| ||

| 20th May 2025 | view in browser | ||

| US Dollar dips as Fed stays cautious | ||

| The market has been focused on U.S. fiscal and bond market developments, with fading concerns over Moody’s downgrade and easing U.S.-China trade tensions reducing haven demand, while tariff-related worries subside. | ||

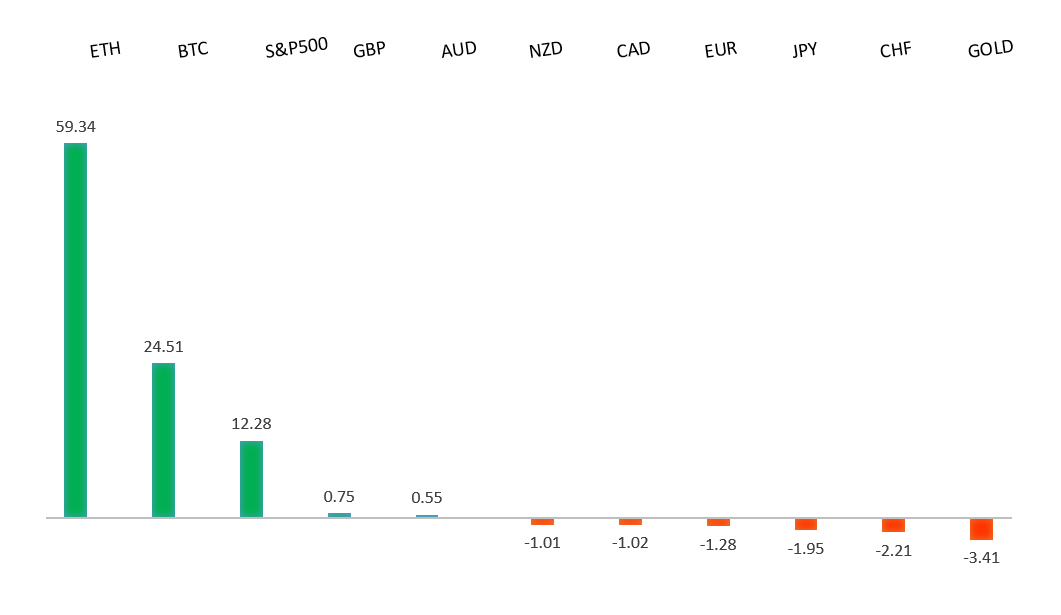

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1382 - 6 May high - Medium R1 1.1293 - 9 May high - Medium S1 1.1065 - 12 May low - Medium S2 1.1000 - Psychological - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB President’s view of the euro’s strength as an opportunity suggests tolerance for further appreciation, potentially nearing 1.20. The European Commission cut its eurozone GDP forecast to 0.9% for 2025 and 1.4% for 2026, citing U.S. tariffs, with inflation projected at 1.7% in 2026, possibly prompting ECB rate cuts. A new EU-UK deal boosting defense and trade eased post-Brexit tensions, while April inflation held steady at 2.2% and May’s Consumer Confidence is expected to rise. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 150.00 - Psychological - Strong R1 148.65 - 12 May high - Medium S1 144.81 - 19 May low - Medium S2 143.44 - 8 May low - Medium | ||

| USDJPY: fundamental overview | ||

| Speculation of Asian currency appreciation, especially the yen, is growing as Japan and South Korea discuss currency matters with the U.S. amid trade talks, with traders betting on stronger Asian currencies as part of U.S. trade agendas. Japan’s Finance Minister Kato will meet U.S. Treasury Secretary Bessent at the G7 meeting (May 20-22, 2025), while a weak GDP print and unresolved U.S. auto tariffs keep the BOJ cautious on rate hikes. A trade deal removing the 25% car tariff could shift focus to BOJ rate hikes, with upcoming inflation and trade data likely to complicate its stance. | ||

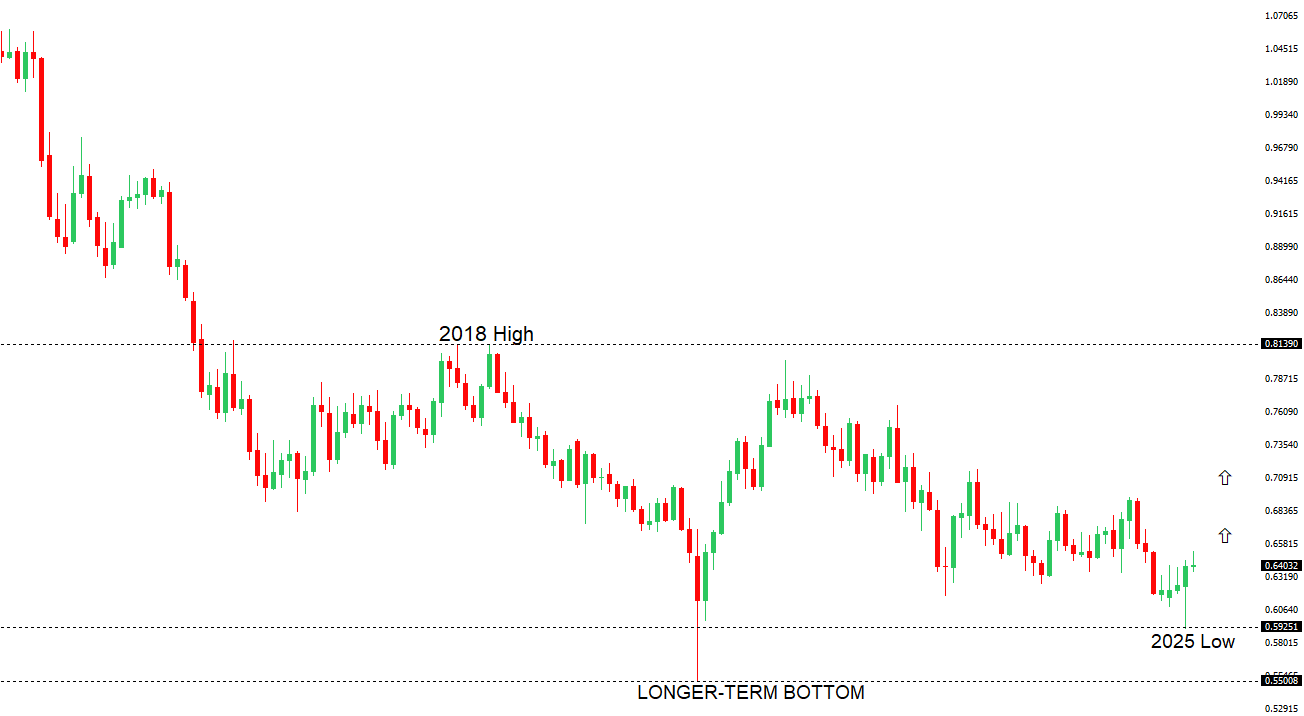

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November high - Strong R1 0.6515 - 7 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| Markets are nearly certain of a 25bps rate cut at the upcoming Reserve Bank of Australia meeting, lowering the Official Cash Rate (OCR) from 4.10% to 3.85%, despite strong job and wage data, as global growth concerns from the “Liberation Day” tariff shock and weak domestic indicators like retail sales and productivity outweigh labor market strength. Core inflation fell to 2.9% in Q1 2025, within the RBA’s 2-3% target for the first time since 2021, giving the RBA room to ease policy, though a hawkish cut is expected due to lingering inflation and labor market concerns, with markets pricing in two more cuts to reach 3.35% by year-end. A U.S.-China trade truce and potential currency appreciation in Asia, particularly in South Korea and Japan, could support a stronger Chinese yuan, boosting the Australian dollar as a yuan proxy, while a rising risk premium on U.S. assets may keep the U.S. dollar weak. | ||

| Suggested reading | ||

| Donald Trump Vs. Joe Biden: Who Was Better On Inflation?, J. Tamny, Forbes (May 18, 2025) Trump’s Gulf gamble, A. Snyder, Axios (May 18, 2025) | ||