Next 24 hours: Euro and Pound shine bright

Today’s report: New narrative around the US Dollar?

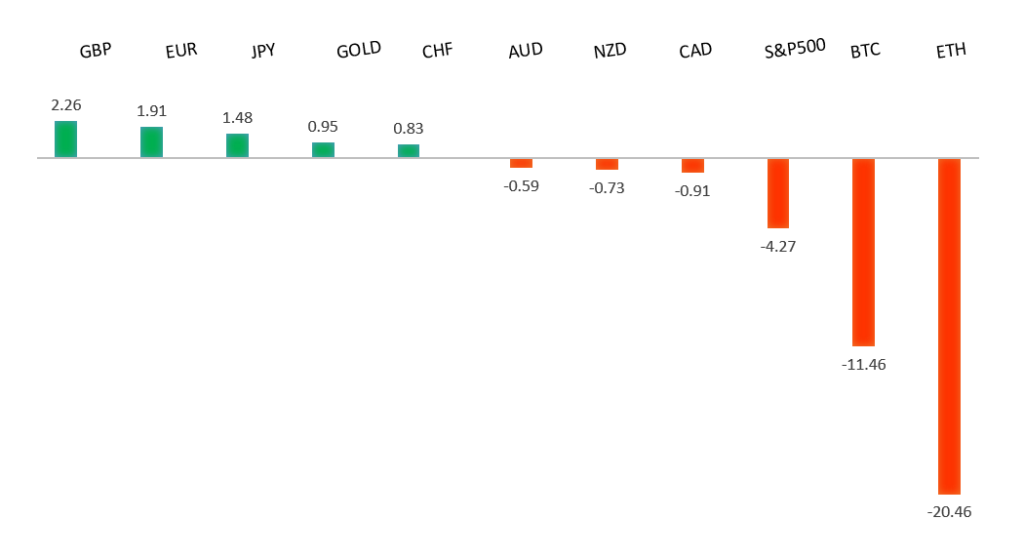

The market is considering a new trade right now, in light of an America first US administration that is weighing heavily on trade and growth prospects. This trade is one in which the viability of the US Dollar as a safe haven is being called into question.

Wake-up call

- defense fund

- GBPUSD Yield differentials move back to Pound

- BOJ Uchida

- Aussie GDP

- retaliatory tariffs

- macro flows

- Trump policies

- Macro themes

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Some Contrarian Moves Michael Burry Is Making In 2025, B. O'Connell, US News (February 28, 2025)

- No Tariffs Required, J. Calhoun, RiskHedge (March 3, 2025)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips towards parity, with a higher platform sought out ahead of the next major upside extension. Look for a major bounce in the days ahead and the start to a push back towards the 2023 high at 1.1276. Only a monthly close below 1.0000 negates.EURUSD – fundamental overview

A lot of the latest bid in the Euro comes on the back of the news of Germany's creation of a 500 billion Euro defense fund. This has resulted in massive demand for European defense stocks, which has translated to Euro inflows. Meanwhile, the news that President Zelensky is ready for a peace deal has also helped to generate demand for the single currency. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Setbacks should be well supported above 1.2000 on a monthly close basis.GBPUSD – fundamental overview

The news of progress towards a peace deal between Russia and the Ukraine has inspired a wave of Dollar outflows as risk sentiment turns back up. Meanwhile, the market has also been pricing more rate cuts than less at the Fed in 2025, forcing yield differentials back in the Pound's favor. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.USDJPY – technical overview

The market is looking to resume the longer-term uptrend after an intense correction in 2024. A higher low is ideally sought out above 140.00 in favor of a bullish continuation. The October monthly close back above 150.00 strengthens the case for longer-term uptrend resumption.USDJPY – fundamental overview

BOJ Governor Uchida was out on the wires today reiterating the BOJ will continue to raise it's benchmark rate if the economy and price trends move in line with forecasts. He also added he's confident the 2% price target will be met and that it's hard to be certain where the neutral policy rate resides, with estimates running from 1% - 2.8%. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6000 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Aussie GDP was the highlight of the day, with the release coming out perhaps just a little better than expected overall. However, underlying components within the data still show the economy has work to do to achieve full momentum. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.USDCAD – technical overview

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in at the 1.5000 psychological barrier. Setbacks should be very well supported ahead of 1.4000.USDCAD – fundamental overview

President Trump has said that Canada's attempts to retaliate against US tariffs will be met with reciprocal retaliatory levies of the same amount in order to maintain the weight of the initial measures. The Canadian Dollar has calmed down somewhat into Wednesday, perhaps on hope for cooler heads to prevail. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5469 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar has held up relatively well in the face of trade tension and intense risk off flow, but remains vulnerable to developments on this front which continue to keep the currency well capped into rallies. Key standouts on Wednesday’s calendar come from German, Eurozone, and UK PMI reads, Eurozone producer prices, US ADP employment, a BOE Bailey speech, US ISM services, factory orders, and the Fed Beige Book.US SPX 500 – technical overview

The longer term uptrend remains intact and dips continue to be exceptionally well supported. Critical support comes in at 5770, with only a break back below this level to compromise the structure and open the door for a more significant corrective decline. Until then, the focus remains on a continued push to fresh record highs.US SPX 500 – fundamental overview

Going forward, it will be important to keep an eye on Trump trade policies, inflation, bigger picture economic data and the Fed policy outlook. Any of these variables are capable of easily ruffling some feathers and we've already seen a little of this as 2025 gets going.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 3000 area. Setbacks should now be well supported above 2500 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in recent months with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported over the coming months.