|

||

| 21st April 2025 | view in browser | ||

| Markets consumed with ‘Sell America’ theme | ||

|

The Trump administration’s efforts to undermine the independence of agencies like the SEC, the Consumer Financial Protection Bureau, and potentially the Federal Reserve, alongside escalating U.S.-China trade tensions and tariff uncertainties, are fueling a “Sell America” sentiment and contributing to the U.S. dollar’s decline. |

||

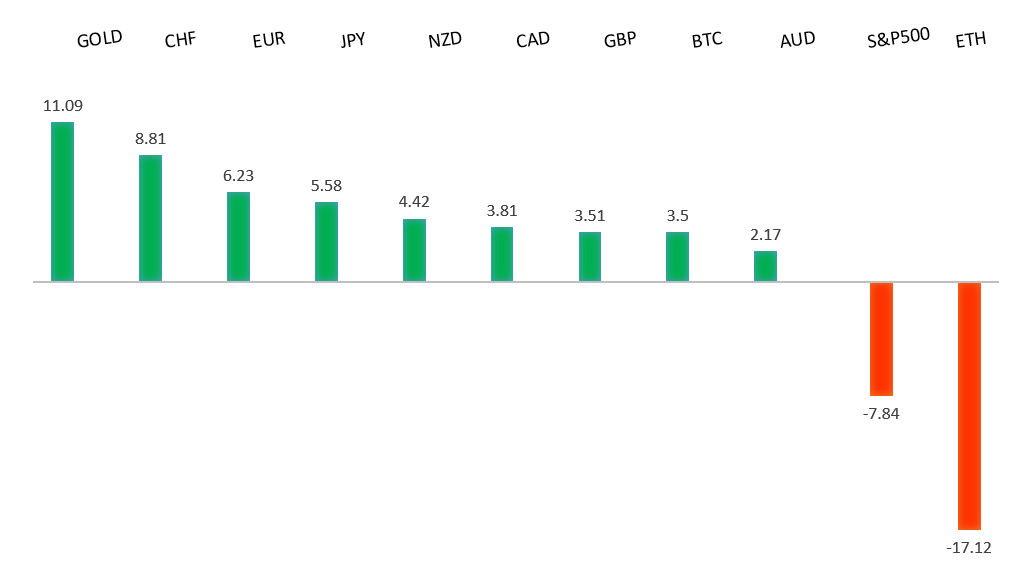

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

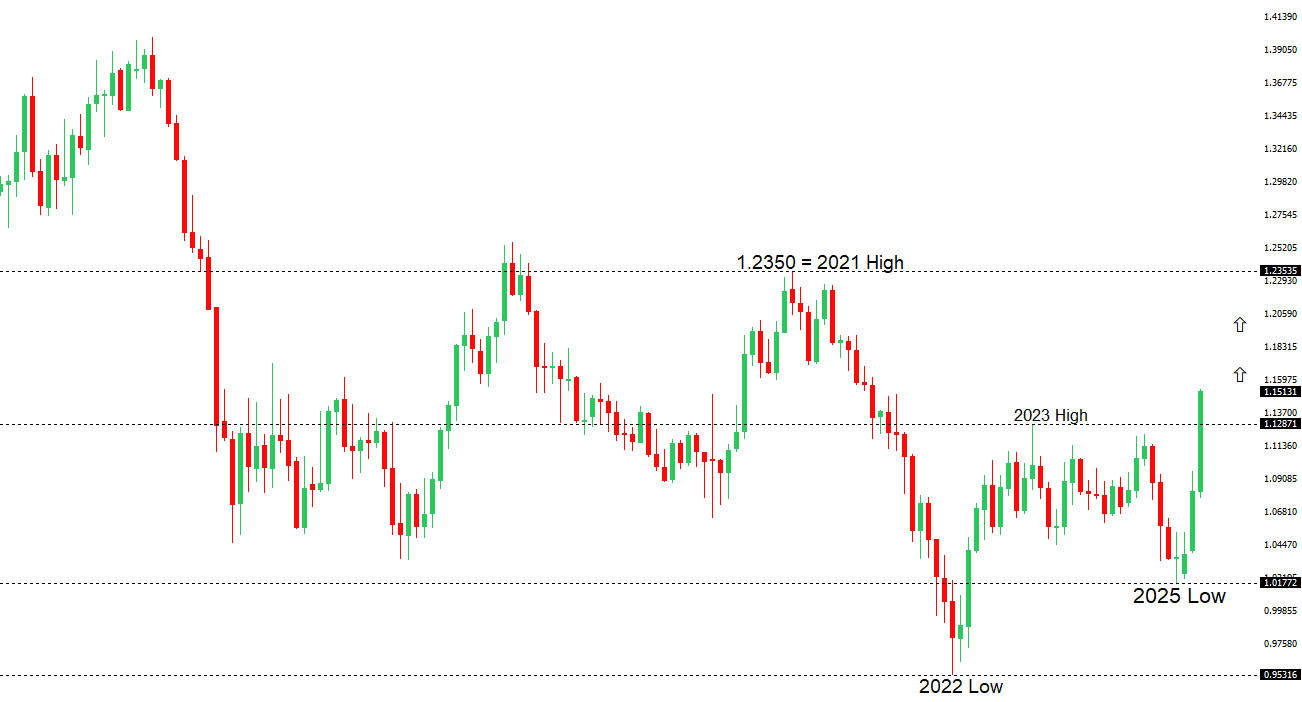

| EURUSD: technical overview | ||

|

The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. |

||

|

||

|

R2 1.1600

- Figure - Medium

R1 1.1533 - 21 April/2025 high - Strong S1 1.1335 - 17 April low - Medium S2 1.1264 - 15 April low - Strong |

||

| EURUSD: fundamental overview | ||

|

The shifting landscape amidst a more unpredictable set of policies from the US administration has forced a major reconsideration of the US Dollar as the choice currency. Chinese investors are shifting from US Treasuries to European bonds, particularly German, Spanish, and Italian debt, while global asset managers like Vanguard and Citigroup favor European bonds, expecting ECB rate cuts and improved fiscal conditions. |

||

| USDJPY: technical overview | ||

|

There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback to the 2024 low at 139.58 over the coming sessions. |

||

|

||

|

R2 143.60

- 15 April high - Medium

R1 142.11 - 21 April high - Medium S1 140.62 - 21 April/2025 low - Medium S2 140.00 - Psychological - Strong |

||

| USDJPY: fundamental overview | ||

|

Japan’s March CPI data indicates persistent inflation, with core CPI rising 3.2% year-on-year, exceeding the Bank of Japan’s 2% target for nearly three years. This reinforces the central bank’s overall hawkish stance, though the BOJ is expected to cautiously pause rate hikes due to economic pressures from U.S. tariffs on Japanese goods. U.S.-Japan trade talks are progressing, with Japan aiming for favorable tariff exemptions, potentially sparking a relief rally in risk assets and impacting yen long positions, while a second round of discussions on April 24 may address currency issues amid U.S. accusations of yen weakening. Speculative net long yen positions have surged to 171,855 contracts, and a major Japanese bank has lowered its year-end dollar forecast to 137.50, citing concerns over U.S. stagflation and asset credibility. |

||

| AUDUSD: technical overview | ||

|

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. |

||

|

||

|

R2 0.6500

- Psychological - Strong

R1 0.6427 - 21 April/2025 high - Medium S1 0.6333 - 17 April low - Medium S1 0.6275 - 14 April low - Strong |

||

| AUDUSD: fundamental overview | ||

|

The Australian Dollar has been performing well of late, potentially signaling a bottoming process for AUD/USD amid a shift away from USD assets and possible Chinese policy support against U.S. tariffs. Despite a robust Australian labor market with a March unemployment rate of 4.1%, the Reserve Bank of Australia is expected to cut rates in May, as markets anticipate economic growth concerns will outweigh inflation risks, with the RBA’s April meeting minutes indicating a cautious approach to policy adjustments. The U.S.-China trade tensions have weighed more heavily on the U.S. dollar than Aussie, positioning the dollar as a new risk currency, while markets await further Australian economic data to confirm the RBA’s rate cut decision at the May 19-20 meeting. |

||

| Suggested reading | ||

|

Are we on the brink of a nuclear revival?, P. Clark, Financial Times (April 17, 2025) Trade War May Have Supercharged AI Development, L. Lango, InvestorPlace (April 17, 2025) |

||