Next 24 hours: Dollar up across the board

Today’s report: What the market wants is not the same as what it's getting

As has been the case for many months now, there’s what the market would like to see, and then there’s what messages are coming out of the Federal Reserve. Lately, the market has been doing its best to once again pressure the Fed into needing to reconsider its higher for longer policy mantra.

Wake-up call

- EZ confidence

- Building materials

- cash earnings

- RBA hikes

- Ivey PMIs

- on hold

- Geopolitical risk

- Global outlook

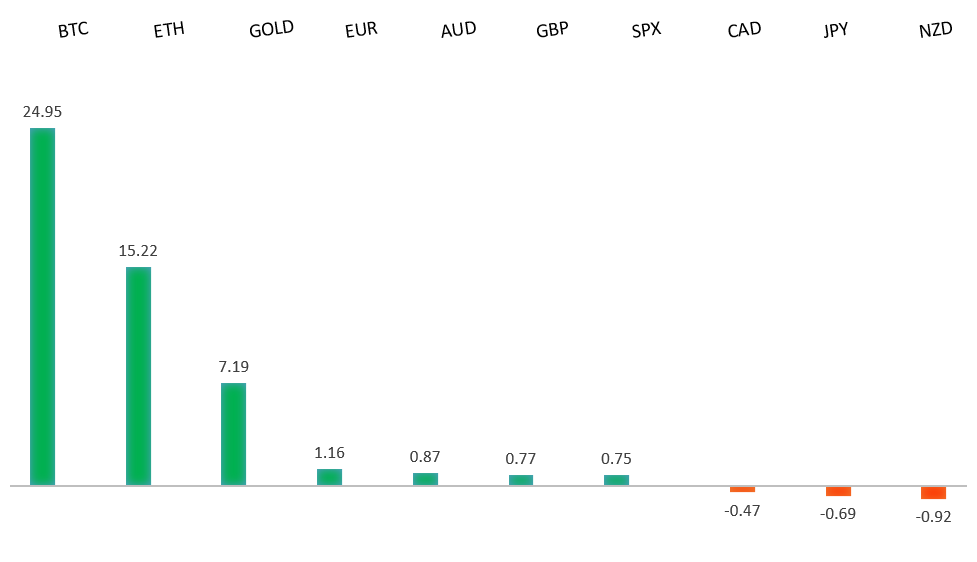

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- There’s No Growth-Inflation Link, and There Never Has Been, J. Tamny, Forbes (November 5, 2023)

- Could Wooden Turbines Complement Traditional Construction, M. McCormick, FT (November 7, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Any additional setbacks should be well supported on dips below 1.0500 in favor of the start to the next major upside extension. Ultimately, only a monthly close back below 1.0500 would give reason for concern. Back above 1.0770 will take the immediate pressure off the downside.EURUSD – fundamental overview

The Euro managed to get an additional boost on Monday from a small improvement in Eurozone confidence and German factory data. There were however decent sell orders in place to cap the rally. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2429.GBPUSD – fundamental overview

The Pound tried its best to extend the recent run after UK construction PMIs improved slightly. However, the survey also showed building materials prices falling at the fastest pace in 14 years. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.USDJPY – technical overview

At this stage, it looks like the market is wanting to resume the bigger picture uptrend and head back towards a retest of that multi-year high from October 2022 up at 151.95. Look for any weakness to continue to be well supported on dips.USDJPY – fundamental overview

Japan cash earnings for September were largely in line with expectation, with nominal labor cash earnings rising for the first time in four months amidst downward revisions made to the August reading, though still notably falling short of levels sought by policymakers. Real cash earnings printed in negative territory for an 18th straight month. Household spending surprised slightly to the upside, but certainly not enough to force a shift in the BOJ's thought process. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6523 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar is under pressure in the aftermath of a fully priced in RBA 25 basis point rate hike. We're seeing a classic case of sell the fact, with additional selling from what could also be a slightly more dovish tone in the communication. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

Canada fundamentals have been less than encouraging of late, which has resulted in a wave of renewed Canadian Dollar selling after the Loonie had benefited from broad USD outflows. On Monday, Canada Ivey PMIs ticked up but came in below consensus estimates. Downside pressure on the price of oil is also factoring into some of the Canadian Dollar selling into Tuesday. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. Ultimately, a break back above 0.6056 would be required to take the immediate pressure off the downside. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Treasury's fortnightly economic update revealed an economic slowdown was underway on weak consumer sentiment, though businesses showed a modest rise in confidence. It also noted the rise in unemployment and underutilization rate suggested the “labor market was experiencing spare capacity as growing labor supply interacted with waning demand." Eyes will now turn to the RBNZ 4Q inflation expectations survey due Wednesday. At the moment, the OIS market sees the RBNZ keeping the rate unchanged until 4Q 2024, while pricing a rate cut at the October 2024 meeting. Key standouts on Tuesday’s calendar come from German industrial production, German and Eurozone construction PMIs, Eurozone producer prices, Canada trade, US trade, the New Zealand GDT auction, and a batch of Fed speak.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4400 will be required to take the immediate pressure off the downside. Next key support comes in at 4103.US SPX 500 – fundamental overview

Investors continue to struggle with the reality of a higher for longer Fed policy track in the face of ongoing worry around inflation, while also contending with an escalation in geopolitical risk. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.