| ||

| 29th January 2026 | view in browser | ||

| Fed on hold, gold flies, FX reversals build | ||

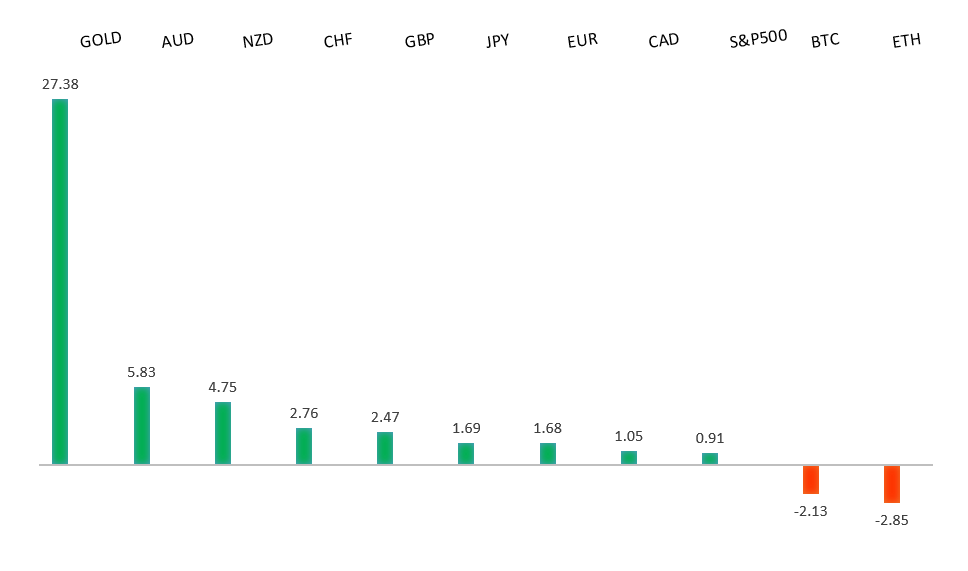

| Global markets kick off the day with a strong risk and reflation tone following the Fed’s decision to hold rates steady, which reinforced expectations for a near-term pause and helped pressure the dollar. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2100 - Figure -Medium R1 1.2083 - 27 Janaury/2026 high - Strong S1 1.1835 - 26 January low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The Euro edged up, sitting just below the key 1.20 level as broad dollar weakness continues to drive a shift out of USD and into the euro, with investors increasingly uneasy about U.S. political and policy risks. While Washington appears comfortable with a softer dollar, and talk of a “strong dollar policy” is unlikely to reverse the trend, further euro gains may meet resistance from ECB officials, who are already warning that a stronger currency could damp inflation and exports and push policy in a more dovish direction. Meanwhile, Germany’s latest consumer confidence data showed a modest improvement, suggesting tentative stabilization in demand, but conditions remain weak—leaving euro strength as a continued headwind and reinforcing the ECB’s cautious stance. | ||

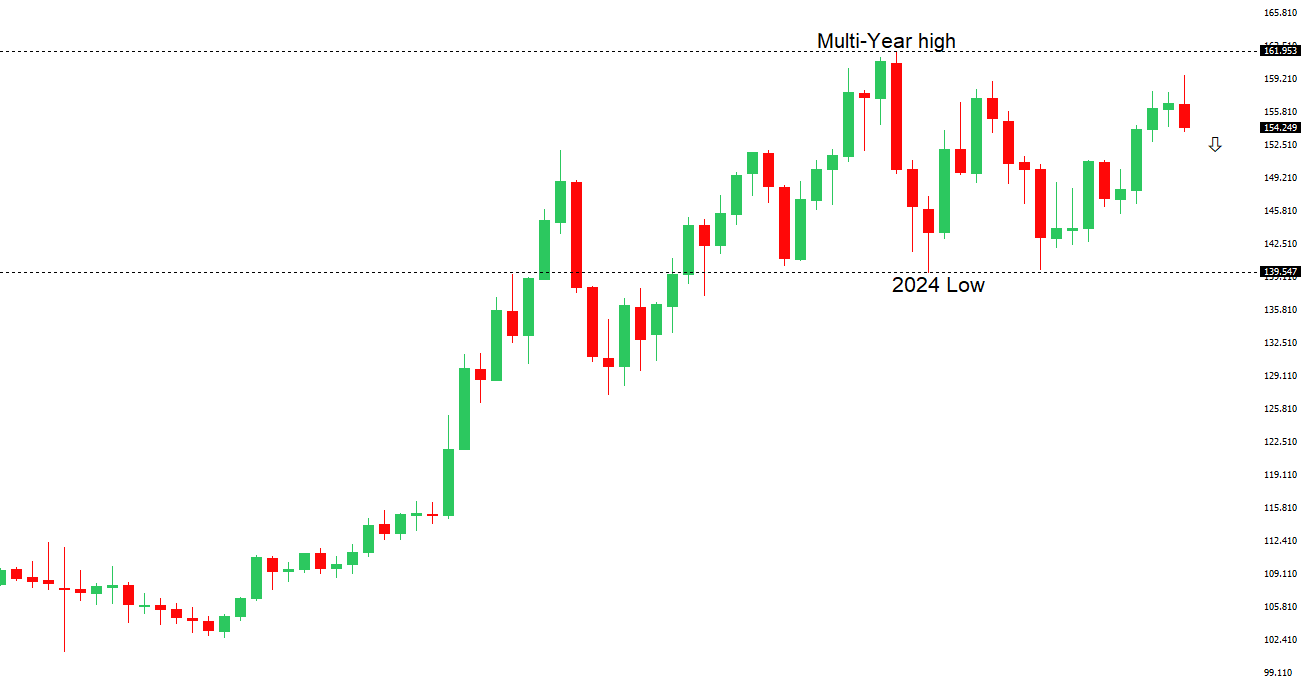

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 155.35 - 26 January high - Medium R1 154.39 - Previous Support - Strong S1 151.97 - 28 January/2026 low - Medium S2 149.38 - 17 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The yen remains under pressure as U.S. officials dismissed intervention talk and Japan’s domestic political uncertainty ahead of the Feb. 8 snap election continues to weigh. While BOJ minutes hint at possible further rate hikes by April as yen weakness feeds inflation—helping stabilize yields—fiscal concerns and election risks limit confidence in sustained yen strength. Overall, intervention could drive a short-term move toward 145–146, but without stronger policy follow-through, any yen gains are likely to prove temporary. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6300. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7095 - 29 January/2026 high - Strong S1 0.6977 - 28 January low - Medium S2 0.6901 - 27 January low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar climbed to its highest level since February 2023, remaining the top-performing G10 currency this year as markets price in a more hawkish RBA. Stronger export prices and firmer Q4 inflation—especially a five-quarter high in core measures—have lifted expectations for at least one more 25bp rate hike, with futures now assigning roughly a 68% chance of a February move, though some see parts of the inflation pickup as temporary. Major banks still lean toward a hike, while a softer US dollar backdrop has added support for AUD. Overall, the RBA is viewed as one of the more hawkish developed-market central banks near term, keeping the bias toward buying dips as long as growth holds up and inflation cools only gradually. | ||

| Suggested reading | ||

| India and the true cost of coal, K. Deep Singh, Financial Times (January 29, 2026) Beneath a $5,000 Milestone Are Gold’s Drawbacks, Fisher Investments (January 26, 2026) | ||