| ||

| 13th November 2025 | view in browser | ||

| Mixed signals define global macro mood | ||

| Germany’s weak growth outlook, despite massive fiscal efforts, set a cautious tone for global markets as the Council of Economic Experts cut its 2026 forecast and warned that Berlin’s spending is failing to generate real momentum. | ||

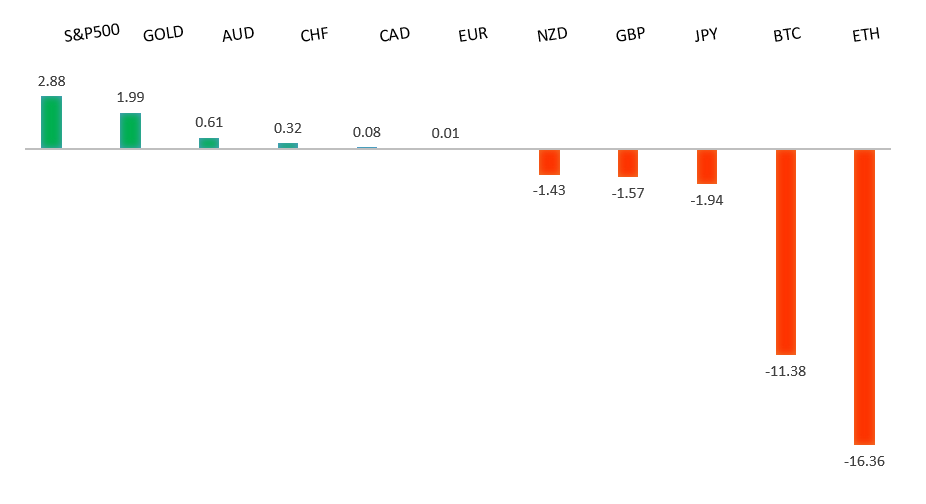

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB officials signaled that interest rates are likely to stay put unless major economic shocks emerge, with Isabel Schnabel saying current policy is well-positioned and inflation near target. Martin Kocher noted that Trump-era trade tensions hurt Europe less than feared, though long-term forecasts—especially for 2028—remain highly uncertain. Some economists argued that political turmoil in the U.S. could weaken the dollar’s dominance, offering Europe a chance to strengthen the euro’s global role through deeper financial integration and a true eurobond market. Banks remain broadly bullish on EURUSD, generally targeting around 1.20 by end-2025 and 1.22–1.24 in 2026, depending on monetary policy, U.S. growth, and geopolitics. Meanwhile, Eurozone industrial production for September is expected to rebound sharply, signaling tentative stabilization in manufacturing, though vulnerabilities from external risks and tight financing remain. | ||

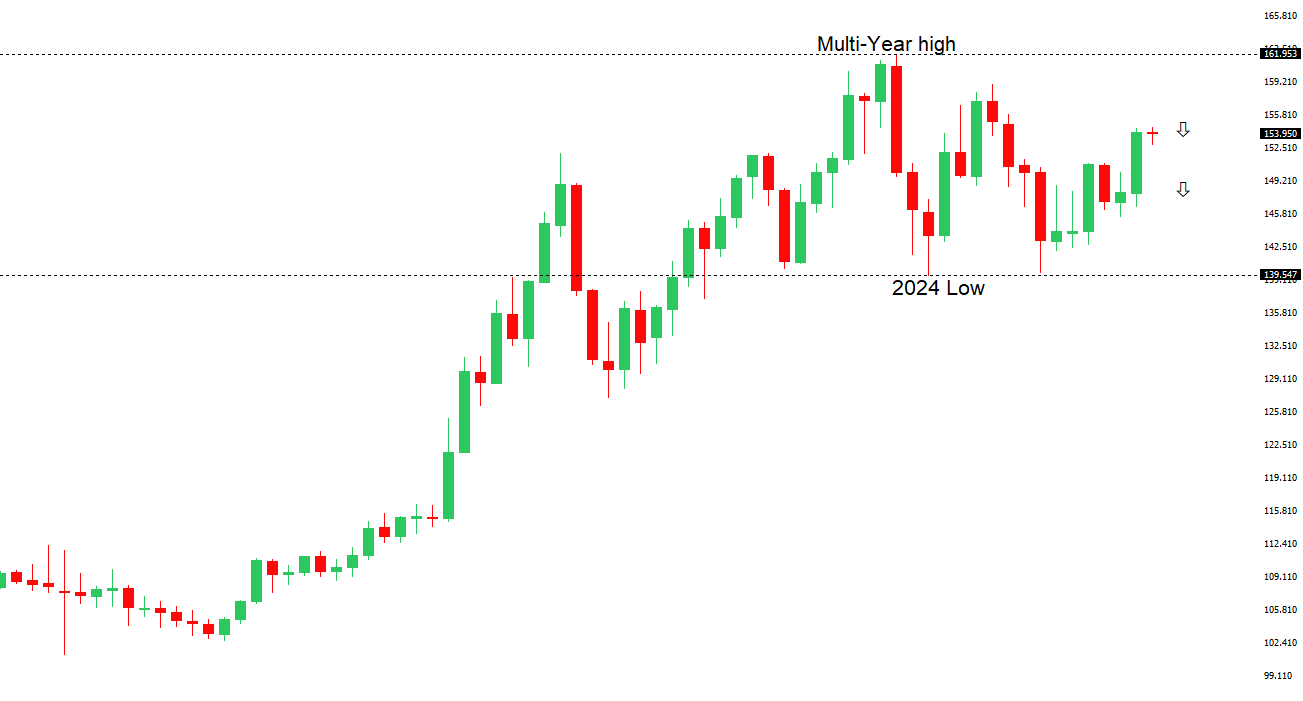

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.98 - 28 January high - Medium R1 155.05 - 12 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s finance minister again warned about yen weakness as USDJPY tested 155, though traders doubt near-term intervention since Japan hasn’t acted since the pair hit 160 in July 2024. Markets see PM Takaichi’s “Abenomics 2” approach—looser fiscal rules, reflation-leaning appointments, and a potential ¥15–20 trillion stimulus— as signaling prolonged easy conditions and a weaker yen, even as she maintains a balanced stance on monetary policy and avoids pressuring the BOJ. Investors expect only a single BOJ rate hike in December or January, meaning yen strength would likely depend more on future Fed cuts than Japanese policy. Recent data showed machine tool orders surging on strong foreign demand and PPI staying firm, underscoring ongoing inflation pressures that keep the BOJ on a slow normalization path. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s latest data—rising consumer confidence, stronger business sentiment, robust home-loan growth, and better-than-expected employment figures—suggests a firm economic backdrop that makes near-term RBA rate cuts unlikely. Officials, including Deputy Governor Hauser, highlight limited spare capacity and the need for productivity gains to avoid inflation pressures, reinforcing the RBA’s cautious stance. Additionally, improved budget conditions and potentially lower government bond issuance support a stronger outlook for the Australian dollar. | ||

| Suggested reading | ||

| Milei Wants to Turn Argentina Into a Mining Powerhouse, R. Dube, WSJ (November 11, 2025) How To Get Zero Inflation For Three Centuries, J. Soriano, American Thinker (November 10, 2025) | ||