| ||

| 2nd February 2026 | view in browser | ||

| Crowded FX trades meet hawkish curveball | ||

| Global markets are consolidating after sharp recent moves, with FX seeing an orderly pullback that still looks more like profit-taking than a true reversal. However, the dollar’s rebound is not purely technical, with demand also supported by Kevin Warsh’s Fed chair nomination. | ||

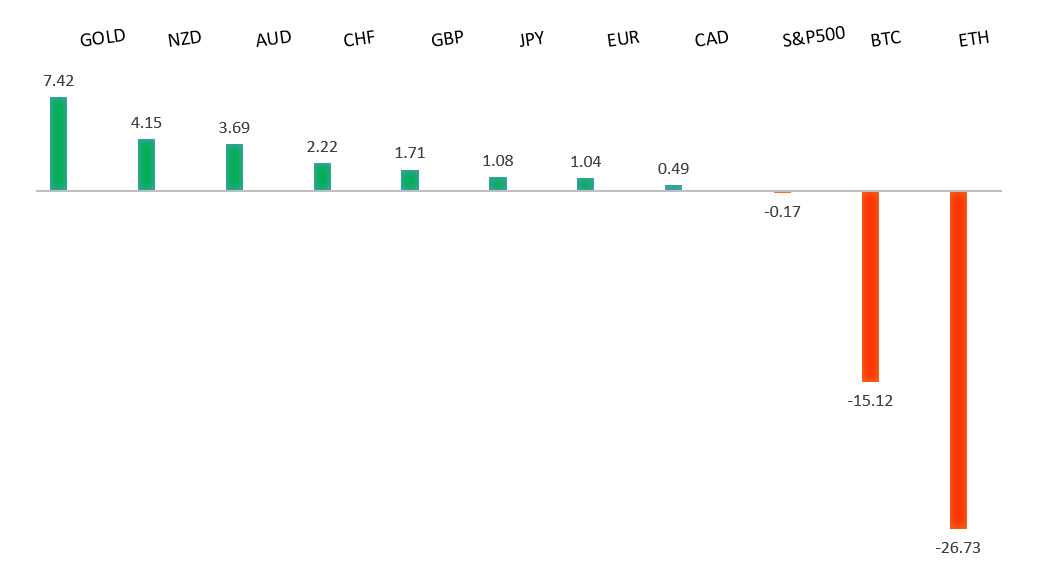

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2100 - Figure -Medium R1 1.2083 - 27 Janaury/2026 high - Strong S1 1.1835 - 26 January low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro is modestly higher despite a stronger dollar, supported by resilient euro-area growth and inflation near target. Q4 GDP beat expectations, lifting 2025 growth to 1.5% on solid domestic demand, while inflation expectations remain anchored—reducing the case for near-term ECB easing. Going into this week’s meeting, policymakers are expected to keep rates steady at 2% and signal continuity, with a major dovish shift unlikely unless data weakens materially, even as geopolitical risks and a stronger euro pose headwinds. Markets will also watch PMIs, CPI, and activity data this week for confirmation of the “steady growth, stable inflation, steady ECB” outlook—or signs that easing speculation could return. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 156.00 - Figure - Medium R1 155.52 - 2 February high - Medium S1 151.97 - 28 January/2026 low - Medium S2 149.38 - 17 October low - Strong | ||

| USDJPY: fundamental overview | ||

| USDJPY is modestly higher after weekend comments from PM Takaichi were initially taken as reducing near-term intervention risk, while Japan’s January manufacturing PMI offered little support for the yen. Japan has recently leaned on “verbal intervention” and coordination signals with the US to stabilize the currency, but officials admit this approach is fragile—especially if USDJPY heads back toward 160—while soft inflation and consumption data have also pushed back expectations for BOJ hikes. Although the BOJ is laying the groundwork for gradual, data-dependent tightening, rate differentials still favor the dollar, leaving markets unconvinced on sustained yen strength; near term, with positioning cautious ahead of potential intervention and the Feb 8 election, USDJPY is likely to trade sideways with a slight upside bias. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6300. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7095 - 29 January/2026 high - Strong S1 0.6901 - 27 January low - Medium S2 0.6834 - 23 January low - Medium | ||

| AUDUSD: fundamental overview | ||

| The Aussie dollar has pulled back, extending last week’s decline and giving back part of January’s strong rally, as a firmer USD and softer gold weighed on the currency. Focus now turns to this week’s RBA meeting, where a likely 25bp hike to 3.85% would keep Australia among the more hawkish G10 central banks, but guidance will be key—signals of a one-off, data-dependent move would leave AUD supported but capped, while talk of further hikes would be a clearer upside trigger. Recent data show cooling monthly inflation but still-elevated annual pressures, alongside tight labor conditions and accelerating home prices driven by supply shortages, reinforcing the case for near-term tightening even as economists expect housing momentum to slow later in 2026 amid affordability and borrowing constraints. | ||

| Suggested reading | ||

| Three Dangers Of The Peter Pan Economy, C. Guo, Soft Currency (January 28, 2026) Is Diversification Finally Working Again?, B. Carlson, A Wealth of Common Sense (January 27, 2026) | ||