|

|

3 September 2024 Seasonal trends and what to expect |

| LMAX Digital performance |

|

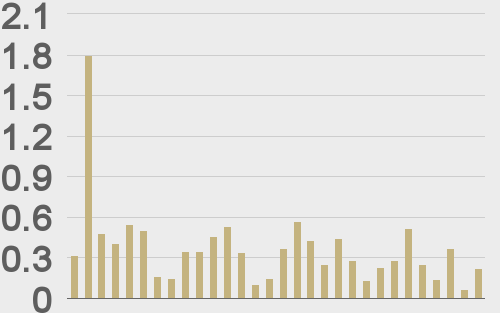

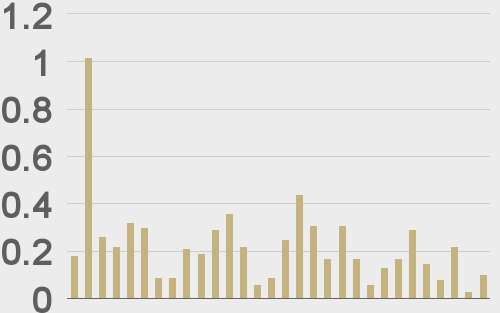

LMAX Digital volumes were exceptionally thin in holiday Monday trade. Total notional volume for Monday came in at $222 million, 40% below 30-day average volume. Bitcoin volume printed $100 million on Monday, 56% below 30-day average volume. Ether volume came in at $84 million, 10% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,889 and average position size for ether at $2,671. Market volatility has cooled off sharply after an impressive run higher in early August. We’re looking at average daily ranges in bitcoin and ether of $2,401 and $128 respectively. |

| Latest industry news |

|

We’re coming out of an ugly month of performance for crypto assets. Seasonal trends had already warned of weakness in August and didn’t fail to deliver on that promise. Seasonal trends for September don’t exactly paint an encouraging picture either. In fact, September has been bitcoin’s worst month of performance on an average return basis. There are however two potential silver linings here. The first is that a string of six consecutive negative September closes were finally followed up by a positive September performance in 2023, perhaps suggesting an end to the streak. The second silver lining is that performance in the fourth quarter has been extremely robust. October and November are the two strongest months for bitcoin performance, and December has been solid in its own right. On net, this paints a pretty picture, with the possibility for a little more chop in the weeks ahead before bitcoin and crypto assets across the board look to make a healthy push to close out the year. In our Monday update, we already highlighted a possible sign that things are starting to look up again by way of the ETHBTC ratio. ETH has been downtrending against bitcoin since 2022 but is finally showing signs of wanting to turn back up. Broadly speaking, ETH outperformance relative to bitcoin is usually a sign that investor appetite for crypto is running high and that both bitcoin and ETH are running higher against the US Dollar. As far as this week’s economic calendar goes, there will be plenty of attention around Friday’s US jobs report and the impact it has on Fed rate pricing. Still, it’s worth noting correlations with the Fed policy outlook have been less relevant in recent weeks. |

| LMAX Digital metrics | ||||

|

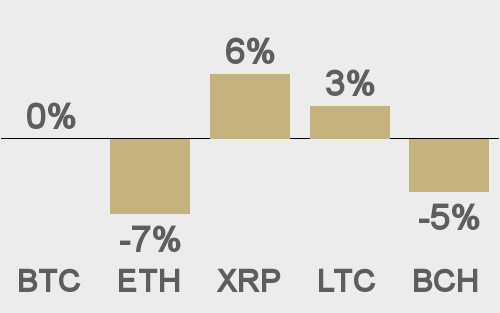

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

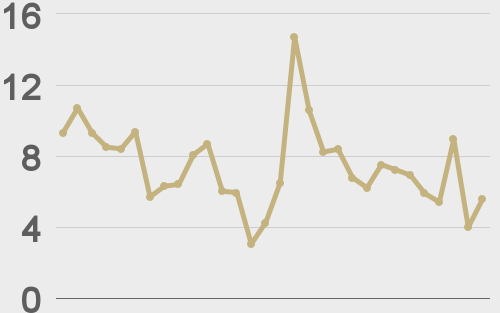

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

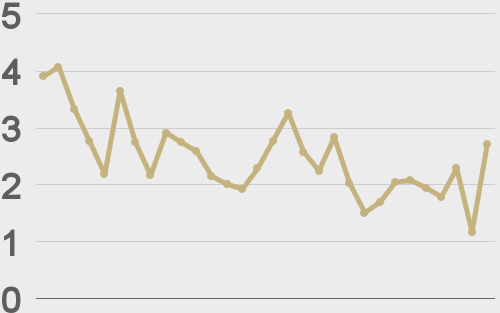

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||