| ||

| 28th November 2025 | view in browser | ||

| Holiday lull masks building macro momentum | ||

| Global markets enter the day with a steadier tone as the dollar pauses its recent slide, even as traders now price in a near-certain Fed cut in December and additional easing next year. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

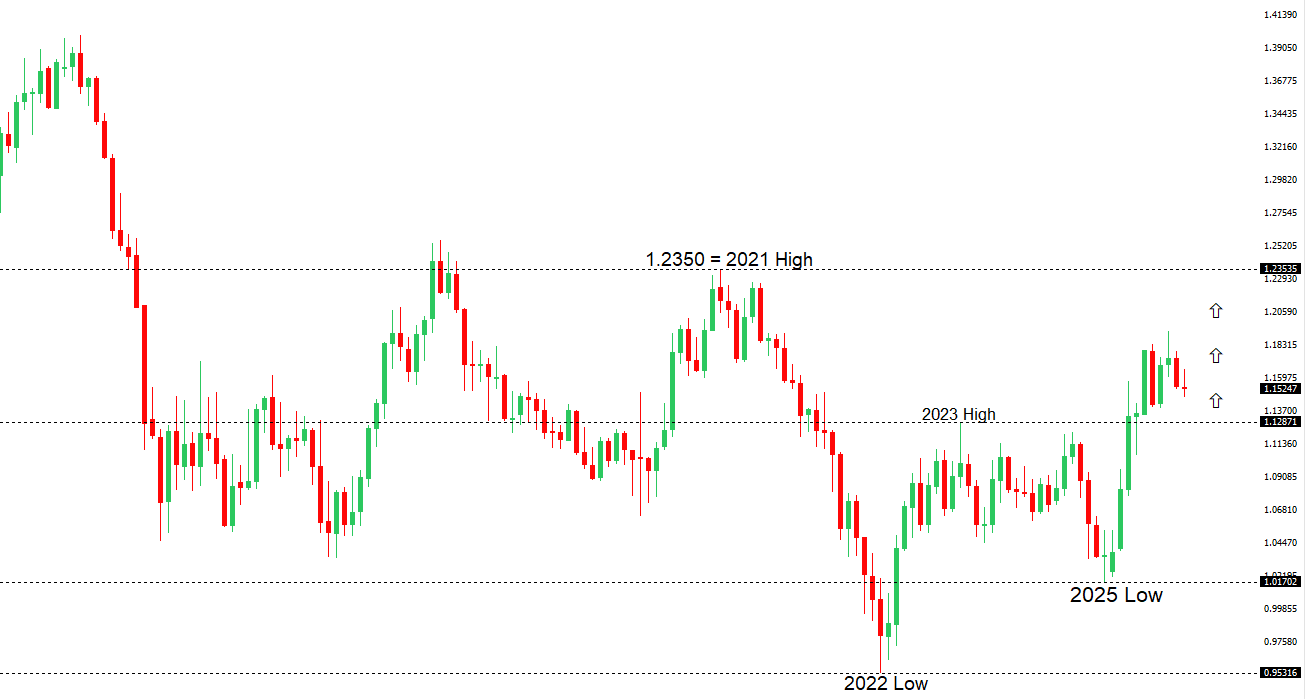

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The eurozone is showing signs of slow, steady improvement: economic confidence has risen for a third month to its highest level since early 2023, supported by stronger services activity and firmer employment expectations, even as industry and consumers remain cautious. Germany’s consumer sentiment has also stabilized, with buying willingness improving ahead of the holidays, though overall confidence and spending power remain weak. Despite geopolitical tensions and new U.S. tariffs, the eurozone economy expanded modestly in Q3 and unemployment remains low, supporting a gradual recovery. Central banks are broadly on hold, and with the Fed likely to be the only major bank easing further into 2026, the dollar could weaken and help the euro turn higher. Upcoming German data—retail sales, unemployment, and CPI—should show slight spending stabilization, steady labor conditions, and inflation hovering near recent levels. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Tokyo’s latest CPI reading stayed firm at 2.7%—with core measures also unchanged—supporting the case for BOJ policy normalization, though markets think PM Takaichi may still push for patience as long as inflation isn’t accelerating. Fresh data showed surprisingly strong industrial output and retail sales, reinforcing pressure for at least one BOJ rate hike, but investors doubt the central bank’s freedom to tighten further under a government still aligned with Abenomics. Policymakers appear to be attempting an unsustainable mix of loose fiscal policy, negative real rates, and a stable yen, a combination markets are likely to challenge. Ultimately, a meaningful yen rebound depends more on U.S. rate cuts, which one major US investment house expects to drive USDJPY toward 140 by early 2026. Meanwhile, geopolitical tensions with China persist—despite Japan denying a report about U.S. advice on Taiwan—adding another headwind for the yen and a factor the BOJ may weigh in its policy decisions. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s Q3 private capital expenditure jumped 6.4% QoQ—far above expectations—driven almost entirely by a surge in tech-related investment, especially data centres and AI infrastructure, which saw machinery and equipment spending soar over 90%. Outside of tech (and a boost from aircraft deliveries), broader business investment remains soft, but the tech-led capex boom should support Q3 GDP. This comes alongside a run of stronger-than-expected economic data and steady credit growth, reinforcing expectations that the RBA will keep policy restrictive for longer, with some even forecasting rate hikes in 2026. Combined with improving U.S.–China relations and the yuan’s recent strength, the Aussie dollar could benefit both as a high-yield currency and a proxy for China-related risk appetite. | ||

| Suggested reading | ||

| Business Surveys Give Us Reasons to Be Thankful, Fisher Investments (November 24, 2025) Thanksgiving Costs at All-Time Highs, P. Earle, AIER (November 25, 2025) | ||