| ||

| 17th November 2025 | view in browser | ||

| Markets tread carefully as global risks resurface | ||

| The Euro has eased slightly after peaking ahead of 1.1700, as reports suggest the EU may downgrade its 2026 growth outlook due to trade tensions, US tariffs, and ongoing economic and political strains in Germany and France. | ||

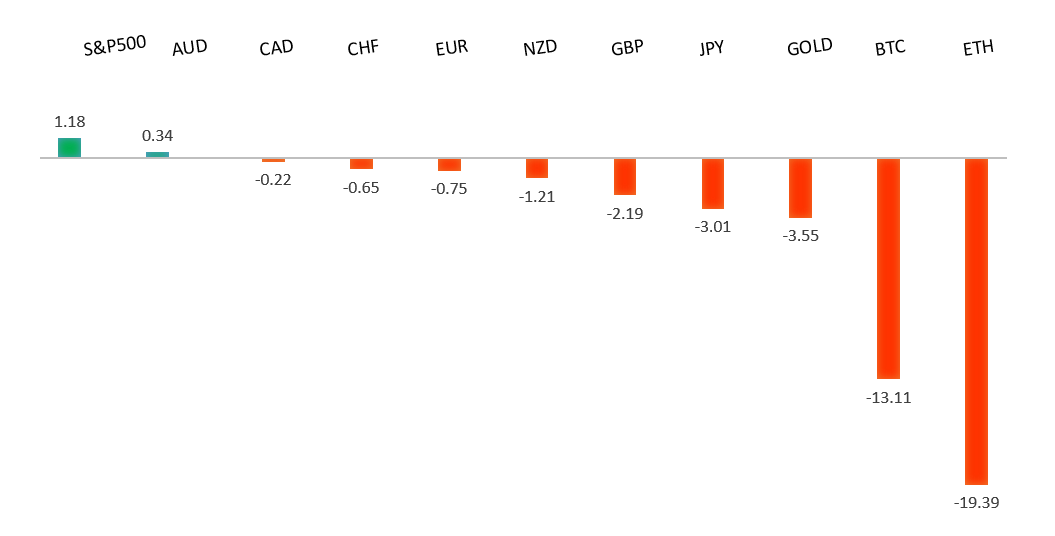

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro managed a second weekly gain despite Friday’s pullback, as expectations for a Fed rate cut in December declined. Eurozone GDP rose modestly in Q3, but nearly half the region—including Germany and Italy—saw stagnation or contraction, raising concerns about uneven growth and policy effectiveness. The ECB is unlikely to cut rates soon, with inflation near 2% and policy seen as neutral, but ongoing weakness in key economies could pressure the euro if peripheral strength fades. Most banks remain optimistic, with forecasts for EURUSD near 1.20 by end-2025 and up to 1.24 by mid-2026, though outcomes hinge on central bank decisions, US growth, and geopolitics. Markets are also speculating about ECB President Lagarde’s successor, with hawkish candidates like Knot, Nagel, and De Cos in focus. Key data this week includes flash PMIs, Germany’s PPI, eurozone consumer confidence, and the EU’s autumn economic forecast. | ||

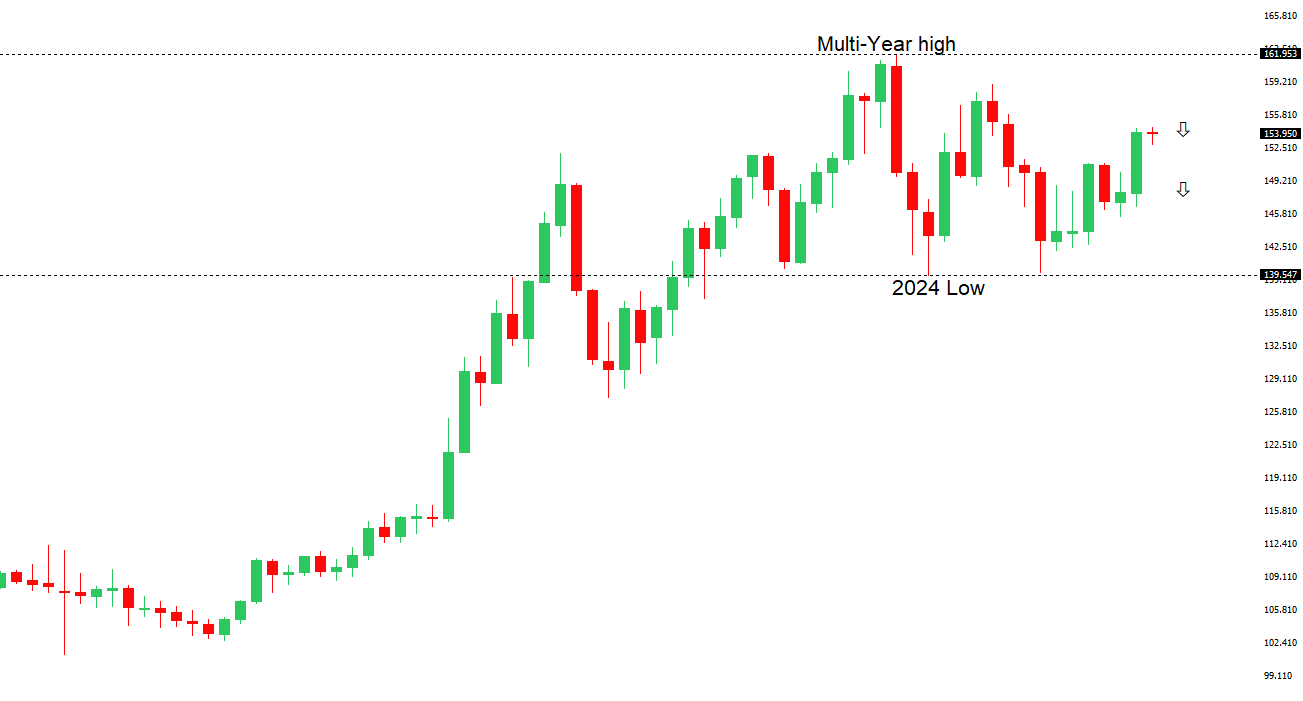

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.98 - 28 January high - Medium R1 155.05 - 12 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Despite rising talk of foreign exchange intervention, most traders still view direct action by Japan as unlikely in the near term, even with USDJPY nearing 160 again. Investors see “Abenomics 2.0” under PM Sanae Takaichi as yen-negative, especially after she shifted to multi-year budgeting and appointed reflationist advisors, signaling more spending and loose policy ahead. A large stimulus package worth ¥15–20 trillion is expected soon, though pushback could shrink it and temper yen weakness. Tensions with China and weak economic data—including a 1.8% GDP contraction—add pressure, while upcoming inflation and trade figures could influence expectations of a Bank of Japan policy shift. Overall, fiscal expansion and diplomatic risks point to continued yen softness unless spending is curbed or the BOJ tightens sooner than expected. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| US President Donald Trump reversed his earlier protectionist stance by signing an executive order removing tariffs on imported foods, including Australian beef, coffee, and bananas—providing a direct boost to Australian agriculture and supporting risk sentiment globally. This comes alongside strong Australian labor data for October, with unemployment falling to 4.3% and a surge in full-time employment, reinforcing the economy’s tight conditions and prompting markets to push back expectations of interest rate cuts by the RBA until at least 2026. The central bank is now expected to maintain its current policy stance due to solid domestic momentum and concerns about inflation, with upcoming RBA minutes and remarks from officials likely to emphasize a hawkish outlook. | ||

| Suggested reading | ||

| Longest Shutdown Did Not Arrest This Bull Market, Fisher Investments (November 14, 2025) The Market’s Decline Can Net You Big Opportunities, P. V. Doorn, Marketwatch (November 14, 2025) | ||