| ||

| 25th April 2025 | view in browser | ||

| Trump’s China trade thaw faces skepticism | ||

| President Trump’s softer approach toward China, aiming for a June summit, has been met with skepticism as China denies trade talks, labeling them “fake news” and demanding the U.S. eliminate all tariffs, though it’s considering suspending 125% tariffs on select U.S. imports like medical equipment in response to Trump’s tariff exemptions on electronics. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

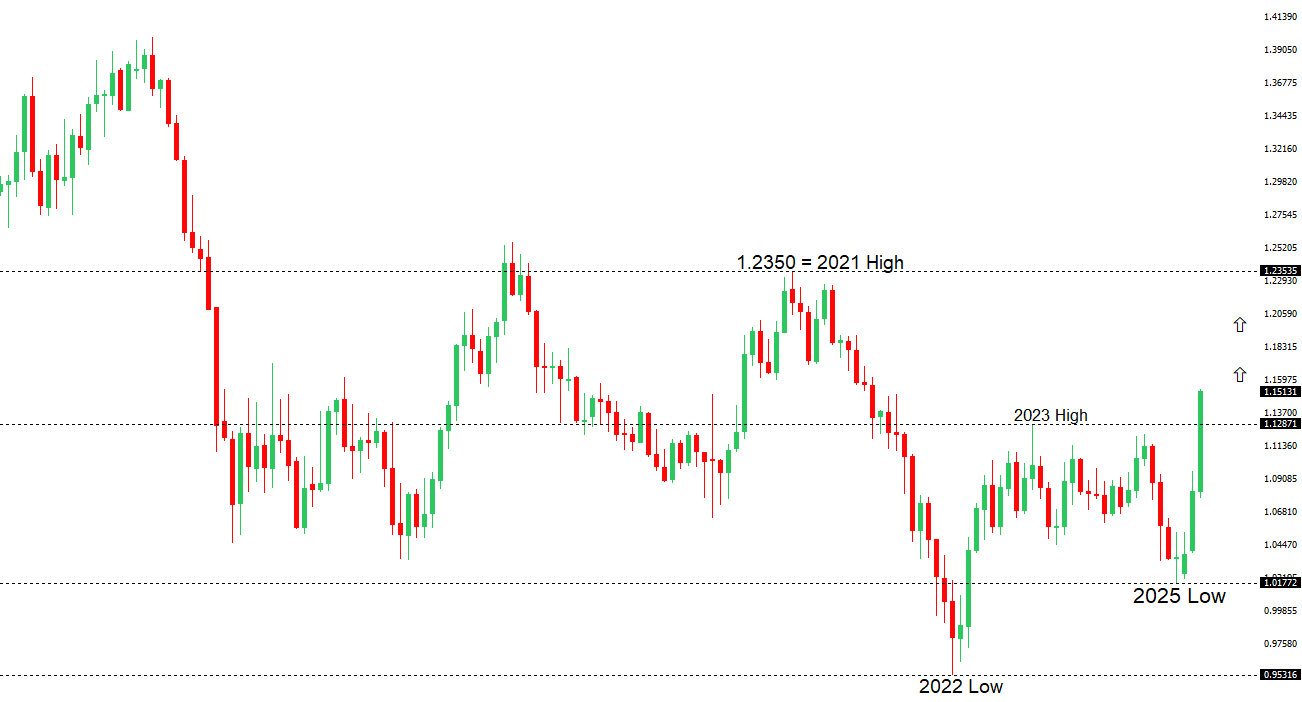

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1600 - Figure - Medium R1 1.1574 - 21 April/2025 high - Strong S1 1.1308 - 23 April low - Medium S2 1.1264 - 15 April low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB Chief Economist Philip Lane stated US tariffs may slow Eurozone growth but are unlikely to cause a recession, as the region has diverse trading partners. The ECB’s June meeting will provide updated economic projections, likely reflecting weaker growth and inflation due to tariffs, with current 2025 growth forecasts at 0.9% (ECB) and 0.8% (IMF). Despite debates among ECB members on pausing or continuing rate cuts, President Lagarde has emphasized a data-dependent approach, with more clarity expected from the June meeting as tariff impacts become clearer. Meanwhile, China aims to strengthen EU ties at a July summit. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions. Rallies should be well capped below 150.00. | ||

| ||

| R2 144.58 - 11 April high - Medium R1 144.00 - Figure - Medium S1 139.89 - 22 April/2025 low - Medium S2 139.58 - 2024 Low - Strong | ||

| USDJPY: fundamental overview | ||

| The Trump administration’s softened stance on China has shifted focus to US-Japan trade talks, with Japan aiming to secure tariff concessions, particularly on rice imports, at the June G7 summit, while resisting US efforts to align against China due to vital trade ties. Goldman Sachs has been out calling for a USDJPY drop to 135 within 12 months, citing an overvalued dollar. A Bloomberg survey indicates no policy change at the BOJ’s April 30-May 1 meeting, with expectations for a rate hike by September falling to 45% and a terminal rate of 1%. The BOJ is expected to lower its 2025 growth forecast to 0.6%, per the IMF, but maintain gradual rate hikes, as a stronger yen offsets tariff impacts by reducing import costs and supporting consumption, according to Itochu Research Institute’s Chief Economist. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6500 - Psychological - Strong R1 0.6440 - 22 April/2025 high - Medium S1 0.6333 - 17 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar is showing signs of bottoming out, supported by a shift away from USD assets and China’s 600 billion yuan liquidity injection to counter US tariffs, with potential tariff relief on US imports further boosting sentiment. The Trump administration’s softened stance on China suggests the worst of the trade war’s impact may be over, benefiting antipodean currencies. Despite US tariffs posing indirect risks to Australia via trading partners like China and Japan, many analysts are projecting growth, with RBA rate cuts expected in May to mitigate slowdowns. Australia’s Labor party is planning a critical mineral reserve if re-elected, aiming to leverage the country’s position as the fourth-largest rare earths producer. | ||

| Suggested reading | ||

| No, Powell Is Not “Keeping Interest Rates High”, R. McMaken, Mises Institute (April 24, 2025) Kitco Interview on Gold, Tariffs, Fed Interference, A. Merk, Merk Investments (April 22, 2025) | ||