| ||

| 6th June 2025 | view in browser | ||

| Markets brace for US jobs report | ||

| In just six months since President Trump’s inauguration, his once-strong alliance with Elon Musk has deteriorated into a public feud, with Musk criticizing the GOP’s tax-cut bill and Trump threatening Musk’s government contracts. Meanwhile, investors are cautious ahead of the U.S. May jobs report. | ||

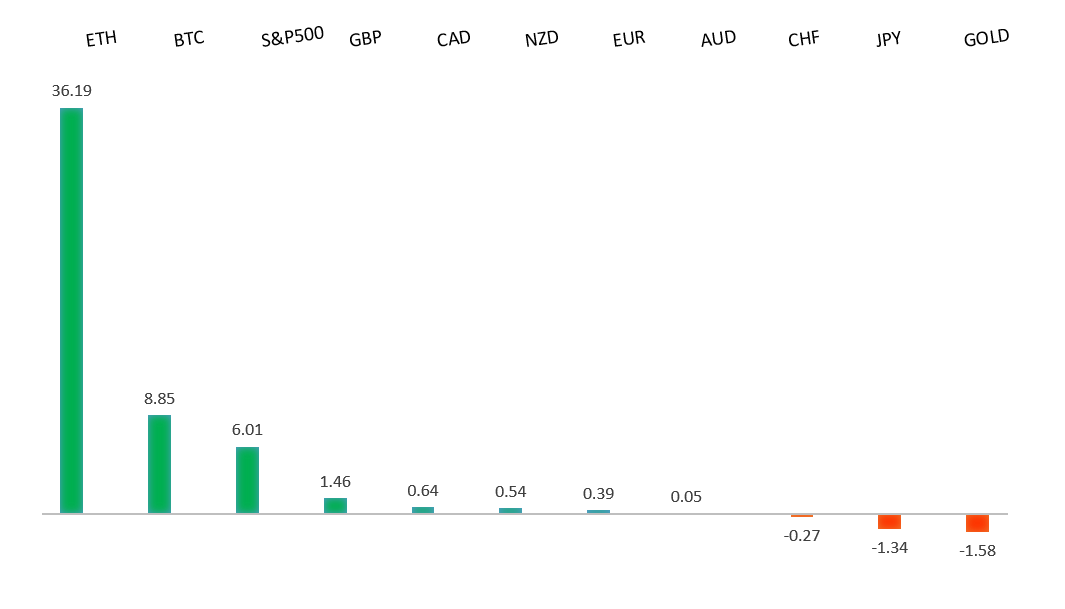

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1574 - 21 April/2025 high - Strong R1 1.1495 - 5 June high - Medium S1 1.1210 - 29 May low - Medium S2 1.1065 - 12 May low - Strong | ||

| EURUSD: fundamental overview | ||

| Markets are bracing for the U.S. nonfarm payrolls report, expected to show a slowdown to 126,000 new jobs in May, with unemployment steady at 4.2%, though mixed signals from higher jobless claims (247,000) and a weak ADP report (37,000 jobs) suggest cooling hiring momentum. The European Central Bank cut rates for the eighth time in a year, but ECB President Christine Lagarde hinted at a potential pause in easing, while lowering inflation forecasts to hit 2% in 2025, dropping to 1.6% in 2026, and rebounding to 2% in 2027, boosting European stocks and pushing German 10-year Bund yields to a low of 2.49%. Eurozone Q1 GDP is expected to edge up to 0.4% quarter-over-quarter, but Germany faces challenges with a projected sharp decline in April industrial production (-1.0%) and a shrinking trade surplus (€19.1 billion), driven by weak exports and global trade tensions. ECB officials, including Lagarde, will speak today, potentially shedding light on future policy moves. | ||

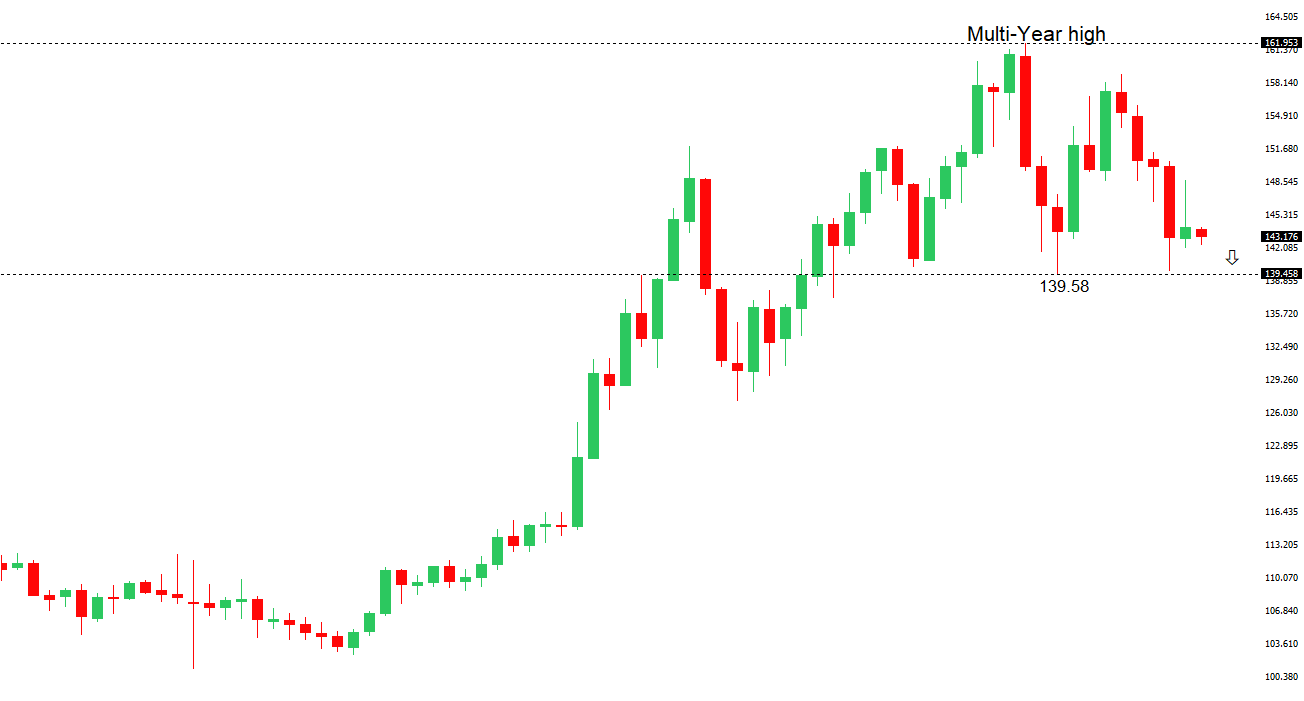

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| The yen weakened as markets awaited the U.S. jobs report, with cautious optimism sparked by Trump-Xi talks, though lacking concrete details. Japanese household spending unexpectedly fell 0.1% in April, missing the 1.5% growth forecast, signaling inflation’s strain on consumers and complicating the Bank of Japan’s plans, though Governor Kazuo Ueda reiterated readiness to raise rates if economic conditions align. Japanese stocks, including the Nikkei 225 (+0.4%) and Topix (+0.5%), rebounded modestly, while 10-year JGB yields dropped to 1.45% after strong bond auctions eased market pressures. The BOJ plans to further reduce bond purchases next year, signaling steady monetary policy normalization amid concerns over Japan’s fiscal health. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6539 - 5 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australian PM Anthony Albanese signaled openness to a beef trade deal with the U.S. to ease tariff tensions, despite strict biosecurity laws, ahead of potential G7 summit talks with Trump. Australia’s housing sector saw a 3.1% surge in private house approvals in April, though total dwelling approvals dropped 5.7% due to a sharp decline in multi-unit developments. The S&P/ASX 200 dipped 0.1% but remains set for a fourth weekly gain, with markets cautiously optimistic about U.S.-China trade talks despite ongoing tensions. | ||

| Suggested reading | ||

| Cathie Wood Goes Hunting: A Look at What She Bought, R. Munarriz, Motley Fool (June 4, 2025) No, AI Robots Won’t Take All Our Jobs, R. Atkinson, WSJ (June 5, 2025) | ||