| ||

| 27th November 2025 | view in browser | ||

| Trading conditions to thin out for US holiday | ||

| Global markets head into the new day digesting a mix of steady U.S. rate-cut expectations, shifting BOJ signals, and strong antipodean data. With U.S. markets shut for Thanksgiving, Wednesday’s softer Beige Book and steady jobless claims kept December Fed cut odds near 90%. | ||

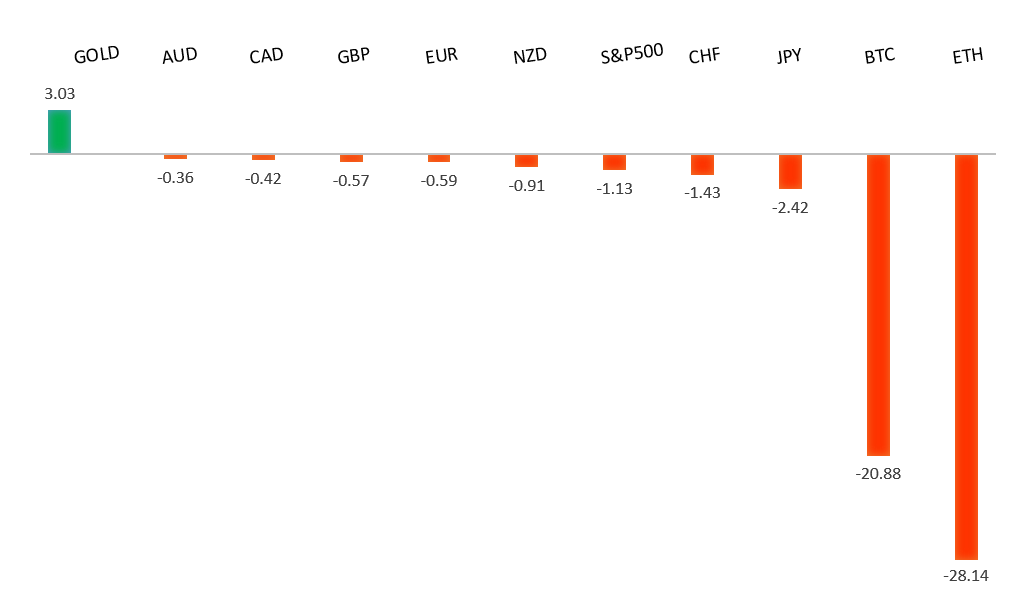

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

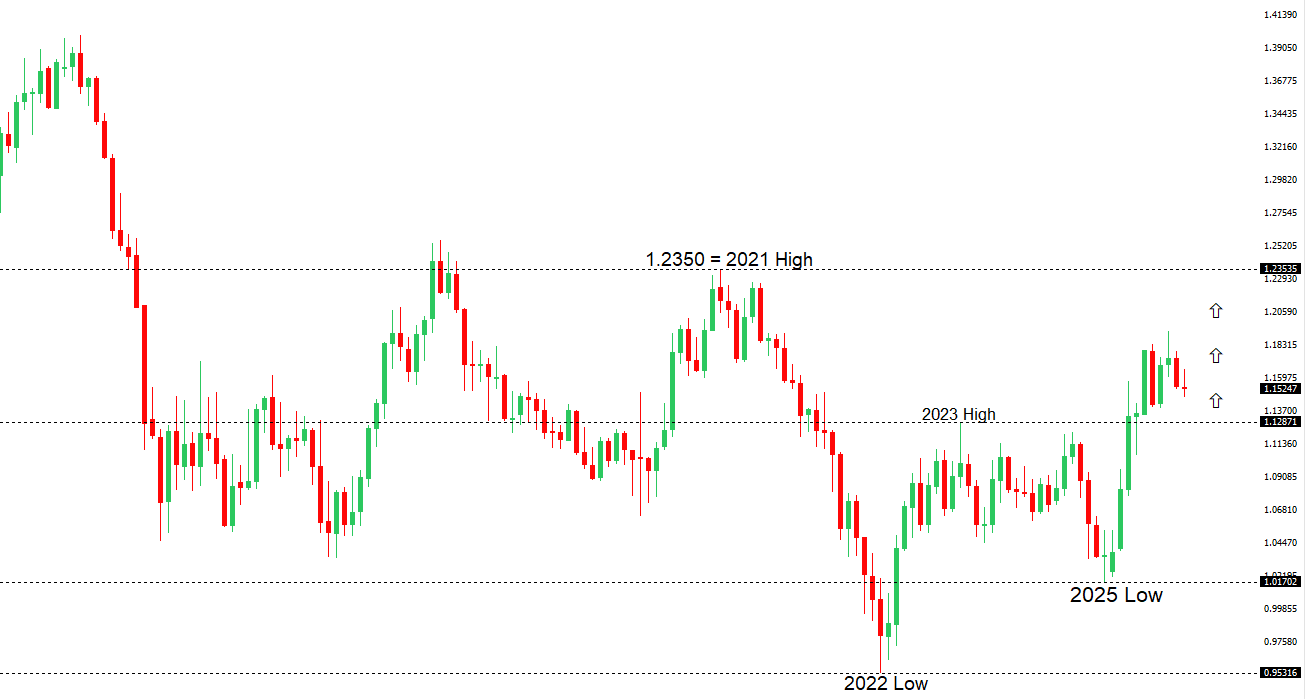

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB officials broadly argue against rushing into more rate cuts, even if inflation briefly dips below 2%, noting that underlying price pressures and wage trends still point toward sustainably reaching the target. Policymakers are expected to hold rates steady in December as inflation eases and growth shows early signs of recovery, though risks persist from higher government spending—especially in Germany—and the gradual rollout of the EU’s carbon-pricing system. Most central banks globally are nearing the end of their tightening or easing cycles, leaving the Fed as the possible lone major bank cutting into 2026, which could weaken the dollar and support the euro. Geopolitically, a U.S. delegation will visit Russia for peace talks, though Europe doubts a near-term breakthrough. Meanwhile, Eurozone confidence data and Germany’s GfK readings are expected to show only slight improvements, reflecting persistent consumer pessimism and implying that any recovery in spending and retail demand will remain slow and fragile. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Markets are increasingly betting that the BOJ may signal a rate hike as early as December, as more policymakers hint that conditions are “ripe” for higher rates. Several board members are now openly pushing for tighter policy, though Asahi Noguchi has recently struck a more cautious tone, advocating gradual, measured adjustments. Political constraints under the Takaichi administration could limit how far the BOJ can tighten, leading markets to see any hike as potentially “one and done.” Meanwhile, China-Japan tensions and retaliatory measures pose additional downside risks for the yen. Ultimately, a meaningful yen rebound depends more on the U.S. outlook, with one major US investment house expecting Fed rate cuts to strengthen the yen by early 2026. Tomorrow’s Tokyo CPI print—likely still elevated—may influence how much patience the government urges on rate hikes. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s October inflation came in hotter than expected, with core prices rising 3.3% and headline inflation at 3.8%—both above the RBA’s 2–3% target. The surprising strength pushed the Australian dollar and bond yields higher as markets scaled back expectations for rate cuts. Some economists now think the RBA’s easing cycle is over, while others warn rates might even rise in 2026 if inflation stays sticky and the labor market tightens, especially given sluggish productivity. If upcoming inflation data remains firm, the case for future hikes could strengthen. Even without tightening, Australia is still poised to have the highest G10 interest rates in early 2026, making the Aussie an appealing high-yield currency. | ||

| Suggested reading | ||

| How Young Stock Market Investors Are Instigating Bear, M. Hulbert, Marketwatch (November 25, 2025) The Bull’s Wild Ride: What We Have Is a Worrywart Market, A. Serwer, Barron’s (November 21, 2025) | ||