| ||

| 14th November 2025 | view in browser | ||

| Hawkish rhetoric does nothing for Dollar | ||

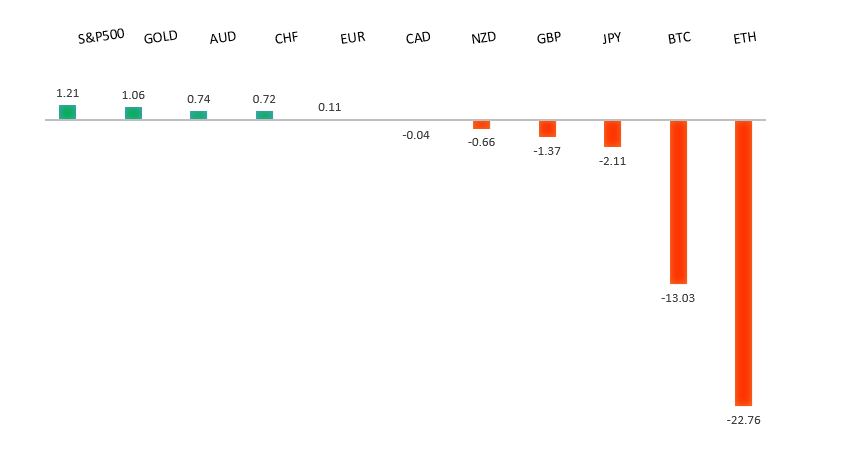

| Global markets come into Friday on the back of an unusually broad risk-off move that saw equities, carry trades, crypto, the dollar index, and gold all sold, even as Treasury yields rose and Fed officials pushed a more cautious—or even slightly hawkish—tone. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB’s latest bulletin shows it is keeping interest rates unchanged as inflation nears its 2% goal, with eurozone growth supported by a strong labour market and earlier rate cuts, though global uncertainty keeps policymakers cautious. Analysts expect the euro to strengthen—potentially moving above $1.20 next year and toward $1.22–1.24 by 2026—driven by improving eurozone growth, potential oil price declines, and a widening policy gap with the Fed. Major US banks share this broadly bullish outlook, while markets are also beginning to speculate about Christine Lagarde’s successor, with Knot, Nagel, and De Cos seen as frontrunners. Recent data, however, show softer industrial production, highlighting an uneven economic backdrop. | ||

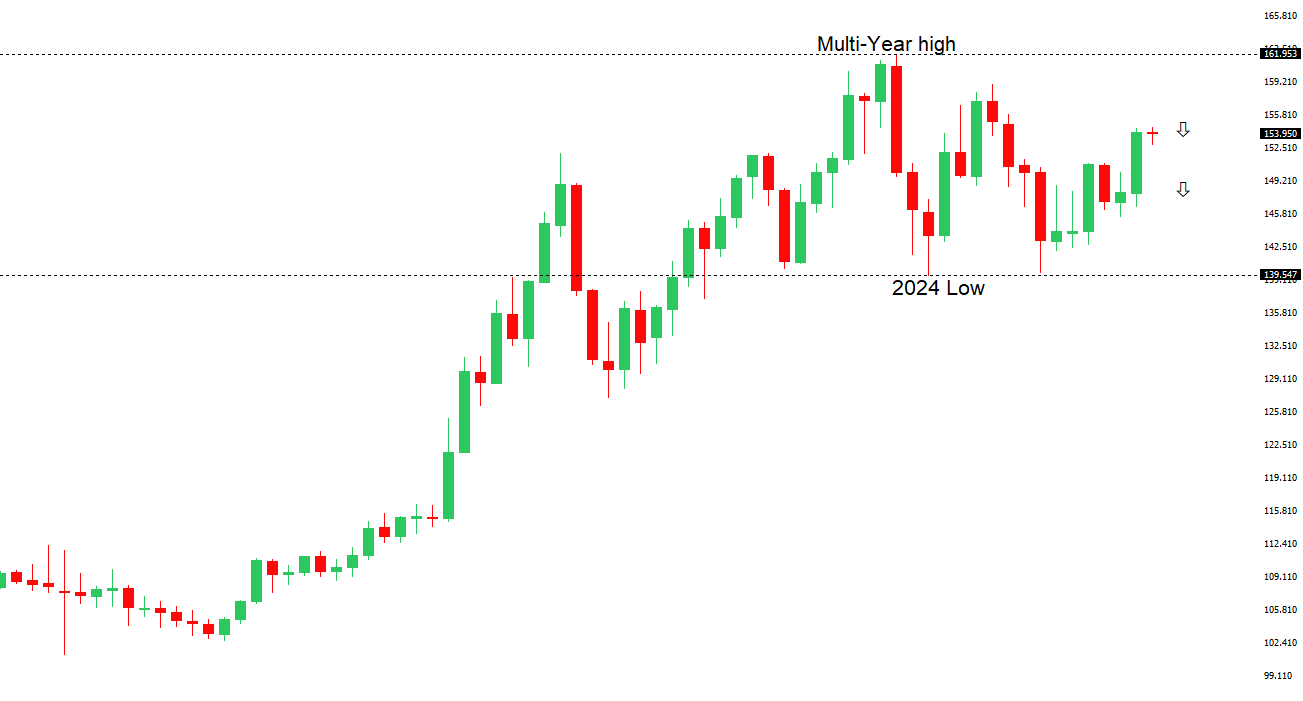

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.98 - 28 January high - Medium R1 155.05 - 12 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s finance minister issued another warning as the yen slid near 155, highlighting growing concerns over the weak currency but offering little confidence that intervention is imminent. Markets see PM Takaichi’s shift toward looser fiscal policy, her appointment of pro-reflation advisers, and expectations of a large stimulus package as signals that Abenomics-style easing will continue—keeping pressure on the yen. Traders also view her comments about closer coordination with the BOJ as a sign that rate hikes could be further delayed. Although the BOJ may still raise rates once in December or January, investors doubt it will go much further, leaving the yen’s fate largely dependent on whether the Fed starts cutting rates; without that, USDJPY is likely to remain biased higher. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s job market strengthened in October, with unemployment slipping to 4.3% and more than 42,000 new jobs added—mostly full-time—while underemployment also eased, signaling a still-tight labour market. The stronger data lifted the Australian dollar and bond yields as investors pushed back expectations for future RBA rate cuts. With inflation risks lingering and the economy showing resilience—from steady wage growth to improving consumer sentiment and housing activity—the RBA is expected to keep policy on hold for now. Analysts see low market volatility ahead as global interest rates settle near neutral levels, which could boost carry-trade demand; in this environment, Australia’s relatively high rates and improving growth outlook position the Aussie dollar as a potential G-10 outperformer. | ||

| Suggested reading | ||

| China: Chip Limits Bite, L. Wei, WSJ (November 11, 2025) Investor Noise, Not News, Fisher Investments (November 12, 2025) | ||