| ||

| 27th May 2025 | view in browser | ||

| Trading activity to pick up post holiday break | ||

| Trading activity is expected to pick up today as the UK and US markets return from holiday. The Yen has maintained a mild bid tone against a weakening US dollar, driven by market-based exchange rate agreements and easing trade tensions. | ||

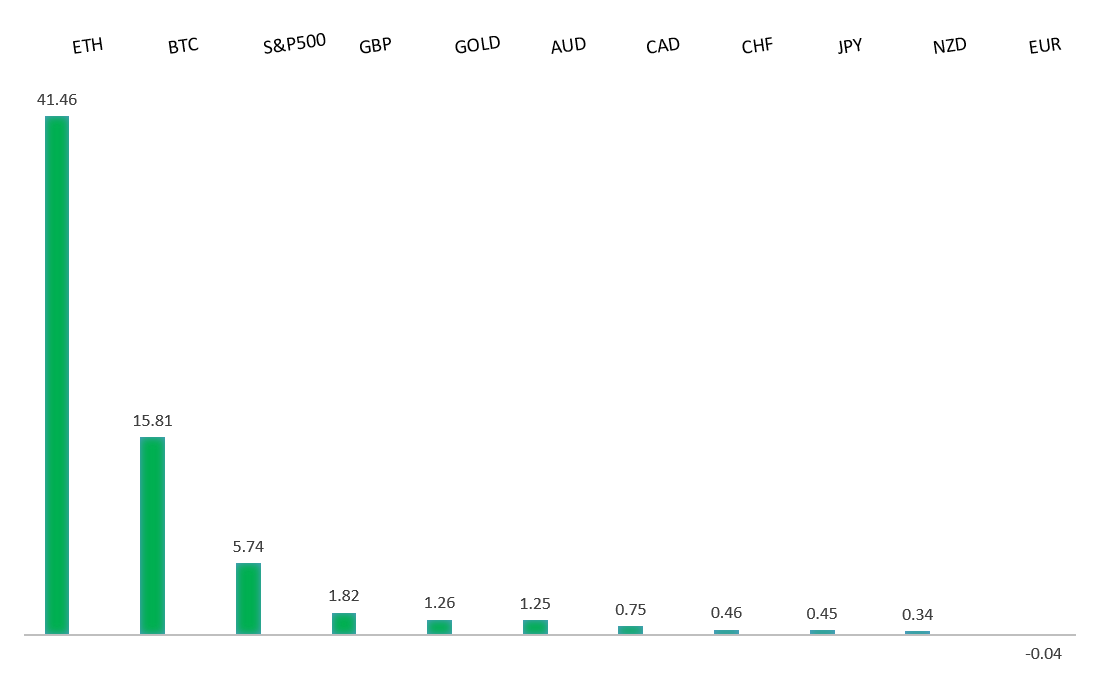

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1474 - 11 April high - Medium R1 1.1419 - 26 May high - Medium S1 1.1131 - 16 May low - Medium S2 1.1065 - 12 May low - Medium | ||

| EURUSD: fundamental overview | ||

| ECB President Christine Lagarde highlighted the potential for the euro to rival the US dollar, citing benefits like increased investment, lower borrowing costs, and protection from exchange rate fluctuations and sanctions. To achieve this, Europe must deepen its capital markets, strengthen legal and institutional frameworks, enhance military capabilities, and promote the euro in international trade through new agreements and improved payment systems. While joint borrowing, as seen in the COVID-19 recovery fund, faces resistance, particularly from Germany, it could pave the way for Eurobonds, strengthening the euro’s global role. ECB officials also noted the possibility of a June rate cut, with inflation risks leaning lower, and emphasized that uncertainty and potential US tariffs could impact the global economy. Eurozone economic data expected today may show slight improvements in economic and industrial confidence but a dip in services, while Germany’s consumer confidence is likely to continue its upward trend, reflecting growing optimism. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.19 - 9 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| The CFTC data shows a slight reduction in net yen longs, though positioning remains near record highs, suggesting a need for significant yen-positive or dollar-negative news to sustain short positions. Bank of Japan Governor Ueda expressed cautious optimism about nearing the inflation target, supported by April’s core inflation rising to 3.5% year-on-year, with Tokyo’s May CPI expected to show further price pressures, potentially paving the way for rate hikes. However, former BOJ board member Sayuri Shirai warns that a fragile economy and weak domestic demand could limit the BOJ’s rate hike window, especially with a critical election looming for PM Ishiba amid falling approval ratings. Successful trade negotiations, particularly resolving auto tariffs before the July 9 deadline, could bolster the case for a BOJ rate hike at its July meeting, with Japan’s trade negotiator aiming for progress at the G7 summit in June. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6538 - 26 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| Former President Trump’s recent threats of 50% tariffs on EU imports and 25% duties on foreign-made smartphones have reignited concerns about trade uncertainty, potentially driven by his push for tariff revenues to fund his proposed “Big Beautiful Bill” or a tougher negotiating stance, which could pressure the US dollar. RBA Deputy Governor Andrew Hauser noted that Australia has seen minimal direct impact from these trade disruptions so far, with stable economic indicators, and some Australian firms see opportunities in the US-China trade rift to gain a competitive edge in China. However, he cautioned that increased competition from Chinese firms redirecting goods from the US could pose future challenges. Australian inflation data, due tomorrow, is expected to soften, supporting predictions of RBA rate cuts later this year, with forecasts pointing to a year-end cash rate of 3.10%–3.35%. | ||

| Suggested reading | ||

| If They’re Telling You Why, They Don’t Know Why, J. Tamny, Forbes (May 25, 2025) The Dumb Money Isn’t So Dumb Anymore, B. Carlson, AWOCS (May 22, 2025) | ||