| ||

| 2nd December 2025 | view in browser | ||

| Markets brace for shifting policy signals | ||

| Global markets open the day navigating shifting policy expectations and uneven data: In the US, weak ISM manufacturing readings and delayed inflation data have strengthened expectations for a December Fed cut, even as Treasury yields rise on global bond pressures and a divided central bank keeps uncertainty high. | ||

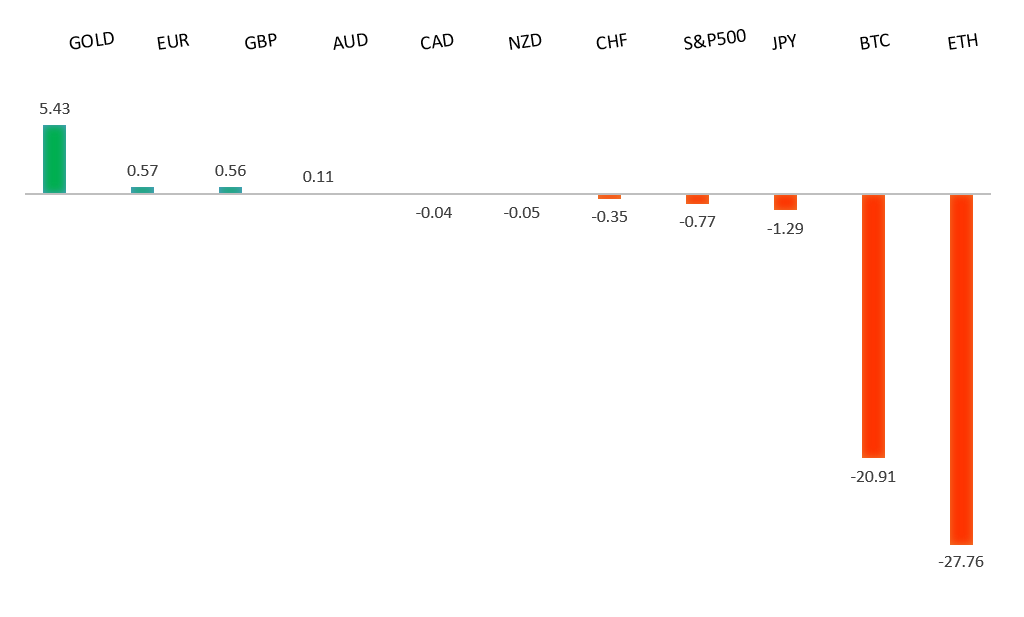

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB President Christine Lagarde signaled that interest rates are appropriately restrictive for the euro area’s current stage of the inflation cycle, with inflation near 2% and wage growth easing. She and other officials—including ECB Vice President de Guindos and Germany’s Nagel—don’t expect a policy change in December unless new forecasts show inflation slipping clearly below target, though they remain watchful of upside risks such as US tariffs or supply disruptions. With most major central banks nearing the end of their easing cycles—or even considering hikes—the Fed may be the only one cutting again in 2026, a setup that could weaken the dollar and revive the euro. Eurozone inflation for November is expected to hold near current levels (headline ~2.1–2.2%, core ~2.5%) before easing more noticeably next year, while unemployment is forecast to remain steady at 6.3%. Geopolitically, Ukraine’s territorial questions remain the biggest obstacle to the US-backed peace plan, leaving negotiations far from resolved. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.90 - 20 November/2025 high - Strong R1 156.59 - 28 November high - Medium S1 154.66 - 1 December low - Medium S2 153.61 - 14 November low - Strong | ||

| USDJPY: fundamental overview | ||

| Governor Ueda signaled that the BOJ will seriously consider a rate hike at its Dec. 18–19 meeting, pushing expectations of year-end tightening sharply higher and lifting JGB yields. MUFG sees Ueda’s stance—and apparent alignment with the government—as paving the way for a near-term hike and supporting a stronger yen, with USDJPY potentially returning toward 150 early next year. Recent comments from Finance Minister Katayama reinforce this view, suggesting the government won’t resist tighter policy. While global FX remains sensitive to the Fed’s trajectory, a December hike may quickly shift focus to whether the BOJ can tighten further, given its slow cadence, fiscal expansion under the Takaichi administration, and rising external risks, including weaker Chinese demand. Meanwhile, Japan’s new DOGE-style fiscal efficiency office appears more symbolic than transformative, especially as it accompanies a ¥21–22 trillion stimulus package unlikely to offset upward pressure on debt or downward pressure on the yen. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6581 - 13 November high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Aussie dollar’s recent pause came amid JGB-driven risk-off moves, but its technical and macro backdrop has strengthened notably. A wave of upbeat data suggests Australia is entering a cyclical upswing, supporting the RBA’s steady stance even as capacity constraints and stagnant productivity limit scope for rate cuts. With several analysts now expecting RBA hikes as early as early-2026, AUD could become one of the highest-yielding G10 currencies, enhancing its appeal. Additional support may come from defence spending, which is set to boost economic activity and housing demand, particularly in Perth. While weak Chinese data and property-sector stress remain headwinds, upcoming policy stimulus from Beijing could improve sentiment and offer the AUD further upside. | ||

| Suggested reading | ||

| The Courage to Do Nothing Is an Essential Skill for Investors, S. Sears, Barron’s (December 1, 2025) Apple’s iPhone Eviscerates Federal Reserve’s Phillips Curve, J. Tamny, Forbes (November 30, 2025) | ||