next year due to improving consumer spending and inflation nearing the 2–3% target. The Australian dollar is climbing to yearly highs, supported by rising Australia-US yield spreads and bullish bets from macro hedge funds via call options against major currencies like the USD, CAD, and CHF. Australia’s superannuation funds are increasing overseas investments and currency hedging, which could bolster the AUD but introduce risks if market volatility spikes. August labor data, due tomorrow, is expected to show stable unemployment at 4.2%, a 67% participation rate, and solid job growth of around 21,000. | ||

| Suggested reading | ||

| Investing’s About Nuance, Incremental Change, J. Calhoun, Alhambra (September 14, 2025) It’s 2020, and You Know AI Is Coming: Intel or Nvidia?, S. McBride, RiskHedge (September 12, 2025) | ||