| ||

| 11th August 2025 | view in browser | ||

| Speculation swirls over Fed appointments | ||

| Recent reports indicate that President Trump’s team has expanded the candidate list for the Federal Reserve Chair, adding James Bullard, former St. Louis Fed President, and Marc Sumerlin, a former Bush economic adviser, in what major media described as a late-stage “shake-up” to broaden options and address concerns about Fed independence. | ||

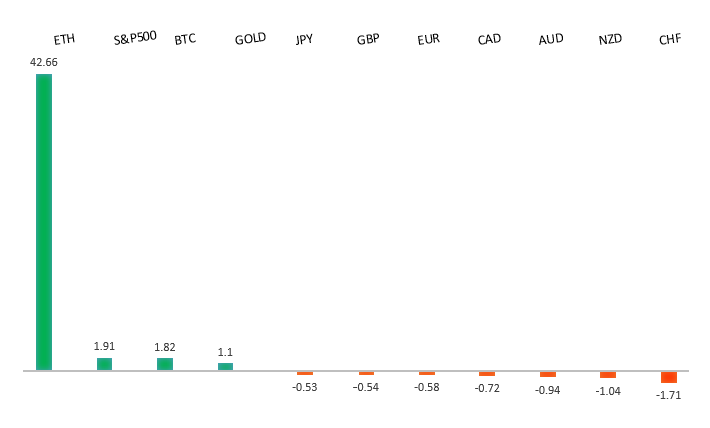

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1700 - 7 August high - Medium S1 1.1528 - 5 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The Euro paused its upward trend against the USD after weak German data raised concerns about the Eurozone’s largest economy, though it remains above the 50-day moving average. Expectations lean toward the ECB holding rates steady in September, while the Fed is increasingly likely to cut rates, potentially supporting Euro bulls due to diverging central bank policies. Meanwhile, President Trump’s proposed US-Russia summit to discuss a peace deal could push European nations, especially those near Russia, to increase defense spending, possibly via joint bonds, which may raise Eurozone bond yields. The ECB’s recent bulletin suggests stable inflation but slower growth, with risks from tariffs and geopolitics, and upcoming data on employment, industrial production, and GDP will provide further economic insights. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.00 - Figure - Medium S1 146.62 - 5 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan’s July meeting summary revealed a hawkish tilt among board members, with growing concerns about inflation risks over growth, potentially setting the stage for a rate hike before year-end if U.S. tariffs have minimal impact and domestic inflation remains steady. Uncertainty persists around U.S. tariff policies, as Japan awaits a timeline for ending tariff stacking and reducing auto tariffs, which could ease conditions for BOJ rate hikes but keeps Japanese markets cautious. Political instability in Japan, with calls for Prime Minister Ishiba’s resignation after the LDP’s election losses, may heighten market volatility and weaken the yen. Key upcoming data, including the U.S. CPI report and Japan’s Q2 GDP, could influence USDJPY movements by shaping expectations for the Federal Reserve and BOJ policy directions. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6542 - 7 August high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| One major Australian bank predicts the Reserve Bank of Australia will cut the cash rate from 3.85% to 3.60% at its next meeting, supported by recent inflation and labor data showing the economy is on track. The bank expects minimal changes to RBA’s forecasts, though economic growth might be slightly higher due to stronger housing investment. Markets anticipate at least two rate cuts this year, with a terminal rate just above 3%, and global uncertainties, like tariffs, are less likely to affect RBA’s outlook. Upcoming Chinese economic data could influence Australia’s economy. | ||

| Suggested reading | ||

| More Meetings Means Less Thinking, J. Wiggins, Behavioral Investment (August 6, 2025) What Corporations Do To Work Around Tariffs, E. Dellinger, Fisher Investments (August 6, 2025) | ||