| ||

| 31st October 2025 | view in browser | ||

| Markets bet on seasonal Dollar strength | ||

| Markets are adjusting to reduced expectations for Federal Reserve rate cuts after Chair Powell emphasized that a December reduction is not guaranteed, boosting the dollar. Historically, the dollar also strengthens in Q4 due to year-end repatriations and liquidity needs. | ||

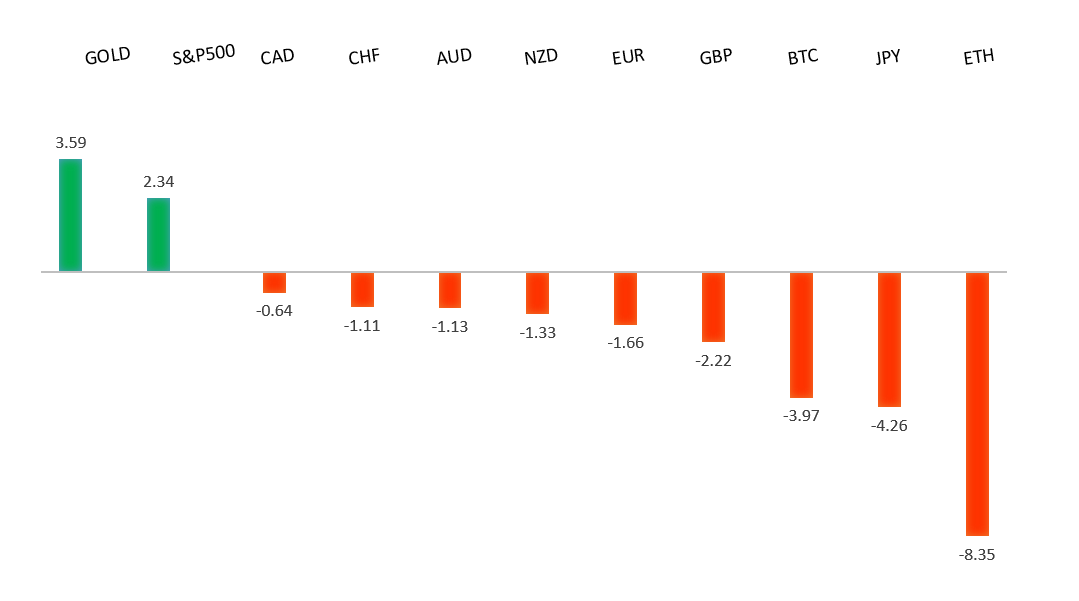

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

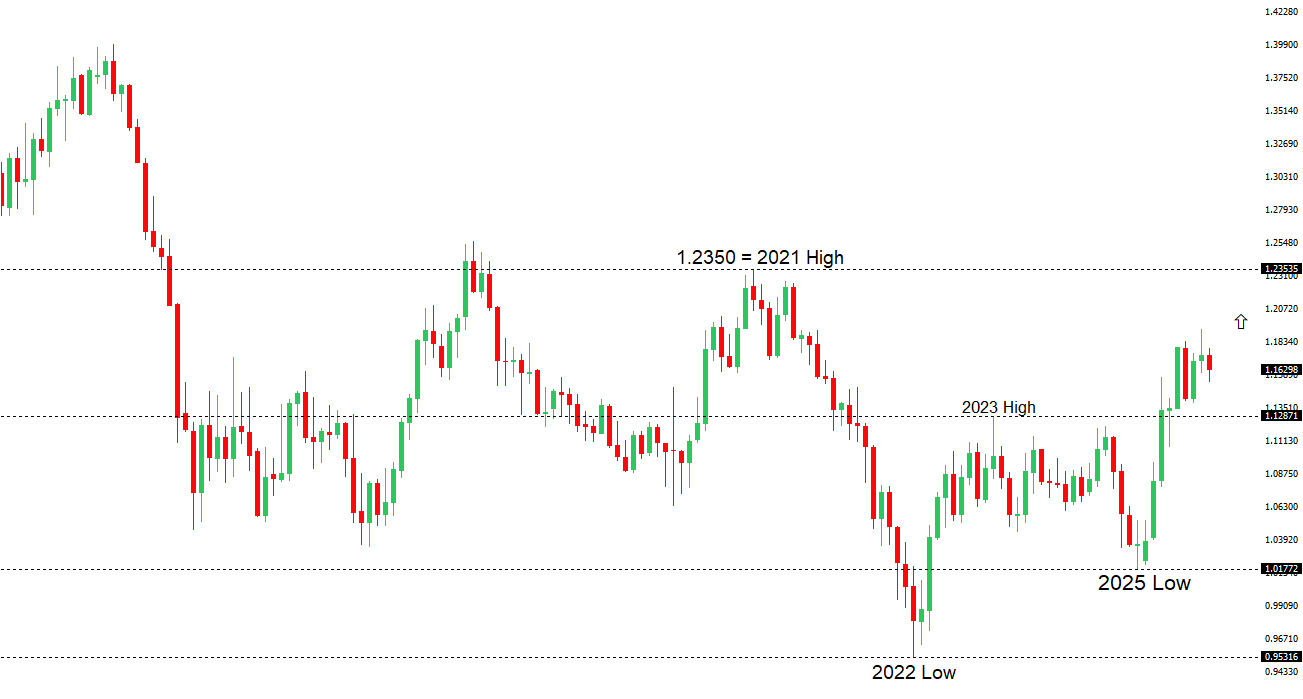

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB held its deposit rate at 2%, citing labor market strength, solid balance sheets, and past cuts as buffers against trade disputes and geopolitical risks, while eurozone Q3 GDP rose to 0.2% from 0.1% in Q2, topping forecasts despite U.S. tariffs—with Q4 and 2026 growth expected to accelerate via German fiscal expansion, infrastructure, and private sector stabilization. Markets ignored the predictable ECB decision, instead pricing a slimmer ECB-Fed rate gap after Powell tempered December cut odds, pressuring EURUSD but likely respecting support absent fresh catalysts. Upcoming: October inflation forecast to ease to 2.1% YoY headline and 2.3% core, aligning with ECB views and trending below 2% from Q1 2026 due to tariffs; German September retail sales seen rebounding 0.2% MoM and 2.7% YoY, confirming gradual consumer recovery despite high rates and weak exports. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 154.45 - 30 October high - Medium S1 151.54 - 29 October low - Medium S2 149.38 - 17 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan kept its policy rate at 0.5%—with two dissenters pushing for a hike for the second straight meeting—aligning with most forecasts despite new easing-friendly Prime Minister Sanae Takaichi, but the yen plunged as markets saw the seventh delay signaling prolonged normalization, amplified by Fed Chair Powell’s warning against assuming a December U.S. cut. Former Governor Haruhiko Kuroda called the yen “too weak” at 153 per dollar, forecasting a rise to 120–130 on narrowing rate differentials, U.S. cuts, and potential BOJ hikes amid stable 1.5% growth, 2.6% unemployment, and met inflation targets, though hedge funds bet against it, driving massive USDJPY call option volume toward 160 by year-end. Reinforcing the hawkish case, Tokyo core inflation accelerated to 2.8% in October, topping expectations and showing persistent underlying pressures. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s hotter-than-expected Q3 CPI—with annual inflation at 3.2%, trimmed mean up 1.0% q/q, and September at 3.5%—has flipped RBA expectations to a near-certain hold on November 4, pushing rate cuts to 2026 unless inflation or labor markets soften sharply; the Australian Dollar spiked to three-week highs but retreated below 0.6600 after Fed Chair Powell tempered December cut hopes. The Trump-Xi meeting yielded no fresh catalysts beyond pre-leaked deals, prompting a “sell the fact” reaction rather than sustained risk-on gains, though one major US investment house stays bullish on AUD amid cooling global inflation and easing trade tensions. Supporting the tighter policy outlook, recent PPI acceleration and robust private sector credit growth reinforce persistent inflationary pressures. | ||

| Suggested reading | ||

| Why AI Spending Spree Could Spell Trouble for Investors, L. Swedroe, Morningstar (October 30, 2025) If It’s a Bubble, So What?!, K. K, The Brooklyn Investor (October 25, 2025) | ||