| ||

| 20th February 2026 | view in browser | ||

| Macro steady, risks elevated | ||

| Global markets enter the day facing elevated geopolitical risk alongside resilient but uneven economic momentum, with cooling inflation in Japan, fragile but stabilizing growth in Europe, and still-firm US activity and inflation reinforcing a cautious outlook for gradual normalization rather than a sharp slowdown. | ||

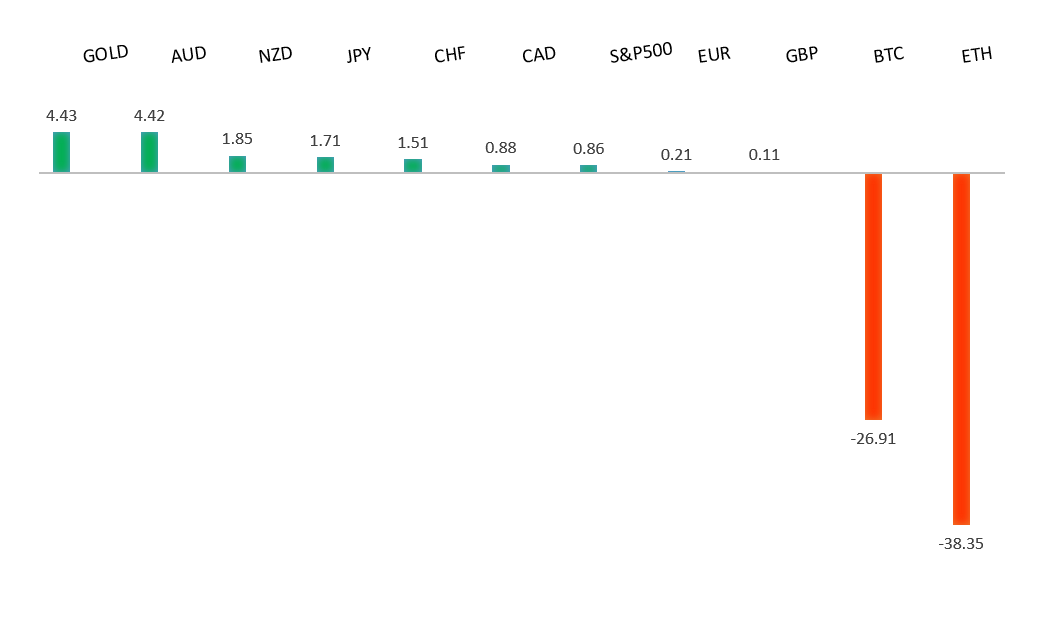

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2081 - 27 Janaury/2026 high - Strong R1 1.1929 - 10 February high - Medium S1 1.1742 - 19 February low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro enters late February under pressure, as fading momentum and political uncertainty offset a still-stable economic backdrop. The ECB kept rates unchanged and maintained a cautious, data-dependent stance as inflation eases and growth remains modest but supported by strong services, government spending, and resilient domestic demand, even as exports face headwinds. Markets still favor buying dips, though positioning appears stretched and vulnerable to periods of dollar strength. Meanwhile, ECB President Christine Lagarde emphasized the importance of preserving and reforming the global rules-based system, warning against fragmentation into rival blocs. Upcoming PMI and wage data, particularly from Germany, are expected to show gradual improvement led by services and a stabilizing manufacturing sector, reinforcing the view of a fragile but ongoing recovery. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 156.30 - 10 February high - Medium R1 155.35 - 19 February high - Medium S1 152.24 - 12 February low - Medium S2 151.97 - 28 January/2026 low - Strong | ||

| USDJPY: fundamental overview | ||

| USDJPY has rebounded after pulling back from its February high, now recovering toward the 50-day moving average near 156. Japan’s latest CPI data showed headline and core inflation easing due to temporary factors, but underlying price pressures remain firm, reinforcing expectations that the Bank of Japan will continue normalizing policy gradually rather than rushing into near-term rate hikes. While softer inflation reduces immediate support for the yen and helps keep USDJPY elevated, persistent underlying inflation and the BOJ’s sensitivity to currency weakness leave room for yen strength if price pressures pick up or depreciation intensifies. Meanwhile, stronger PMI readings point to improving business momentum, supporting confidence as the government prepares multi-year fiscal initiatives aimed at boosting long-term investment and growth. | ||

| AUDUSD: technical overview | ||

| There are signs of the formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6700. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7147 - 12 February/2026 high - Strong S1 0.7007 - 9 February low - Medium S2 0.6897 - 6 February low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar has held recent dips comfortably above the 9 February low of 0.7007, supported by still-tight domestic fundamentals. Strong labor data—including low unemployment, solid job gains, and firm wage growth—reinforce the view that the economy remains resilient and inflation risks persist, keeping the RBA biased toward further tightening or maintaining restrictive policy. Although recent PMI data point to slowing but still-positive growth alongside renewed price pressures, expectations for at least one more RBA hike—contrasted with a Fed closer to easing—continue to underpin the AUD, encouraging investors to buy dips rather than expect sustained downside. | ||

| Suggested reading | ||

| The AI Disruption We’ve Been Waiting for Has Arrived, P. Ford, NY Times (February 18, 2026) Housing Doesn’t Need Higher Prices, Just More Homes, T. Peter, AEIdeas (February 18, 2026) | ||