| ||

| 7th August 2025 | view in browser | ||

| Trump’s tariff talk and Fed chatter sink Dollar | ||

| On Wednesday, the U.S. dollar dropped significantly due to the Federal Reserve’s dovish remarks and uncertainty surrounding potential tariffs. | ||

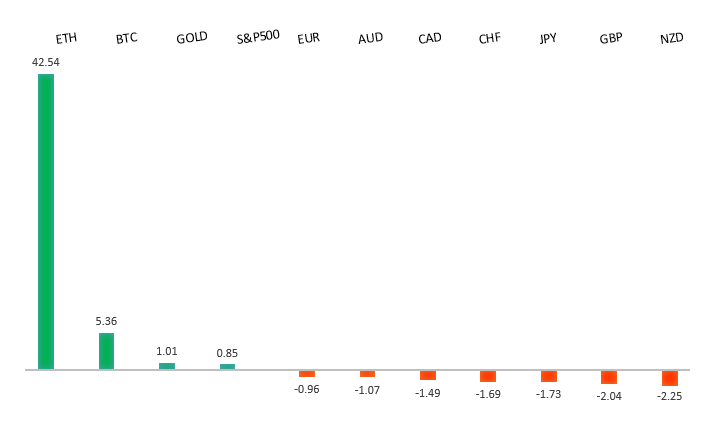

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1703 - 25 July low - Medium R1 1.1669 - 6 August high - Medium S1 1.1392 - 1 August low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank is unlikely to cut interest rates further soon, with outgoing Governing Council member Robert Holzmann suggesting rates are appropriately set and the bank should monitor global economic developments, particularly U.S. tariffs. ECB President Lagarde emphasized a data-dependent approach, and while recent Eurozone data shows resilient consumer demand with strong retail sales, Germany’s factory orders disappointed, though revisions may occur. Market expectations lean toward minimal ECB rate cuts this year, potentially one in December, while U.S. Federal Reserve policy divergence and concerns over manipulated U.S. economic data could influence the EURUSD exchange rate. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.00 - Figure - Medium S1 146.62 - 5 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Confusion surrounds a U.S.-Japan trade deal, with the U.S. clarifying that a 15% tariff will apply to all Japanese exports, contrary to Japan’s expectation that only goods below 15% would be affected, potentially escalating trade tensions. Japan’s markets are focused on a 30-year JGB auction, where a weak outcome could raise concerns about fiscal expansion and hinder yen recovery. Taro Kono, a ruling party member, echoed calls for tighter monetary policy to strengthen the yen, urging the Bank of Japan to raise rates while criticizing past economic policies. A government panel proposed a record 6% minimum wage hike to JPY 1,118, signaling a robust wage-price cycle that supports BOJ’s confidence in potential rate hikes. Despite nominal wages rising 2.5% in June, real earnings fell 1.3% due to inflation, though wage data supports BOJ’s outlook. Political uncertainty looms as the Liberal Democratic Party meets to review its electoral loss, with potential leadership changes possibly impacting BOJ policy expectations and yen volatility. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6688 - 7 November 2024 high - Strong R1 0.6625 - 24 July/2025 high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australian household spending grew 4.8% year-over-year in June, driven by sectors like clothing and recreation, but monthly growth slowed to 0.5%, below expectations, amid rising household costs and fading post-rate cut effects. Bloomberg Economics warns that cooling migration and high household debt could weaken spending momentum, despite Australia facing lower tariffs. Markets anticipate at least two RBA rate cuts in 2025, but analysts, including former RBA executive Jonathan Kearns, expect a cautious approach, with cuts likely in August and November, contingent on economic data, particularly unemployment trends. | ||

| Suggested reading | ||

| Meme Stocks & Mr. Market, B. Carlson, A Wealth of Common Sense (August 5, 2025) Don’t Let Crypto Boom Deter You From Jumping In Now, S. McBride, RiskHedge (August 5, 2025) | ||