| ||

| 16th May 2025 | view in browser | ||

| Soft US data boosts rate cut bets | ||

| Soft US economic data, including weaker-than-expected April retail sales and PPI, fueled expectations of Fed rate cuts, with futures pricing in ~57bp by end-2025, boosting bonds and pressuring the US dollar | ||

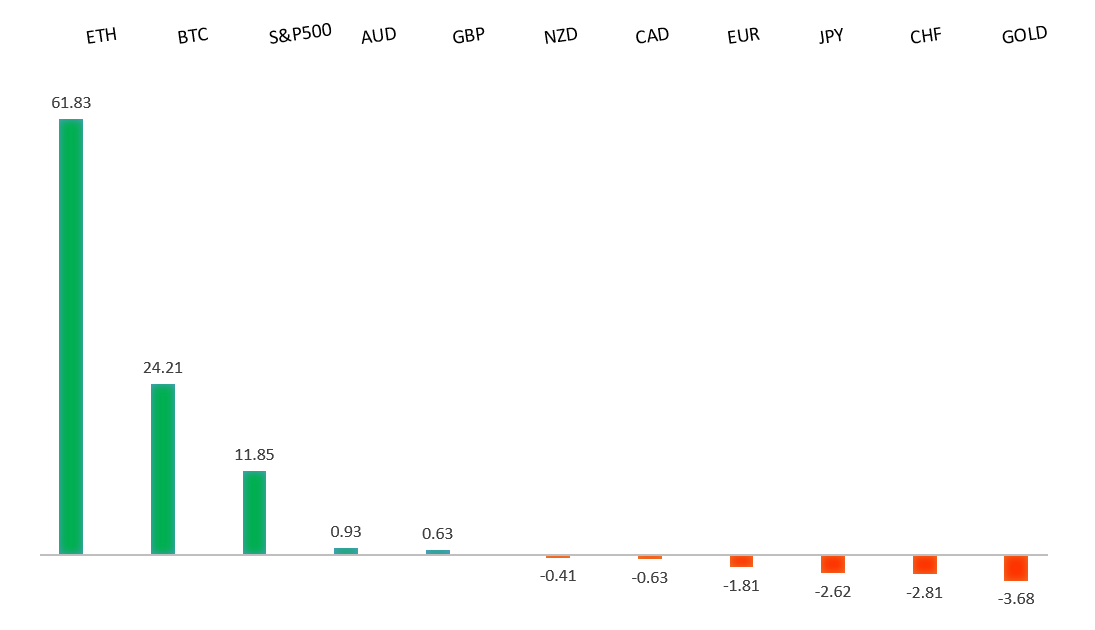

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R1 1.1293 - 9 May high - Medium R1 1.1266 - 14 May high - Medium S1 1.1065 - 12 May low - Medium S2 1.1000 - Psychological - Strong | ||

| EURUSD: fundamental overview | ||

| The Eurozone’s Q1 GDP growth was revised down to 0.3%, missing forecasts, yet marked five quarters of expansion, bolstered by robust March industrial production (2.6% MoM, 3.6% YoY) and steady employment gains (0.3% QoQ, 0.8% YoY), signaling cautious optimism that may lead ECB hawks to tread carefully on rate changes amid geopolitical trade risks. Meanwhile, the ECB targets early 2026 to finalize plans for a digital euro, aiming for a launch within two to three years to reduce reliance on U.S. digital payment systems, seen as a vulnerability after Trump’s Transatlantic alliance exit, while Russia-Ukraine ceasefire hopes dim as Putin ignores demands and Trump shows no sign of backing heavier sanctions. | ||

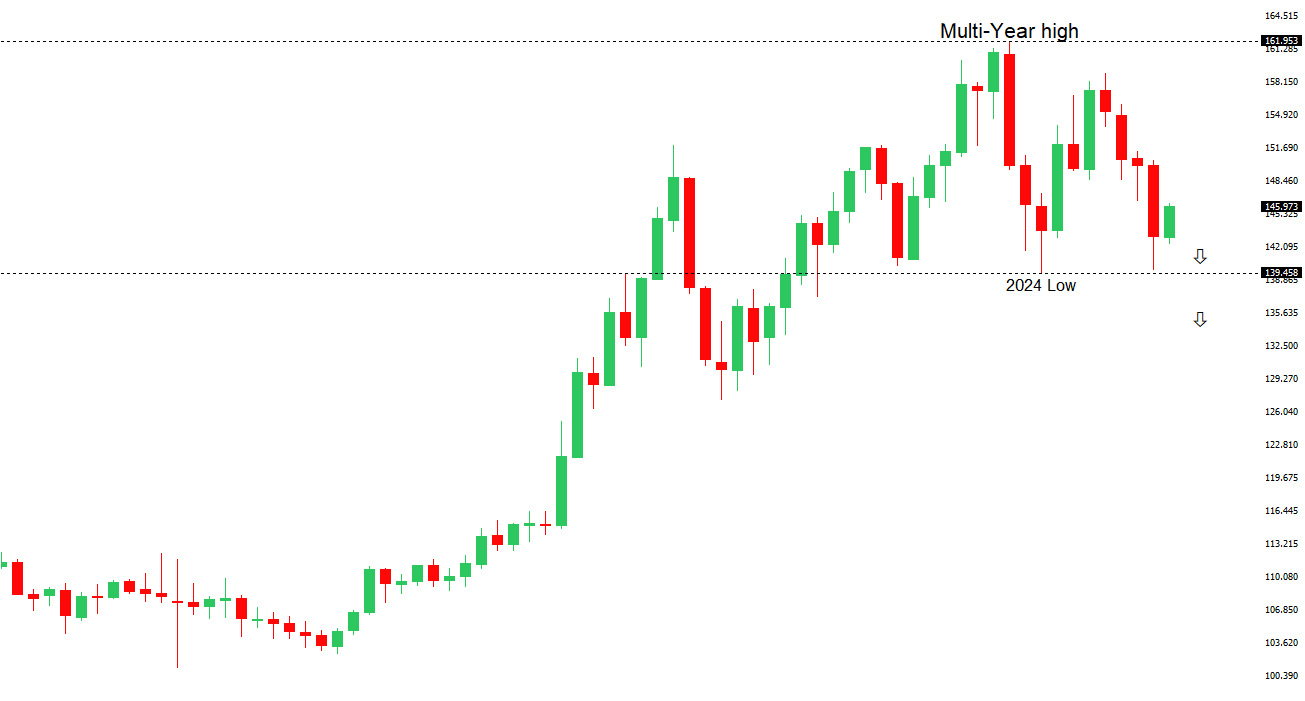

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 150.00 - Psychological - Strong R1 148.65 - 12 May high - Medium S1 145.00 - Figure - Medium S1 144.82 - 9 May low - Medium | ||

| USDJPY: fundamental overview | ||

| USDJPY is tracking the narrowing US-Japan 10-year yield gap, with Japan’s yields nearing two-week highs and US yields easing after data signaled slowing US growth. Japan’s Q1 GDP contracted more than expected at -0.7% annualized, raising concerns about a technical recession and likely delaying BOJ rate hikes until at least January, as trade talks with the US remain unresolved. Japan’s Finance Minister Kato aims to discuss currency volatility with US Treasury Secretary Bessent at the G7 meeting in Canada, while PM Ishiba targets a July trade deal but resists agreements retaining high US auto tariffs. A successful deal could revive BOJ hike expectations, while the yen may benefit if Asian currency appreciation talks reignite, amid a global slowdown boosting haven demand. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November high - Strong R1 0.6515 - 7 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The PBOC has kept the yuan fixing near 7.2, signaling reluctance to allow rapid appreciation that could hurt Chinese export competitiveness, with yesterday’s weaker fix marking the first in four sessions, tempering bullish bets on yuan proxies like antipodean currencies. However, a temporary US-China trade truce and talks of currency appreciation among Asian exporters like South Korea and Japan could ease China’s concerns, potentially allowing faster yuan gains and boosting the yen, won, and antipodeans. This truce also supports Australia’s export sector, while former RBA board member Warwick McKibbin urged the RBA to hold rates steady next week, citing Australia’s fiscal stimulus, strong employment, and inflation near target amid global uncertainty. | ||

| Suggested reading | ||

| The $40bn bitcoin bet, K. Martin, Financial Times (May 14, 2025) The US Dollar’s Fall from Grace, Project Syndicate (May 14, 2025) | ||