| ||

| 15th September 2025 | view in browser | ||

| Markets eye Fed’s next moves amid economic slowdown | ||

| Declining sentiment and job insecurity may prompt the Federal Reserve to cut rates further to bolster the economy, with markets anticipating a 25bps cut in September and focusing on the Fed’s projections and Chair Powell’s press conference for clues on future rate cuts, inflation risks, and labor market conditions. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1830 - 1 July/2025 high - Strong R1 1.1789 - 24 July high - Medium S1 1.1608 - 3 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank maintained its key interest rates, keeping the deposit rate at 2%, reflecting a cautious approach as inflation remains stable and the euro zone economy shows resilience. ECB policymakers are adopting a data-driven, meeting-by-meeting strategy, with no further rate cuts expected soon, and some analysts predict a potential rate hike by mid-2026. Austrian Central Bank Governor Martin Kocher noted the rate cycle may be nearing its end, while ECB member Joachim Nagel warned that further rate cuts could threaten the 2% inflation target, emphasizing fiscal discipline. Key upcoming data, including Germany’s ZEW Survey and Eurozone CPI, may influence the EURUSD, which is expected to trend upward. | ||

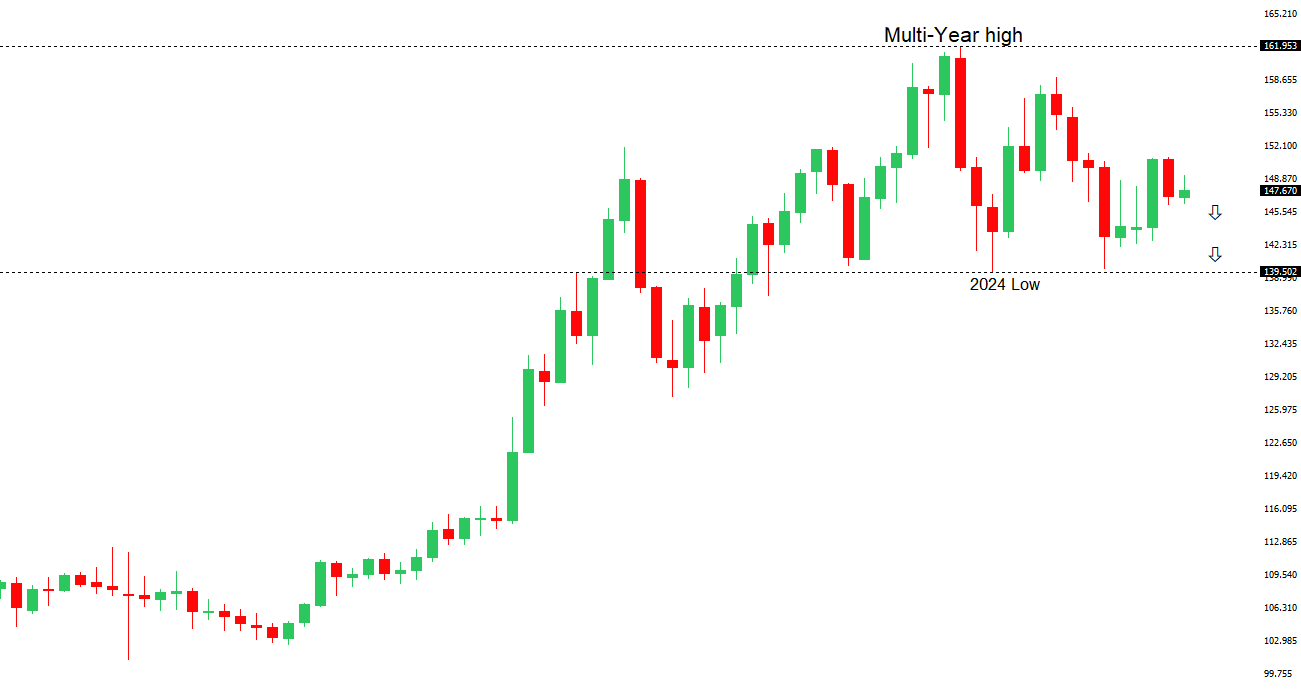

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.14 - 3 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan is likely to keep its benchmark interest rate at 0.5% this Friday, awaiting clarity on new leadership following Ishiba’s resignation, which has weakened investor confidence and introduced a yen-negative premium. Despite political uncertainty, economic growth, rising wages, and reduced trade risks support a potential rate hike by October or December, with a Bloomberg survey favoring October. While markets remain skeptical about near-term tightening, a hawkish signal from Governor Ueda on September 19 could strengthen the yen, especially as the U.S. Federal Reserve continues its rate cuts. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6700 - Figure - Medium R1 0.6669 - 12 September/2025 high - Strong S1 0.6483 - 2 September low - Medium S1 0.6414 - 22 August low - Strong | ||

| AUDUSD: fundamental overview | ||

| Recent U.S. economic data supports expectations for a 25bps Federal Reserve rate cut, with further cuts anticipated in October and December. In Australia, strong economic indicators have reduced the likelihood of a November RBA rate cut to 81%, as inflation remains stable and household spending rises for the sixth consecutive month, signaling a consumer recovery. However, robust consumer spending could delay further RBA rate cuts if it drives inflation. The Australian dollar is gaining strength, supported by a dovish Fed outlook, a stronger Chinese yuan, and bullish bets from hedge funds, with Australia’s August labor data due this week. | ||

| Suggested reading | ||

| Getting innovative with insurance in a world of climate change, L. Harris, Financial Times (September 15, 2025) Could the U.S. Dollar Lose Its Dominance?, B. Eichengreen, Wall Street Journal (September 11, 2025) | ||