Next 24 hours: Yen leads the way as currencies recover

Today’s report: What's behind the latest US Dollar selling?

The US Dollar has been very well bid overall and continues to rally into any dips. The primary driver for the Dollar’s bid has been US rate expectations, with only 29 basis points of rate cuts priced in for the entire 2025.

Wake-up call

- tighter budget

- fiscal responsibility

- Tankan index

- Aussie employment

- Higher oil

- producer prices

- dovish Fed

- Macro themes

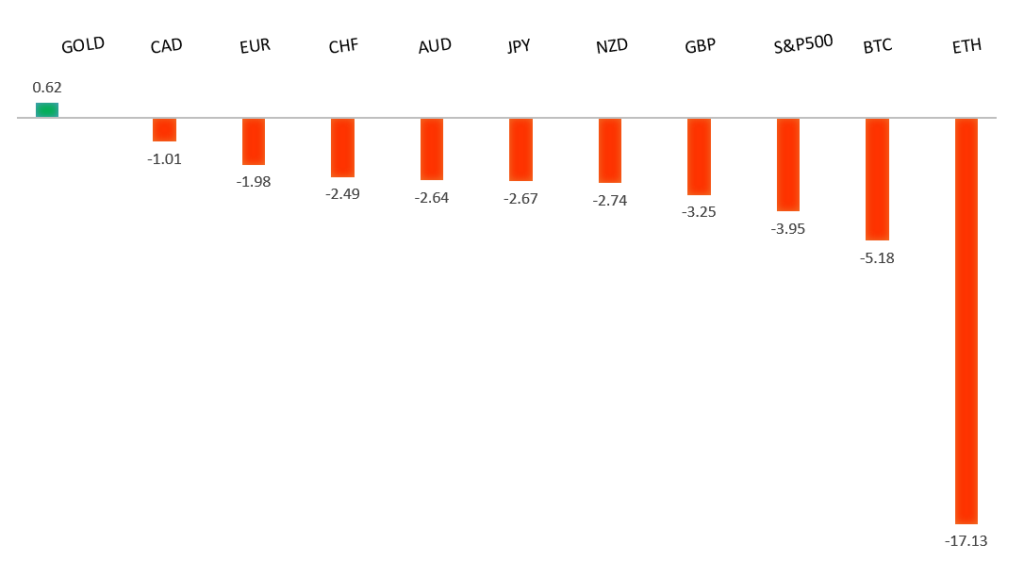

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- EV charging companies' ‘chicken and egg’ conundrum, J. Smyth, Financial Times (January 14, 2025)

- Compounding As the Path To Retirement Wealth, S. Maranjian, The Motley Fool (January 10, 2025)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips towards parity, with a higher platform sought out ahead of the next major upside extension. Look for a major bounce in the days ahead and the start to a push back towards the 2023 high at 1.1276. Only a monthly close below 1.0000 negates.EURUSD – fundamental overview

The Euro put in a nice recovery on Tuesday, getting a boost from French PM Bayrou's proposal for a tighter budget and softer US producer prices. The French PM ruled out any adjustments to pension reform. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Setbacks should be well supported above 1.2000 on a monthly close basis.GBPUSD – fundamental overview

Messaging from UK FinMin Reeves around fiscal responsibility helped to give the Pound a bit of a lift, while more demand came from the softer US producer prices print. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.USDJPY – technical overview

The market is looking to resume the longer-term uptrend after an intense correction in 2024. A higher low is ideally sought out above 140.00 in favor of a bullish continuation. The October monthly close back above 150.00 strengthens the case for longer-term uptrend resumption.USDJPY – fundamental overview

The Yen seems to be getting a bit of a Wednesday boost from the better than expected Japanese Tankan manufacturers sentiment index. At the same time, there is some caution ahead of today's US CPI read. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6000 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar has been better bid this week, getting help from the latest softer US producer prices print. The currency will now settle down ahead of today's US CPI release and tomorrow's Aussie employment report. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.USDCAD – technical overview

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4500-1.5000 area, exposing a retest of the 2020 high just ahead of 1.4700. Setbacks should be very well supported ahead of 1.3500.USDCAD – fundamental overview

The Canadian Dollar has been trying to find some support in recent sessions on the back of higher oil prices and softer US producer prices. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5500 will intensify bearish price action.NZDUSD – fundamental overview

Most of this latest Kiwi recovery has come from the US Dollar side of the equation, this after US producer prices came in softer than expected. Overall however, it will be hard for the New Zealand Dollar to put in any major rallies given expectations for a 50 basis point rate cut from the RBNZ next month. Key standouts on Wednesday’s calendar come from German wholesale prices, UK inflation, ECB speak, Eurozone industrial production, Canada manufacturing sales, US inflation, New York empire manufacturing, the Fed Beige Book, and some Fed speak.US SPX 500 – technical overview

The longer term uptrend remains intact and dips continue to be exceptionally well supported. Critical support comes in at 5679, with only a break back below this level to compromise the structure and open the door for a more significant corrective decline. Until then, the focus remains on a continued push to fresh record highs.US SPX 500 – fundamental overview

Investors are feeling better about a soft landing in the US economy. Moreover, there has been a fresh wave of market optimism in anticipation of a market bullish Trump presidency. It will however be important to keep an eye on inflation, bigger picture economic data and the latest shift in the Fed dot plot. Any of these variables are capable of easily ruffling some feathers and we've already seen a little of this in the aftermath of the latest Fed decision.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 3000 area. Setbacks should now be well supported above 2500 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in recent months with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported over the coming months.