| ||

| 10th June 2025 | view in browser | ||

| Markets eye US CPI, trade talks for direction | ||

| The U.S. dollar hovered near its lowest levels since April, despite a slight rebound, as markets focused on ongoing U.S.-China trade talks in London, described as “good” and “fruitful” by Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, though geopolitical tensions in the Russia-Ukraine and Israel-Iran conflicts kept investors cautious. | ||

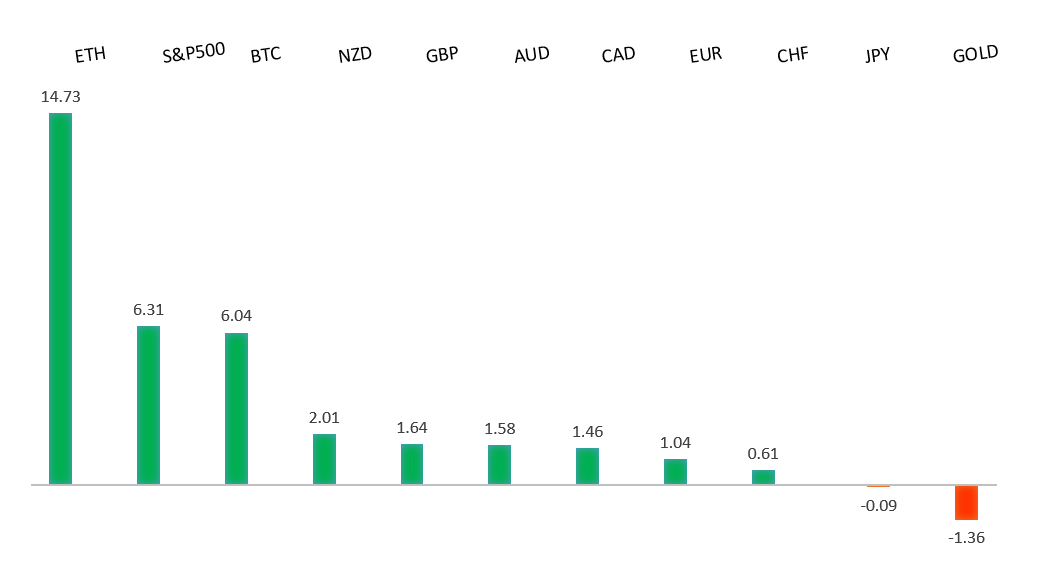

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1574 - 21 April/2025 high - Strong R1 1.1495 - 5 June high - Medium S1 1.1210 - 29 May low - Medium S2 1.1065 - 12 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro gained momentum as US-China trade talks in London continued, focusing on rare-earth minerals and tech exports, while investors awaited speeches from ECB officials, including Francois Villeroy de Galhau, Robert Holzmann, and Olli Rehn, on monetary policy and trade uncertainties. The ECB’s recent 25-basis-point rate cut and lowered inflation forecasts signal easing price pressures, though hints of a nearing end to rate cuts bolstered the euro, despite money markets expecting one more cut by year-end. European bond yields dipped, with Germany’s 10-year Bund at 2.51%, and stocks remained flat, though chipmaker Alphawave soared 20% on Qualcomm’s $2.4 billion acquisition, and Spectris jumped 60% amid takeover talks. Persistent euro selling by central banks and sovereign funds, as noted by Bank of America, tempers gains, but a shift toward de-dollarization could strengthen the euro, while upcoming UK labor data and euro-area sentiment indicators, expected to improve slightly to -5.5, highlight ongoing economic concerns. | ||

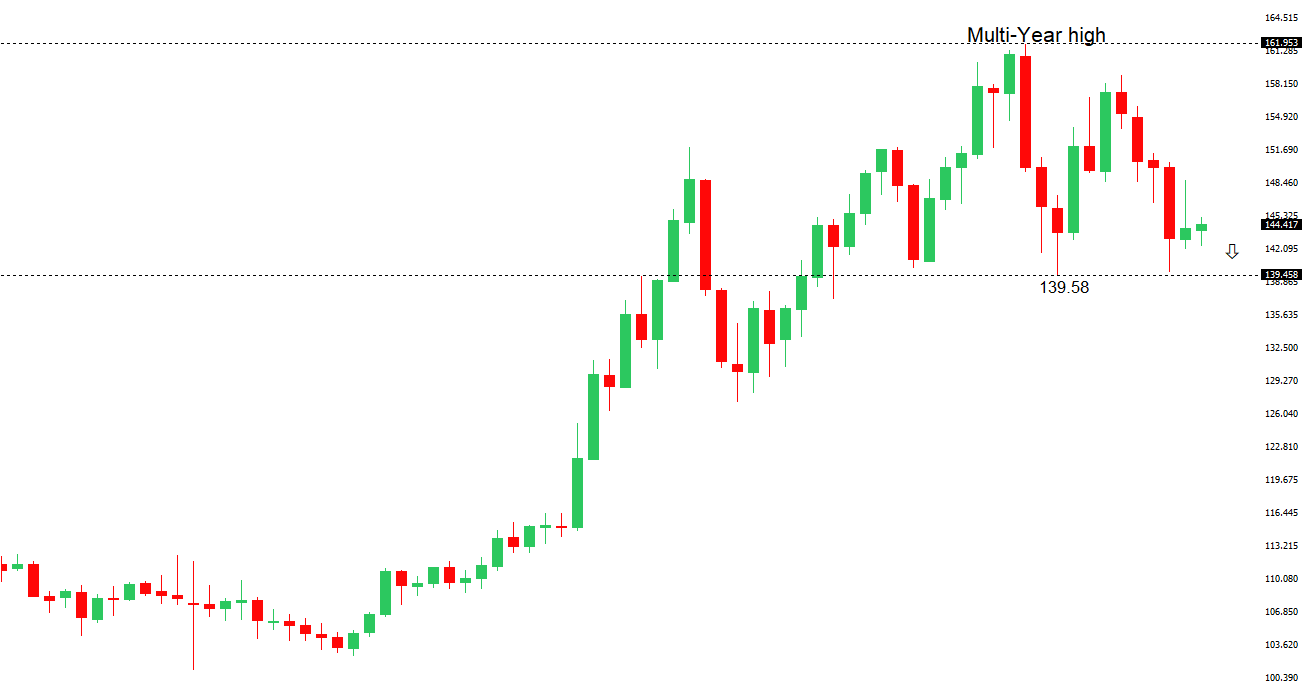

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s Q1 GDP was revised to flat growth, better than the initially reported 0.2% contraction but slower than Q4 2024’s 0.6% expansion, boosting the Nikkei 225 by 0.92% to 38,088 and the Topix by 0.58% to 2,785, led by tech stocks. The 10-year JGB yield rose above 1.47% as BOJ Governor Kazuo Ueda signaled potential rate hikes and continued bond purchase tapering, with speculation of a slower tapering pace at next week’s meeting possibly pushing short-term yields higher. Positive US-China trade developments, including China’s approval of rare earth exports and Boeing’s resumed jet deliveries, further lifted investor sentiment as trade talks in London continued. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6539 - 5 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar extended Monday’s 0.3% gain, trading near 0.6520, up 2.28% over the past month and 5.32% year-to-date, with momentum suggesting a push past resistance at 0.6550 toward last November’s high of 0.6688, supported by a floor at 0.6479. Optimism from ongoing US-China trade talks in London, led by U.S. Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng, has boosted risk appetite, though China’s persistent deflation, with consumer prices falling for a fourth month and producer prices dropping sharply, raises concerns for Australia’s economy. Australia’s 10-year ACGB yield climbed above 4.3%, reflecting improved market sentiment, but RBA Assistant Governor Sarah Hunter warned that U.S. tariffs could hamper growth, potentially necessitating further policy support, with a 75-basis-point rate cut priced in by year-end and an 82% chance of a 25-basis-point cut in July. | ||

| Suggested reading | ||

| What’s Harder? Planning Rates, or Harvard’s Class Of 2029?, J. Tamny, Forbes (June 8, 2025) A Chart That Vivifies the Beginning of an AI Stock Boom, L. Lango, InvestorPlace (June 7, 2025) | ||