|

|

15 August 2023 Tight ranges and light summer trade |

| LMAX Digital performance |

|

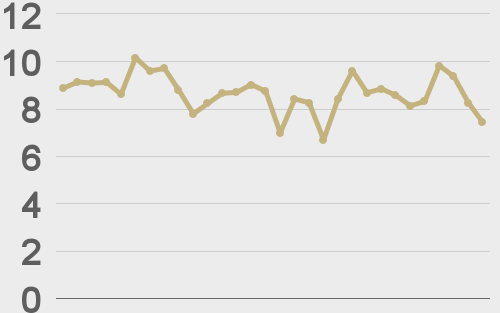

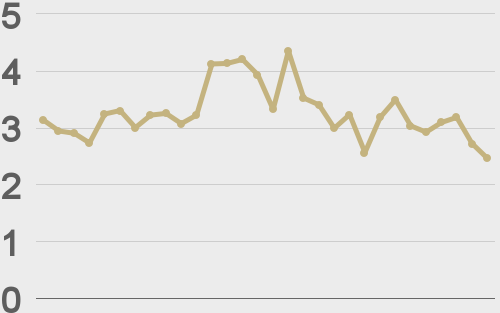

LMAX Digital volumes were light on Monday. Total notional volume for Monday came in at $122 million, 41% below 30-day average volume. Tight trading ranges and thin summer conditions have been behind a lot of the absence in volume. Bitcoin volume printed $73 million on Monday, 37% below 30-day average volume. Ether volume came in at $29 million, 45% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,570 and average position size for ether at $3,305. Volatility as reflected through daily ATR is tracking at multi-month lows. We’re looking at average daily ranges in bitcoin and ether of just $556 and $34 respectively. |

| Latest industry news |

|

Though correlations between crypto assets and US equities have fallen off, Monday’s positive close for stocks certainly hasn’t hurt the crypto space. Both bitcoin and ether were up on the day, albeit mildly. Nevertheless, we remain confined to some very tight trading ranges and activity has been anemic. At the moment, the crypto market is waiting for more regulatory clarity out of the US, along with updates from the SEC with respect to ETF applications. While all of this all hangs in the balance, there is a good chance crypto assets will focus back in on global macro fundamentals. As far as today goes, how the market digests this latest round of US economic data could very well influence direction. The big release on the day is US retail sales, though we also get accompanying second-tier US economic data. As far as crypto specific updates go, we’re seeing signs of more mainstream adoption – this as Coca-Cola debuts an NFT collection on Ethereum’s new Layer 2 network Base, and as Metamask integrates Apple Pay’s One-Click by way of its partnership with Banxa. Technically speaking, as per today’s chart analysis, the range contraction serves as a warning sign for a breakout ahead. We highlight bitcoin $30,225 and $28,480 as the key levels to watch above and below. |

| LMAX Digital metrics | ||||

|

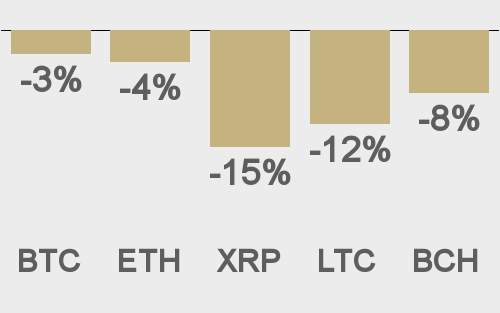

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

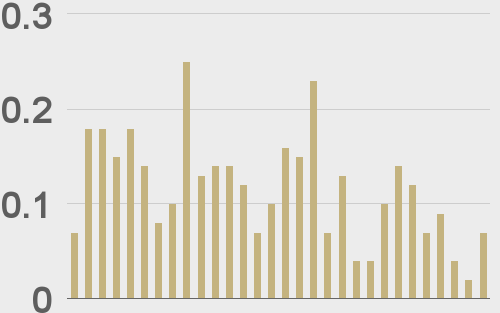

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||