Today’s report: UK and US markets out on holiday

A lot of the UK market will be off for the Spring Bank holiday and the US market is completely shut down for the Memorial Day long weekend. This will leave market conditions trading on the thin side today, with activity not expected to pick back up again until Tuesday.

Wake-up call

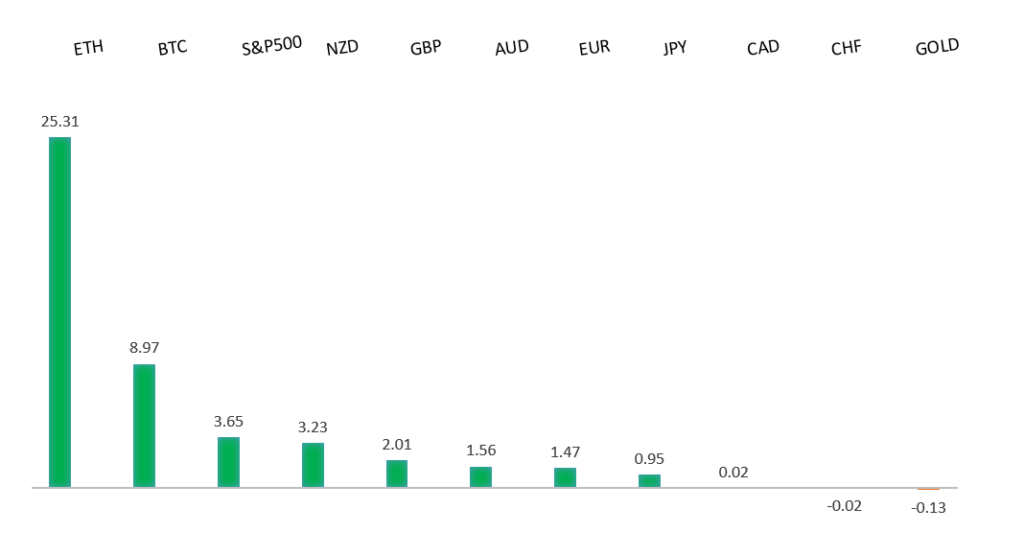

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Why the Far Right is Surging in Europe, J. Sandy, Financial Times (May 24, 2024)

- How We Got Here In 10 Steps, B. Ritholtz, The Big Picture (May 22, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro is coming off a healthy session of demand this past Friday after ECB officials downplayed successive rate cuts and front end Euro rates advanced to fresh year to date highs. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The latest push to a fresh 2024 high beyond 1.2830 confirms the outlook and opens the door for the next major upside extension towards the 2023 high at 1.3143. Any setbacks should now be well supported ahead of 1.2000.GBPUSD – fundamental overview

The Pound closed out the previous week on a strong note after the first full BOE rate cut was pushed back to November. Ugly UK retail sales data has been overlooked, with more of the focus on the recent run of hotter than expected inflation data. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.USDJPY – technical overview

The market remains confined to a strong uptrend, most recently extending to a multi-year high through 160.00. Key support comes in at 151.95, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

Plenty of commentary out of Japan over the past 24 hours. BOJ Governor Ueda said the central bank would move cautiously to keep inflation expectations anchored at 2%. BOJ Deputy Governor Ucheda said the end of the battle with deflation is in sight. And ex-BOJ Masai said she thinks that it would be "okay for another one or two hikes, ending up at like 0.5% or so." Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar is perhaps getting a little boost from today's round of China data. Earlier today, China industrial profits moved back into growth territory on a year over year basis. The data reflects a continued recovery in the industrial sector on healthy external demand and improving domestic consumption. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has held up relatively well in recent sessions when considering weaker than expected Canada retail sales and 66% odds for a Bank of Canada rate cut in June. It seems the recovery in the price of oil and broad based US Dollar selling have been helping to more than offset any Canadian Dollar weakness from softer economic data. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

Absence of first tier data out of New Zealand has the New Zealand Dollar tracking higher on Monday alongside its Aussie cousin. Broad based US Dollar outflows and a healthy risk backdrop have also been supportive. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, and the Canada CFIB business barometer. Trading activity will be thin today on account of the UK and US holidays.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended, begging for a deeper correction ahead. At the same time, the latest bullish breakout to a fresh record high beyond the 2024 high opens the door for the next measured move upside extension targeting the 5650 area. Key support comes in at 4928.US SPX 500 – fundamental overview

Though we have seen a healthy adjustment of investor expectations towards the amount of rate cuts in 2024, the market still hopes policy will end up erring more towards the investor friendly, accommodative side of things. This bet has kept stocks well bid into dips and consistently pushing record highs.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 2500-3000 area. Setbacks should now be well supported above 2000 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in 2024 with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an end.