| ||

| 12th November 2025 | view in browser | ||

| Yen on the edge: Tokyo turns up the heat | ||

| The Yen sunk to a nine-month low against the US Dollar, prompting Japan’s Finance Minister Katayama to warn of rapid, one-sided moves and stress growing concerns over its weakness. | ||

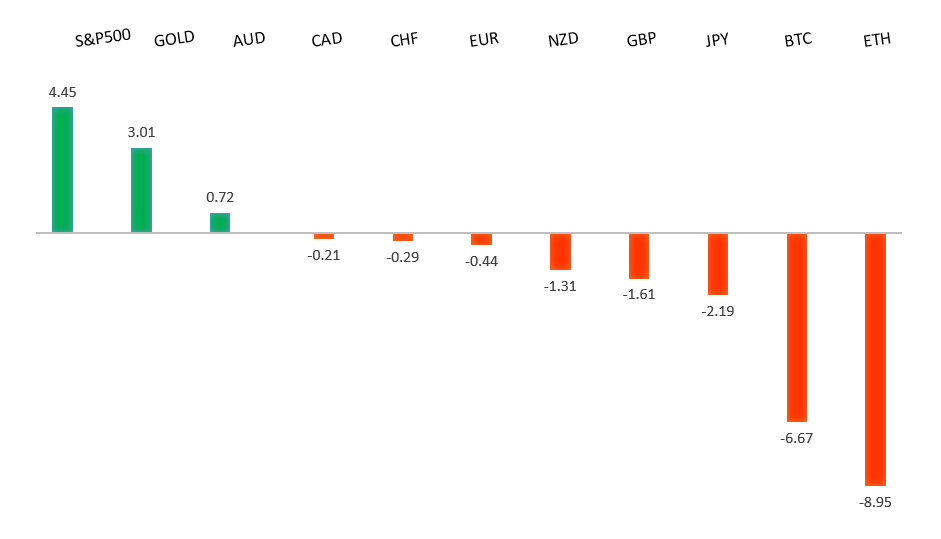

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Investor confidence in Germany weakened in November as the ZEW index fell to 38.5, reflecting doubts about the country’s recovery despite slight improvements in current conditions. While government spending on defense and infrastructure is supporting modest growth, industrial data shows an uneven rebound. External pressures—such as U.S. tariffs and competition with China—pose risks, though Germany still expects growth around 1.3–1.4%, with potential spillover benefits for Europe. The ECB has paused rate cuts as inflation nears target, and officials like Martin Kocher warn of uncertainty beyond 2027 despite signs of stability. Meanwhile, some economists suggest U.S. institutional decline could open a chance for Europe to elevate the euro’s global role through stronger economic union and a potential eurobond market. | ||

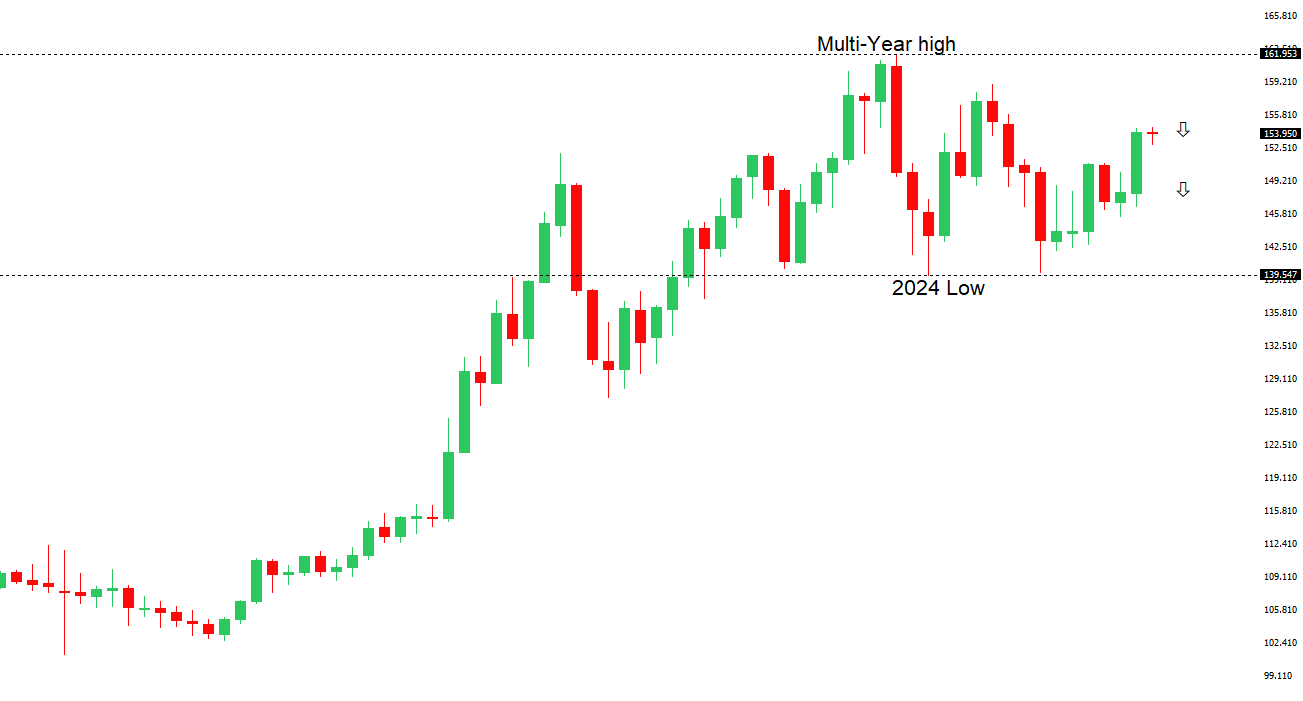

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.00 - Round Number - Strong R1 154.80 - 12 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Weakness in the yen persists amid PM Takaichi’s shift toward looser fiscal goals (yen to a nine month low), raising concerns over Japan’s long-term debt and dampening demand for government bonds. Meanwhile, the BOJ’s October meeting notes and recent remarks from board member Junko Nakagawa suggest conditions are aligning for a gradual rate hike once inflation and wage growth targets are met. However, any BOJ move in December or January is expected to be modest, with markets viewing it as a “one-off” unless the Fed eases policy more sharply. On a brighter note, Japan’s October Economy Watchers Survey showed continued improvement, with sentiment rising to multi-month highs as front line workers observed a mild recovery despite ongoing price pressures. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s strong November consumer confidence and solid business sentiment suggest the RBA is unlikely to cut interest rates soon. Deputy Governor Hauser highlighted limited spare capacity and the need for productivity gains to curb inflation risks. With rates held at 3.6% and no easing expected until mid-2026, yield dynamics favor AUD strength, supported by higher GDP forecasts and firm domestic demand. Rising home and investor loans, fueled by lower borrowing costs and tight rental markets, point to robust housing activity. Combined with stable labor conditions and steady commodity prices, these trends reinforce the RBA’s cautious stance and outlook for continued AUD resilience. | ||

| Suggested reading | ||

| The “native AI” stock with $1T potential, S. McBride, RiskHedge (November 10, 2025) Warren Buffett’s (Last) Letter To Shareholders, Berkshire Hathaway (November 10, 2025) | ||