|

||

| 24th April 2025 | view in browser | ||

| Trump softens stance on China | ||

|

The Trump administration is softening its stance on China, with President Trump indicating tariffs will decrease significantly but not to zero, and Treasury Secretary Bessent hinting at a potential major deal, while the Wall Street Journal has reported proposed tariffs of 50-65%, a significant reduction from China’s current 145%. |

||

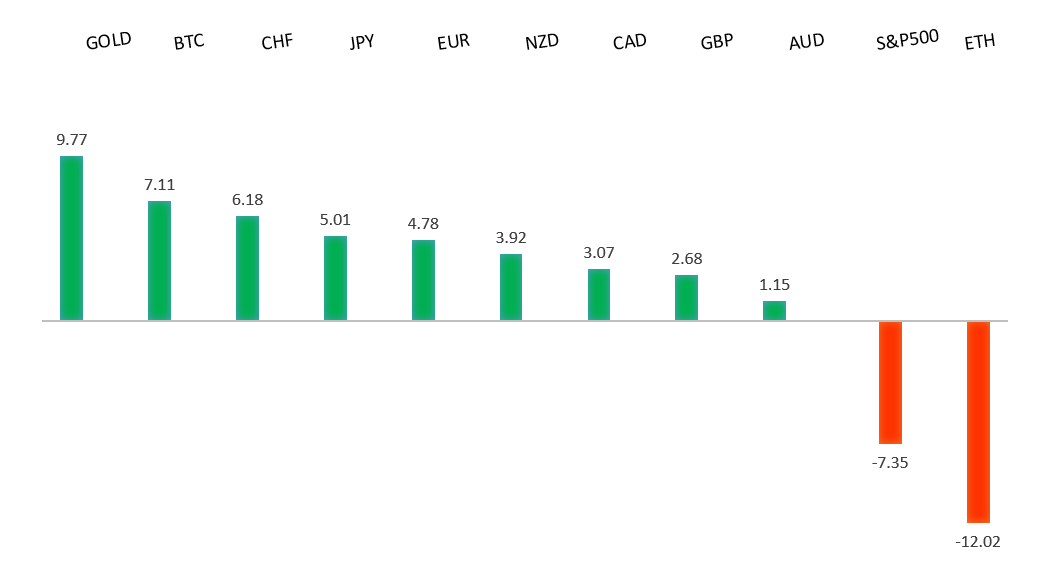

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

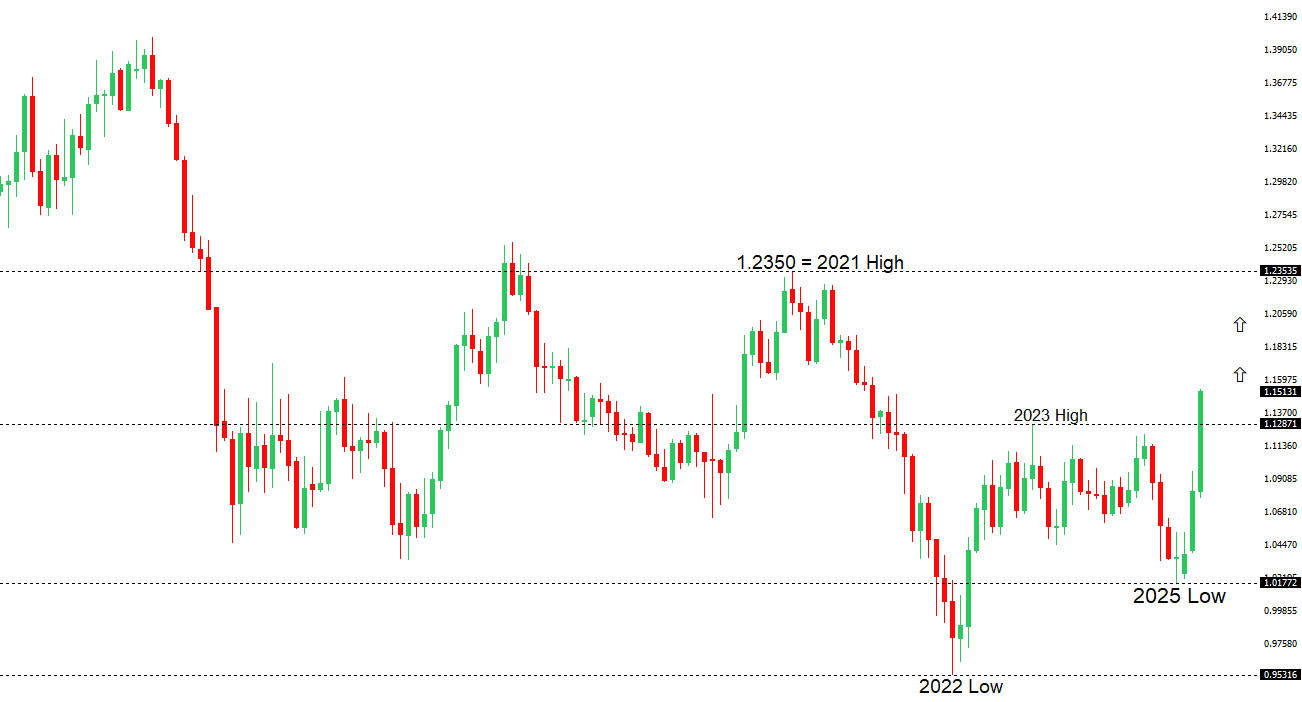

| EURUSD: technical overview | ||

|

The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. |

||

|

||

|

R2 1.1600

- Figure - Medium

R1 1.1574 - 21 April/2025 high - Strong S1 1.1308 - 23 April low - Medium S2 1.1264 - 15 April low - Strong |

||

| EURUSD: fundamental overview | ||

|

The latest headlines around President Trump softening his stance on trade have opened the door for some profit taking on long Euro positions. But overall, the trend of selling the US Dollar and buying Euros remains in play on account of US administration policies and unpredictability. Also weighing on the Euro a bit is the ECB’s wage tracker, which indicates a sharp slowdown in wage growth to 1.6% in Q4 2025, down from 5.3% last year, supporting expectations of declining inflation and potential ECB interest rate cuts, with markets anticipating two more cuts in 2025. ECB President Lagarde has emphasized a data-dependent approach to future rate decisions, with clarity expected from the June 2025 ECB meeting, while U.S. tariffs and China’s export rerouting could have a disinflationary effect on the Eurozone. Geopolitical tensions, particularly fading hopes for a Russia-Ukraine peace deal, and Germany’s upcoming IFO Business Climate Survey, expected to decline to 85.2 from 86.7, add further uncertainty amid U.S. tariff impacts. |

||

| USDJPY: technical overview | ||

|

There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions. |

||

|

||

|

R2 144.58

- 11 April high - Medium

R1 143.58 - 23 April high - Medium S1 139.89 - 22 April/2025 low - Medium S2 139.58 - 2024 Low - Strong |

||

| USDJPY: fundamental overview | ||

|

The Trump administration’s softened stance on China has shifted focus to U.S.-Japan trade talks, where Japan may leverage the U.S.’s desire for a “successful” deal to negotiate favorable tariff concessions, such as tariff-free U.S. rice imports to address Japan’s domestic shortages. U.S. Treasury Secretary Bessent has ruled out currency targets in these talks, disappointing yen bulls, with speculative yen positions likely to unwind, though the dollar’s long-term downtrend persists. The Bank of Japan is expected to maintain current interest rates through June 2025, with 52% of economists in a Reuters poll anticipating a hike in Q3 2025, while the BOJ’s upcoming outlook report will likely reaffirm gradual rate increases despite U.S. tariff risks. Japan’s economy is projected to benefit from a stronger yen reducing import costs, supporting consumption and mitigating downturn risks, though the IMF cut Japan’s 2025 growth forecast to 0.6% and urged fiscal consolidation. Tokyo’s April CPI, a key inflation indicator, is expected to rise to 3.3% year-on-year, potentially fueling expectations for BOJ rate hikes in late 2025. |

||

| AUDUSD: technical overview | ||

|

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. |

||

|

||

|

R2 0.6500

- Psychological - Strong

R1 0.6440 - 22 April/2025 high - Medium S1 0.6333 - 17 April low - Medium S1 0.6275 - 14 April low - Strong |

||

| AUDUSD: fundamental overview | ||

|

The Australian Dollar is showing signs of bottoming out above, supported by a broader shift away from USD assets and potential Chinese policy measures to counter U.S. tariffs, which could further bolster the Australian dollar if it reclaims the 200-day moving average. The Trump administration’s recent conciliatory gestures toward China suggest that the peak of trade war tariffs may have passed, reducing negative impacts on China and benefiting antipodean currencies like the Australian Dollar. Despite inflationary pressures, markets expect the RBA to cut rates in May to prioritize economic growth. |

||

| Suggested reading | ||

|

Thinking the Unthinkable (About US Assets), J. Wiggins, Behavioral Investment (April 22, 2025) China’s ‘Bleeding’ Exporters Have 3 Options. All of Them Are Bad., T. Brown, Barrons (April 22, 2025) |

||