| ||

| 15th December 2025 | view in browser | ||

| Global markets shift as growth doubts build | ||

| Global markets are starting the week with a clear rotation theme as investors move away from expensive tech into more reasonably valued areas. U.S. equity futures have stabilized after a mixed week in which the Dow hit new highs while the S&P 500 and Nasdaq fell. | ||

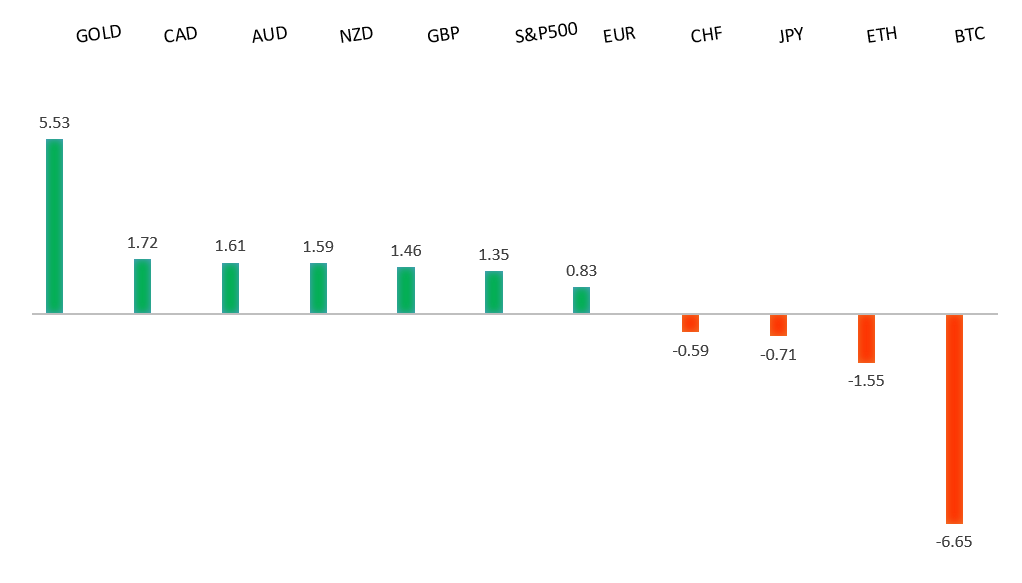

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1400. | ||

| ||

| R2 1.1919 - 17 September/2025 high -Strong R1 1.1779 - 1 October high - Medium S1 1.1615 - 9 December low - Strong S2 1.1469 - 5 November low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro stayed supported as investors expect the ECB to keep interest rates unchanged, with President Christine Lagarde signaling possible upward revisions to growth forecasts. Political concerns in France also eased after approval of the 2026 social-security budget. Still, a modest rebound in the dollar capped further gains in the euro. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.90 - 20 November/2025 high - Strong R1 156.96 - 9 December high - Medium S1 154.34 - 5 December low - Strong S2 153.61 - 14 November low - Medium | ||

| USDJPY: fundamental overview | ||

| The Japanese yen has been better bid of late as investors look ahead to the Bank of Japan’s policy meeting, where a 25-basis-point rate hike to 0.75% is widely expected. Markets are focused on Governor Kazuo Ueda’s comments for signals on next year’s outlook, with some analysts forecasting rates could reach 1% by mid-year, supported by strong economic data and persistent inflation. Government officials also appear supportive of tighter policy, citing concerns over yen weakness fueling import costs, while business sentiment among large manufacturers climbed to a four-year high in the fourth quarter. | ||

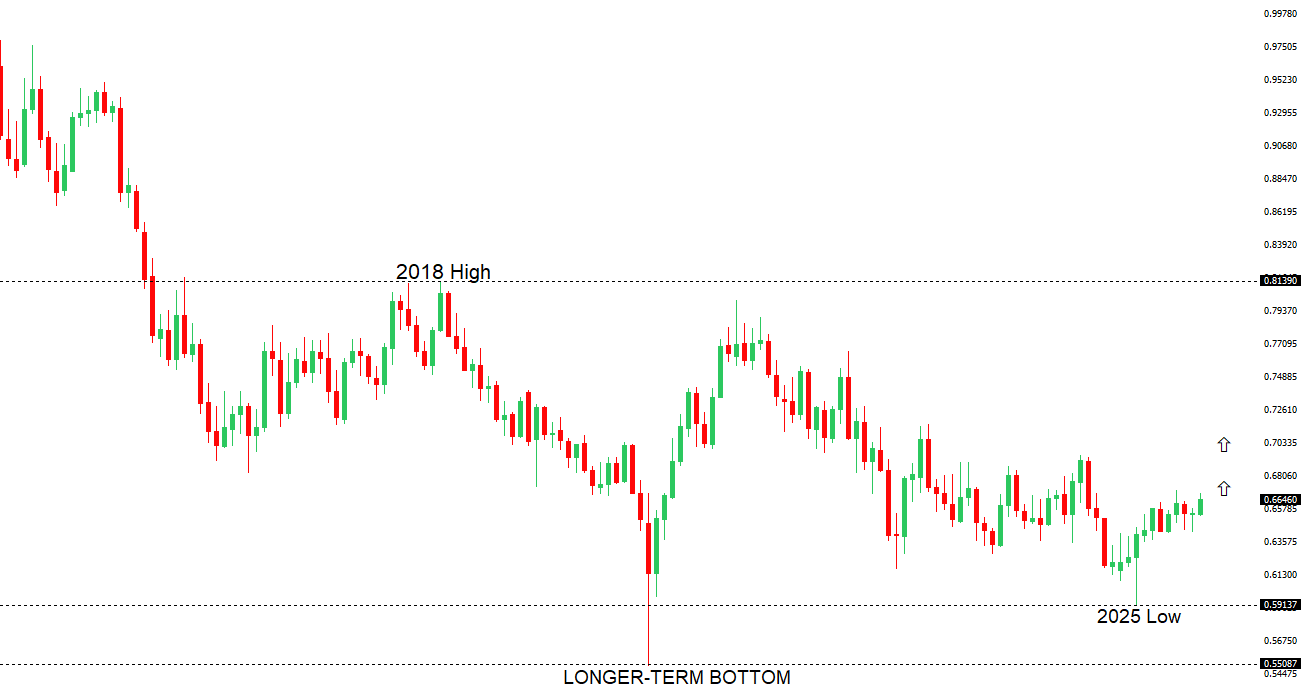

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6707 - 17 September/2025 high - Strong R1 0.6686 - 10 December high - Medium S1 0.6520 - 28 November low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar has cooled off following the latest surge as investors weigh mixed labor market data. An unexpected drop in jobs in November suggested the job market is slowly cooling, prompting traders to push back expectations for interest rate hikes to late 2026, even as the Reserve Bank of Australia maintains that conditions remain tight. Attention now turns to upcoming PMI data, while the US dollar also softened after the Federal Reserve delivered a rate cut and struck a less hawkish tone than expected. | ||

| Suggested reading | ||

| Prediction Mkts. Mint Youngest Self-Made Billionaire, S. McBride, RiskHedge (December 12, 2025) Next Decade Expected Return For The S&P 500, T. Slok, Apollo Academy (December 11, 2025) | ||