|

|

18 February 2025 This too shall pass |

| LMAX Digital performance |

|

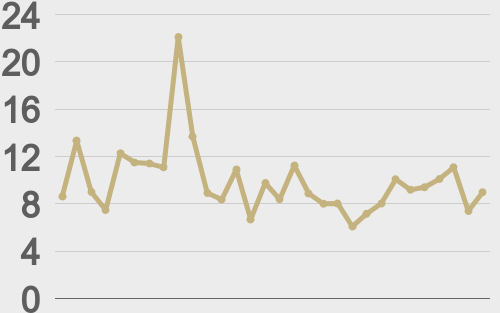

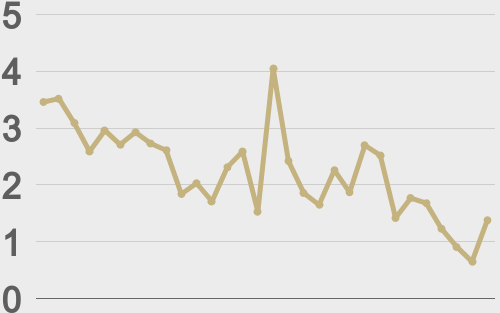

LMAX Digital volumes got off to a light start this week. Total notional volume for Monday came in at $363 million, 38% below 30-day average volume. Bitcoin volume printed $102 million on Monday, 65% below 30-day average volume. Ether volume came in at $109 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,577 and average position size for ether at $2,187. Market volatility continues to cool off since peaking out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $3,245 and $182 respectively. |

| Latest industry news |

|

Crypto assets are under a little pressure as the week gets going. While there have been no major shifts in any of the trends, with price action still very much confined to consolidation, there has been some stress associated with bad actors within the space. The advantages of a warmer, crypto friendly regulatory climate do not come without some peril, and we are seeing this play out as retail traders get sucked into the dangerous world of memecoin trading. The weekend news around the fallout from a coin tied to the Argentinian government has cast a shadow over the space, with the focus shifting away from the meaningful value proposition of crypto assets. At the same time, crypto is not unfamiliar to such bumps in the road, particularly ones connected to nefarious activities, that at the core, are very much inconsistent with the decentralized ideals of the technology. All of these setbacks come from scams around centralized entities looking to unfairly extract value from parties involved. We suspect the market will do a formidable job absorbing these setbacks, with medium and longer-term players looking to take advantage of attractive dips. On a positive note, seasonality trends are encouraging, with February one of the stronger months for crypto performance. This could set the stage for a healthy rally in the second half of the month. |

| LMAX Digital metrics | ||||

|

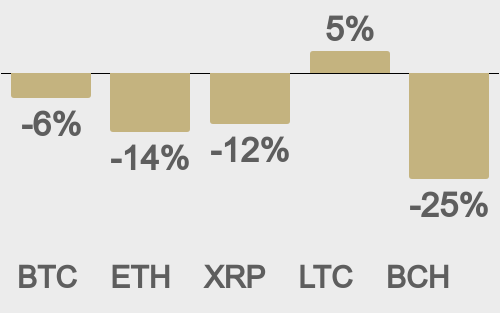

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||