|

|

20 May 2024 Bullish drivers from all fronts |

| LMAX Digital performance |

|

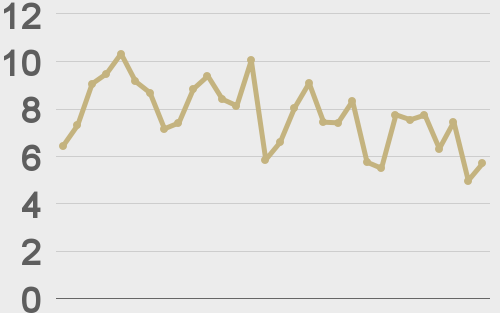

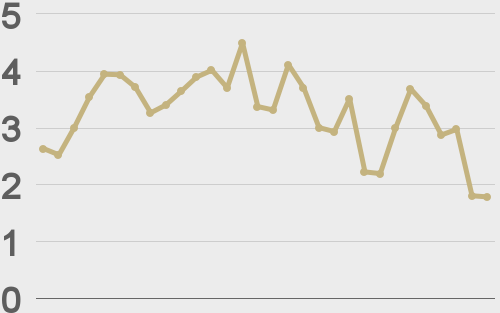

Total notional volume at LMAX Digital improved in the previous week. Total notional volume from last Monday through Friday came in at $2.39 billion, 17% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.5 billion in the previous week, 19% higher than the week earlier. Ether volume came in at $508 million, 12% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,079 and average position size for ether at $3,352. Market volatility continues to trend lower since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $2,484 and $141 respectively. |

| Latest industry news |

|

We’re coming off an impressive week of performance in bitcoin and crypto assets. As per our technical insights, the bullish price action strengthens the prospect a bitcoin higher low is in place for that next upside extension to yet another record high. Fundamentally speaking, a lot of the recent flow can be attributed to US rate expectations. The latest batch of economic data out of the US has been supporting the idea the Fed should lean more towards the investor friendly, accommodative side of monetary policy. This has resulted in a dovish repricing of Fed bets, which in turn has translated to less favorable US Dollar yield differentials and broad based US Dollar outflows. As the US Dollar weakens, other currencies, including cryptocurrencies, benefit from the flow. We’ve also seen many positive updates from within the crypto space. Growing demand from traditional finance is becoming a more central theme in 2024. Meanwhile, reports the CME group is planning to launch bitcoin trading have also been well received. On the ETF circuit, even the Grayscale Bitcoin Trust is back to showing some inflows. Overall, spot ETFs are back to managing in excess of $5.65 billion in daily volume, the highest levels since late March. Research also shows nearly 1,000 US firms have now bought into bitcoin ETFs. |

| LMAX Digital metrics | ||||

|

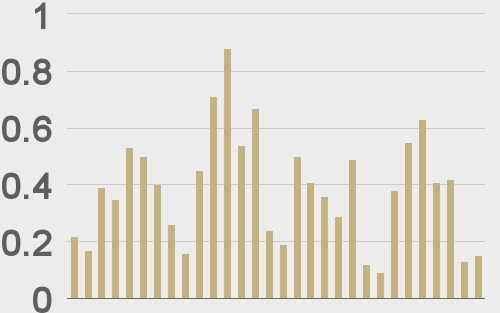

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

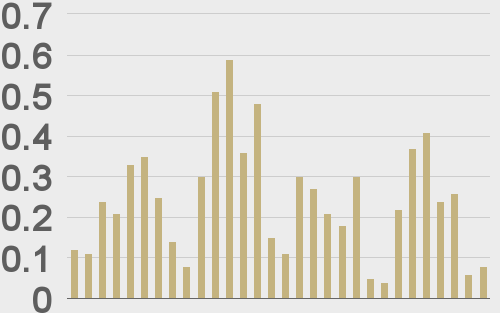

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||